little knowledge

industrial real estate is the physical goods used or suitable for industrial activities, including the production, manufacture, assembly, warehousing, research, storage, distribution and related office needs, rather than service-related users. in the united states, each city divides specific industrial areas based on its partition map, which will mark areas where industrial real estate can be built and operated so that activities in those areas do not destroy other commercial properties or residences that might otherwise be adjacent.

a partition map is a map that divides communities into different areas of use, including residential, commercial, industrial, and agricultural areas. a partition map must show the exact boundaries of each area, so most partition maps in the united states rely on streets as regional boundaries.

Photo:Google

looking back at 2020, the u.s. industrial real estate market bucked the trend

since the outbreak of the new crown, people’s home time increased, consumption from offline to online transfer, promoting the rapid development of the online consumer market, promoting the iterative upgrading of the consumption structure, online shopping, fresh e-commerce, online education and other online consumption have bucked the trend, online consumption has become the biggest bright spot in the entire u.s. consumer market.

the trend of online shopping has given birth to competition among retailers, and the construction of offline supply chains is imperative in order to enable customers to receive their online orders more quickly. the surge in e-commerce distribution is supporting an increasingly strong industrial real estate market by increasing demand for warehouses in the u.s. industrial real estate market and third-party logistics in the consumer market.

Photo: Google

e-commerce, because of its dependence on industrial real estate (warehouses, factories, logistics, etc.), has not been affected by the outbreak, but has flourished, so that the united states industrial real estate to maintain a strong market performance. demand for industrial real estate rentals in the united states has grown rapidly, with new tenants flocking to the market and rental incomes rising sharply, providing stable cash flow to owners of industrial real estate.

This has led more and more investors to turn to industrial real estate and continue to invest (warehouses, distribution centers),especially mega-warehouses leased to big e-commerce platforms such as Amazon, eBayand Walmart. It will also prompt investors around the world to rethink their preferred investment targets, further boost the U.S. industrial real estate market and open up new ideas for the U.S. economic recovery.

Photo: Google

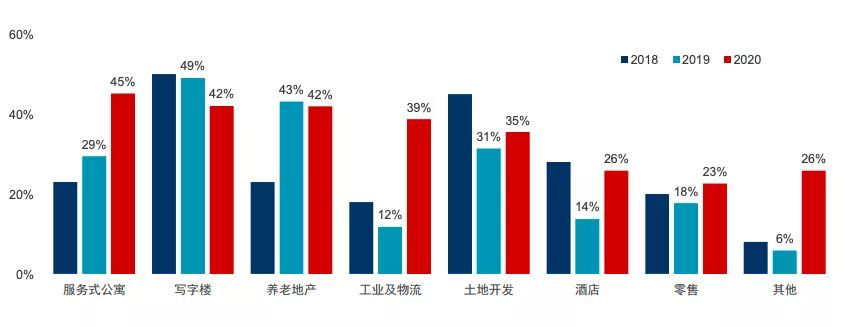

In addition, investors’ interest in offshore industrial property has also increased significantly in Chinese mainland, with Chinese mainland’s appetite for overseas investment in industry and logistics soaring in 2020, from 12 per cent in 2019 to 39 per cent, according to Cushman-Wakefield.

Photo: Cushman-Wakefield

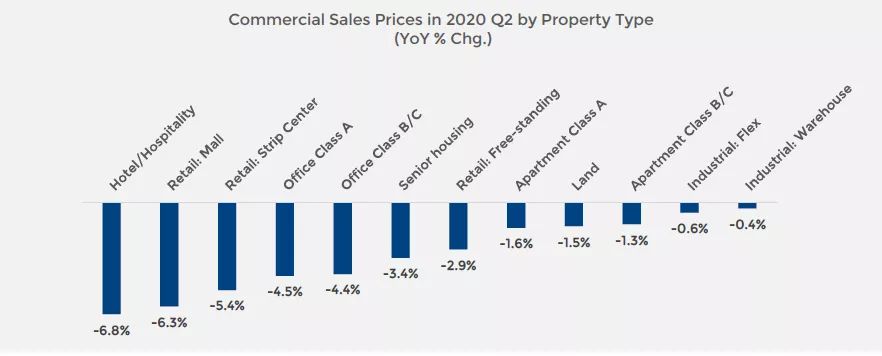

industrial real estate was particularly strong in the outbreak compared to commercial real estate categories such as retail and office buildings, with commercial transactions falling 3.8 percent in the second quarter, the worst loss in all industries, according to data from the national association of realtors in June 2020, ranking second in the same category and 0.4 percent in the same category.

