little knowledge

Office Office refers to one or more buildings for office use, and mostly to commercial office buildings with modern facilities. Of these, 75% of the interior space is used to accommodate office users, and the rest can include other uses such as retail, restaurant, or fitness. Office buildings are usually classified as Class A, Class B and Class C based on factors such as building quality, amenities and geographical location.

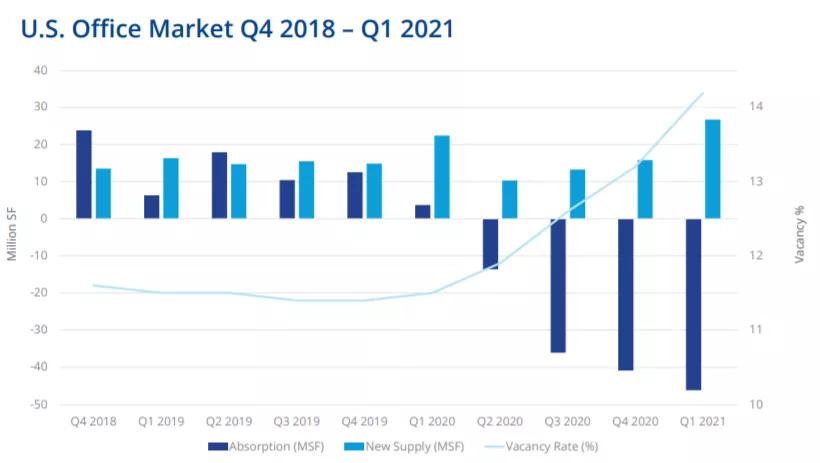

in 2020, the u.s. office market will face challenges

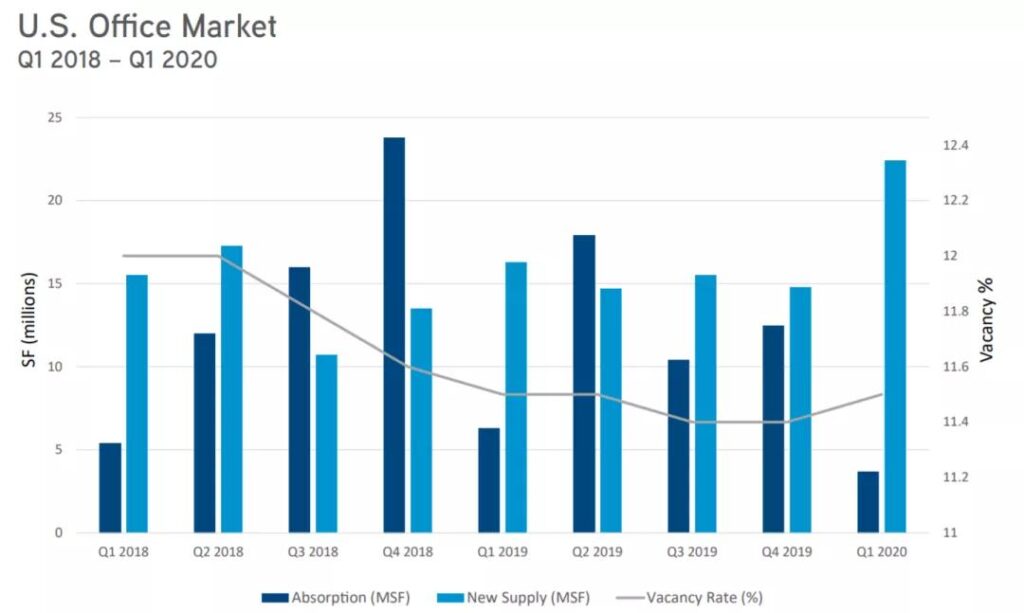

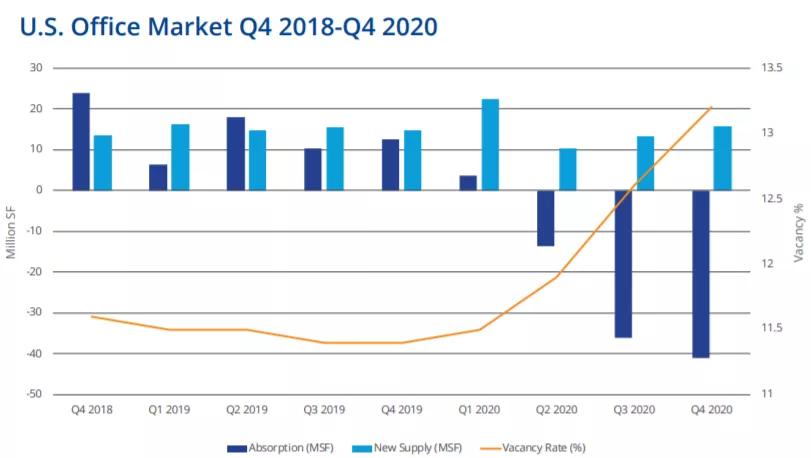

According to U.S. Research Report 2020 Office Market Outlook, released by Colliers International, Vacancy rates in the U.S. office market rose to 11.5 percent,the 21st consecutive quarter below the historical average.