Picture: NAR

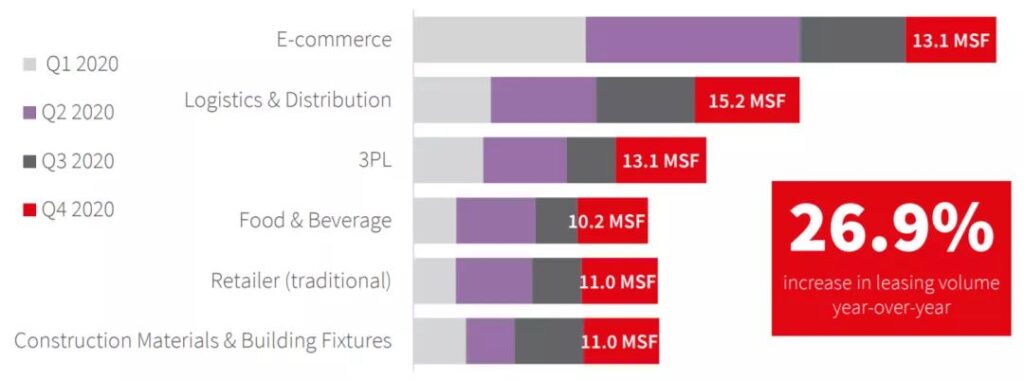

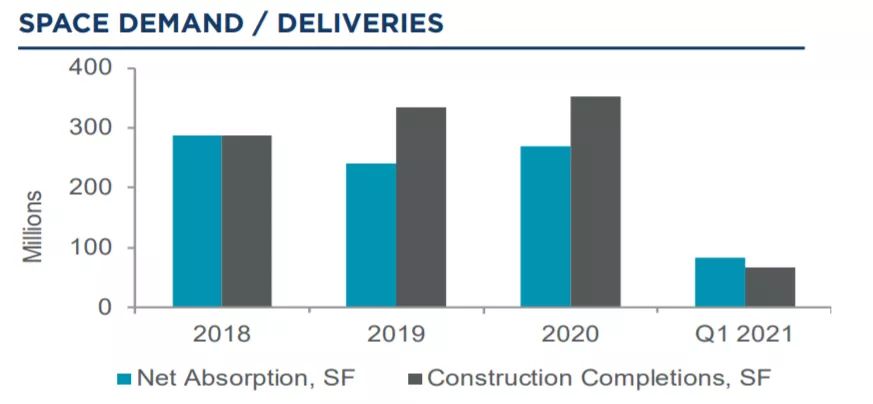

According to Jones Lang LaSalle (JLL), the U.S. industrial real estate rental market exceeded expectations in 2020, with total leases reaching 524.2 million square feet, up 26.9 percent from 2019. As new deliveries in the U.S. industrial real estate market climb, tenants begin to take up new rental space, and net absorption climbs, with a record total of more than 270 million square feet in 2020.

Picture: JLL Research

According to Marcus Millichap’s 2021 Marcus Millichap Industrial Investment Forecast and Jones Lang LaSalle (JLL), there is an increase in demand for industrial land. Rents in the industrial real estate market are rising $0.27 to $7.66 per square foot in 2020, $7.39 per square foot in 2019 and 5.4 percent in 2020.

Picture: Marcus Millichap

Info: BLS; CoStar Group, Inc.; Real Capital Analytics

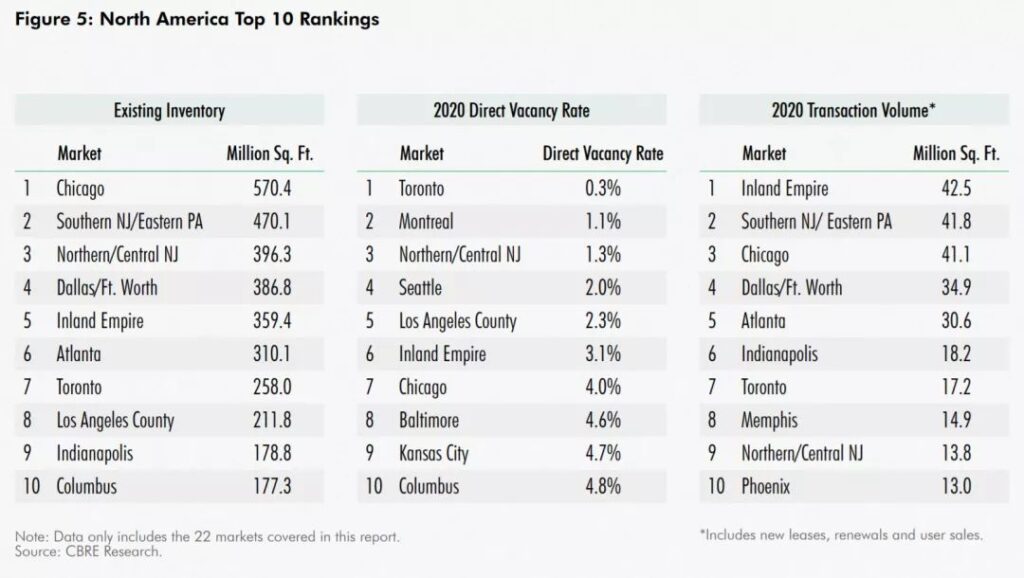

CBRE noted in a 2020 North American Industrial Big Box Review and Outlook report that the top 10 regions in North America’s top 22 industrial real estate markets tracked in 2020 were:

First-tier cities: Chicago alone came in third with 41.1 million square feet of sales.

West Coast: California’s Inland Empire leads all markets with 42.5 million square feet of land, with Phoenix in 10th place

East Coast: Southern New Jersey (Southern NJ) and Eastern Pennsylvania (Eastern PA) came in second with 41.8 million square feet of land, while New Jersey East and Central (Northern/Central NJ) came in ninth.

Southern Region: Dallas/Fort Worth and Atlanta, ranked fourth and fifth, respectively.

Midwest: Indianapolis was sixth and Memphis eighth.

The Inland Empire is a metropolitan area of Southern California. The official name used by the U.S. Census Bureau is riverside-San Bernardino-Ontario.

Photo: CBRE Research

According to CBRE’s Record Number of Mega Facilities On Top 100 Industrial Deals of 2020, the U.S. industrial real estate market will sign a record 48 transactions of 1 million square feet or more in 2020, nearly double the 29 in 2019. Demand for industrial buildings of all sizes exceeds total demand for 2019, with the largest demand for oversized warehouses/distribution centres of 1 million square feet or more.

Photo: CBRE Research

the top 100 deals were mostly concentrated in the midwest and south, followed by east and west coast cities:

Midwest: Chicago leads with eight deals, followed by Indianapolis (5), Columbus (4) and Memphis (3);

South: Atlanta leads with 13 deals, followed by Dallas/Fort Worth with 11;

West Coast: Inland Empire, California (11) and Phoenix (3);

East Coast: Pennsylvania (Pennsylvania, 11) I-78/81 Corridor and Philadelphia (Philadelphia, 5).

THE PENNSYLVANIA I-78/81 CORRIDOR, WHICH HAS 12.9 MILLION SQUARE FEET OF FLOOR SPACE, IS IN HIGH DEMAND BECAUSE IT IS ONE OF THE LAST MARKETS IN THE NORTHEAST WITH SIGNIFICANT LAND TO DEVELOP.

Photo: Google

CBRE SEES AN INCREASE IN BULK TRADING ACTIVITY IN THE U.S. INDUSTRIAL REAL ESTATE MARKET, WITH INCREASED TOTAL LEASES, NET ABSORPTION, STABLE RENTAL INCOME AND LOW VACANCY RATES INDICATING A STRONG OUTLOOK FOR U.S. INDUSTRIAL REAL ESTATE. WHILE ECONOMIC ACTIVITY IN THE UNITED STATES STALLED SLIGHTLY IN EARLY 2020 DUE TO THE NEW CROWN OUTBREAK, INDUSTRIAL REAL ESTATE COULD BE A HAVEN FOR THE OUTBREAK’S CAPITAL TO MEET THE CHALLENGE.

for the foreseeable future, consumers’ adoption of online shopping will drive e-commerce as a major driver of market demand in 2020, while online shopping will require suppliers to keep additional inventory to avoid supply disruptions. as a result, the average size of industrial real estate transactions will increase further in 2021. at the same time, logistics and distribution in 2020 is also very active, third-party logistics demand and logistics distribution users are also increasing. with the increase of supply chain operation pressure in 2020, the logistics and distribution industry is expected to continue to maintain a strong momentum of development in 2021.

Photo: Google

looking ahead to 2021, the u.s. industrial real estate market is growing strongly and demand is surging

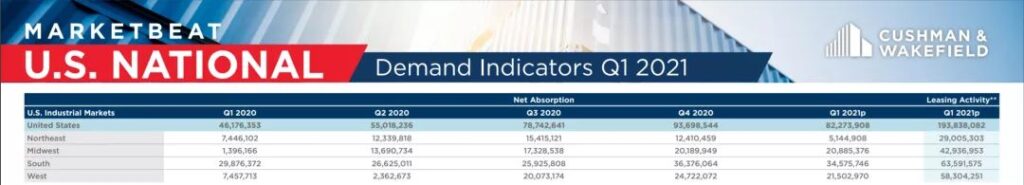

The U.S. industrial real estate market started stronger than expected in the first quarter of 2021, with demand outpacing supply for the first time since the second quarter of 2019. According to the U.S. INDUSTRIAL MARKETBEAT REPORTS report released in April 2021 by Cushman-Wakefield, net absorption in the U.S. industrial real estate market was approximately 82.3 million square feet in the first quarter of 2021 alone. This is an increase of 78.2% over the 46.2 million square feet reported in the first quarter of 2020.

warehouse/distribution centers are the best performing secondary property type in the market, with net absorption of 77.9 million square feet. of the 81 industrial markets in north america, 23 had net absorption of more than 1 million square feet and 62 had positive net absorption.

Photo: Cushman-Wakefield

net absorption of industrial real estate markets in all regions of the united states in the first quarter of 2021 is as follows:

the industrial real estate market in the southern region was the best performer, absorbing about 34.6 million square feet;

this was followed by the western region, which absorbed about 21.5 million square feet;

this was closely followed by the midwest, which absorbed about 20.86 million square feet;

finally, the northeast, which absorbs about 5.14 million square feet.

Photo: Cushman-Wakefield

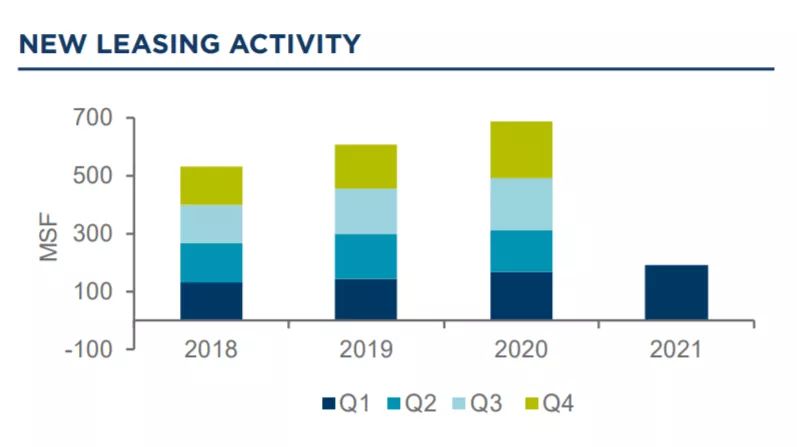

Meanwhile, in the first quarter of 2021, the total area of new lease transactions in the U.S. industrial real estate market exceeded 100 million square feet for the 21st consecutive quarter, with the southern region leading the U.S. industrial real estate market with a total new lease transaction area of about 63.59 million square feet, followed by the western and Midwest with new lease transactions totalling approximately 58.3 million square feet and 42.94 million square feet, respectively and finally, in the northeast, about 29 million square feet.

New lease volumes increased year-on-year in 47 of the 81 north American industrial markets tracked by Cushman-Wakefield. Strong market demand has accelerated construction in the U.S. industrial real estate market, with new leases expected to total more than 600 million square feet by the end of the year. In addition, in the first quarter alone, there were 12 markets with new lease transactions of more than 5 million square feet and 46 markets with more than 1 million square feet of new lease transactions.

Photo: Cushman-Wakefield

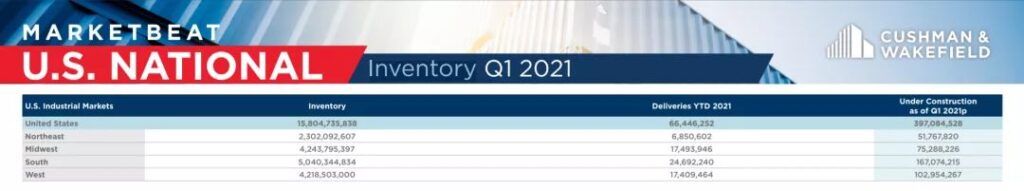

By the end of the first quarter of 2021, more than 1 million square feet of new industrial buildings had been delivered in 23 of the 81 north American industrial markets tracked by Cushman and Wakefield. In these markets, Chicago, Inland Empire, Houston, Dallas/Fort Worth, Atlanta, Central New Jersey, Milwaukee, Detroit, Phoenix and Columbus provided the most space, accounting for 56.4 per cent of all new industrial buildings completed. At the same time, these 10 markets accounted for more than 55% of net absorption at the end of the first quarter of 2021, and new supply remains concentrated in markets where demand has been strong.

Photo: Cushman-Wakefield

continued tight market conditions and strong demand contributed to a 7.8% year-on-year increase in rents in the first quarter of 2021. rents in the first quarter of 2021 were $6.90 per square foot, another record high in the u.s. industrial real estate market. warehouse/distribution center rents rose 4.7 percent to $6.26 per square foot over the same period. total industrial real estate rents in the northeast grew by 11.6% year-on-year, followed by the western region, which grew by 8.3% year-on-year.

Of the 81 industrial property markets in North America tracked by Cushman-Wakefield, rents in 56 industrial property markets showed positive or steady growth, while rents in 65 markets increased or were flat compared with the same period last year.

Photo: Cushman-Wakefield

industrial real estate markets in all regions of the u.s. in the first quarter of 2021 rents are as follows:

western the highest rental price is $10 per square foot;

northeast the second most expensive rental price, at $8.30 per square foot;

midwest the rental price is $5.84 per square foot;

in the south, the rental price is $5.20 per square foot.

industrial real estate markets in u.s. regions in q1 2021 warehouse/distribution center rents are as follows:

western ranked first at $8.88 per square foot;

northeast came in second at $8.28 per square foot;

the southern region came in third at $5.34 per square foot.

midwest ranked fourth at $4.72 per square foot;

The midwest and south have lower rental prices because of their low asset costs, good employment environment, diversity of enterprises, rich human environment, and so on. Despite a slight slowdown in rental growth over the past few quarters, Cushman-Wakefield expects rents to remain positive through the year.

Photo: Cushman-Wakefield

in 2021, the vacancy rate in the u.s. industrial real estate market fell by 30 basis points quarter-on-quarter, with a vacancy rate of 4.9% at the end of the first quarter,unchanged from the same period last year.

the first-quarter vacancy rates in the industrial real estate markets in various u.s. regions were as follows:

vacancy rates in the northeast were down 50 basis points year-on-year, at 4.5% at the end of the first quarter;

the vacancy rate in the central and western regions decreased by 10 basis points year-on-year, to 4.7% at the end of the first quarter;

the vacancy rate in the southern region was 6%, the same as in the same period last year;

vacancy rates in the western region rose 30 basis points year-on-year, to 4.1% at the end of the first quarter.

Photo: Cushman-Wakefield

The decline in vacancy rates is mainly due to the demand for high-quality storage space in the industrial real estate market that exceeds the level that supply can keep up with, which can be attributed to the accelerated development of e-commerce. Among them, orange Co., CA, Los Angeles, Philadelphia and central New Jersey had vacancy rates of about 2.8 percent or less in the first quarter of 2021, with the lowest overall vacancy rates in the East-West Coast industrial real estate market, at 4.1 percent and 4.5 percent, respectively.

Photo: Cushman-Wakefield

by the end of the first quarter of 2021, new supplies totaled approximately 66.4 million square feet, down 14.8 percent from the 77.9 million square feet reported in the first quarter of 2020. but that’s higher than the five-year average of first-quarter deliveries of 63.5 million square feet. supply has outstripped overall demand for u.s. industrial real estate since 2019.

demand for u.s. industrial real estate far outstripped supply (more than 15.8 million square feet) as of the first quarter of 2021, and the surge in demand prompted a gradual recovery and accelerated construction in the u.s. industrial real estate market.

Photo: Cushman-Wakefield

The surge in industrial real estate market demand can not be separated from the rapid development of e-commerce, Amazon, Ebay, Wal-Mart, Target as the representative of the large e-commerce platform in the United States to invest heavily in warehouses, distribution centers and other industrial real estate to meet its rapid growth of online business.

Amazon, for example, currently has about 500 different types of buildings and facilities in the U.S., including large distribution centers, distribution stations, Prime Now distribution centers, regional sorting centers, airport distribution centers, and more, according to the latest data from CoStar Group and Maping Amazon. As you can see from the map, Amazon’s buildings and facilities are concentrated in the Midwest, the South, and the Gateway City on the East and West coasts.

Photo: Maping Amazon

In addition to the rise in e-commerce, concerns about industrial property inventories are an important factor in stimulating a surge in demand for industrial space, said James Breeze, global head of industrial and logistics research at CBRE. About 70 percent of the U.S. industrial real estate market is now warehouses and distribution centers, with the rest being research and development facilities, manufacturing and flexible spaces such as showrooms or offices.

Over the past few months, Breeze has seen increased demand from third-party logistics companies, which help other companies handle storage and distribution, and are the most active occupiers in large industries, accounting for about 26 percent of the market.

PICTURE: JLL

e-commerce, while maintaining the vitality of the industrial real estate market, is also guiding industrial real estate innovation. people began to add automation equipment and high-tech management functions to the corresponding plants and warehouses to meet the supply chain’s demand for automated management. with the expansion of e-commerce market share and the expansion of the online retail market itself, the demand for logistics storage facilities will continue to increase in the future.

large e-commerce platforms (such as amazon, wal-mart and other companies) will continue to adhere to their self-built self-employed strategy because of their all-round distribution and self-employed logistics with scale effect, thereby weakening the rental demand of e-commerce for public modern logistics storage facilities. small and medium-sized e-commerce enterprises will continue to increase the dependence of socialized third-party logistics, thereby continuously increasing the rental demand of public logistics warehousing.

Photo: Google

DHL (Third Party Logistics Services) announced a $3 billion investment to add automation equipment, the Internet of Things and machine assistive features to its industrial real estate supply chain. Augusto Alizo, DHL’s vice-chairman of transaction management, also told a summit that automation was now a “game changer” in the industrial property market.

the rise and boom of the online retail market not only affects and changes the traditional retail market pattern, but also promotes the development of third-party logistics, but also has a great impact on the modern logistics facilities market. new leasing activity in the logistics sector accounted for 168.8 million square feet, representing 87.1% of all new leasing activities for all product types at the end of the first quarter of 2021.

Photo: Google

CBRE believes that in the future, third-party logistics will become a new driving force for market development, warehouse market demand will be further subdivided, express delivery, e-commerce, medicine, fresh, manufacturing and other different industries users, because of its business characteristics of warehouse facilities to put forward a variety of specialized needs, customization is expected to become the mainstream trend in warehouse development and construction, It is expected that the proportion of custom warehouses in high standard warehouses will be greatly increased.

with the growth of personal consumption, the maturity of the retail market and the continuous development of e-commerce, the demand for logistics facilities, especially high standards of warehousing in the retail industry, will grow rapidly.

LED BY JLL, IT WILL SELL A 300,000-SQUARE-FOOT DISTRIBUTION CENTER NEAR ORLANDO, FLORIDA, FOR $71.45 MILLION IN 2020 ON 21.2 ACRES, FULLY LEASED TO A GLOBAL BEVERAGE COMPANY.

PICTURE: JLL

the outbreak may have a permanent impact on consumer behaviour, and online consumption, home-based work and online education will continue to exist in our lives after the outbreak ends. changes in consumer behavior will help some niche technology industries emerge, including self-service warehousing, cloud kitchens, online education, and more.

CBRE believes the industrial property market in the Midwest and South will be the two most investable regions in 2021. Especially in Chicago, Dallas/Fort Worth, Atlanta, and its surroundings. and the Central NJ on the East-West Coast, along the I-78/81 corridor in Pennsylvania, and the Los Angeles Metro Area.

Photo: Google

Cushman-Wakefield predicts that strong demand for industrial space in the U.S. industrial real estate market will continue in 2021, with net absorption again exceeding 200 million square feet, and that annual new supply is expected to exceed annual demand in 2021, putting upward pressure on overall vacancy rates in the coming quarters, which will rise to between 5.2 and 5.4 percent Rents will continue to increase, with positive year-on-year growth.

more supply means more options for the u.s. industrial real estate market, with more new supplies coming into the market and more options for investors. at the end of march 2021, u.s. president joe biden unveiled a $2.3 trillion infrastructure plan that bodes well for rising prices for hard assets such as infrastructure and industrial real estate, which will provide long-term stable returns and be the highest return on investment.

Picture: TheWhite House

That will allow global investors to invest more in hard assets such as industrial real estate, which will boost the U.S. commercial real estate market and help revive the u.s. industrial real estate investment market. Investors and players in the commercial real estate market can reinvent and rise in these challenging times only if they act quickly and wisely.

Photo: Google