Two-thirds of the U.S. office market it tracks has vacancy rates below the national average, and 45 percent have vacancies below 10 percent. Average rents for Class A office space rose slightly in the first quarter to $39.05 per square foot.

Photo: Colliers International

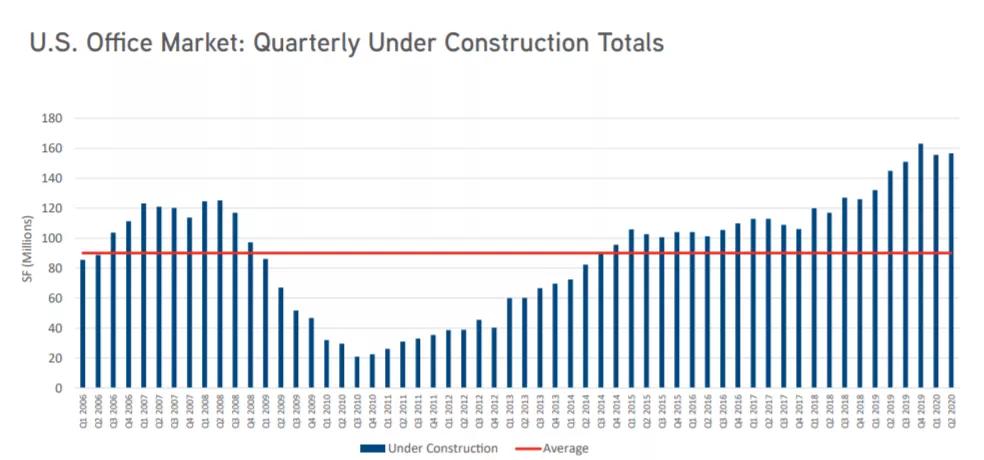

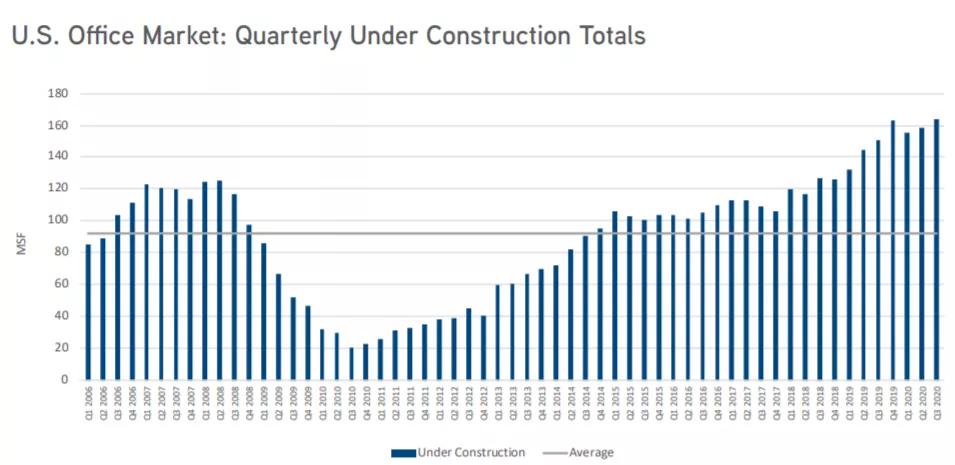

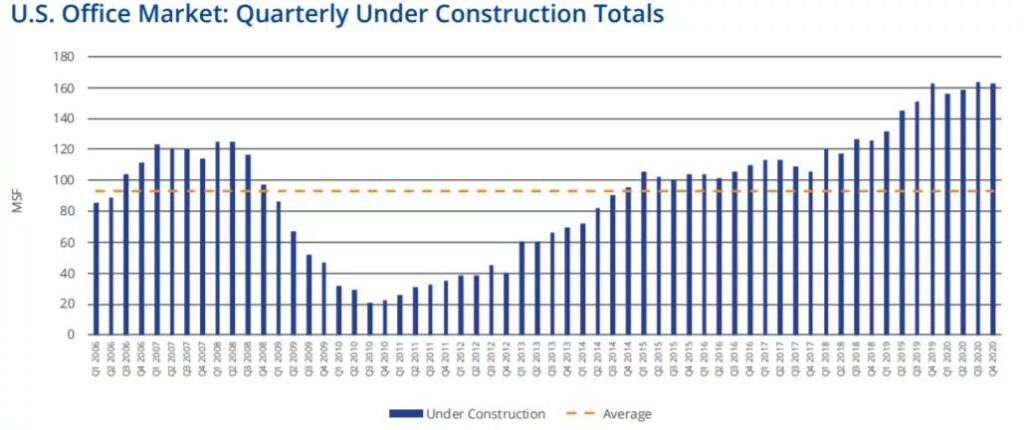

Absorption in the U.S. office market fell 32 percent year-on-year to about 5.8 million square feet, while under construction fell 5.4 million square feet to about 158 million square feet Average return on capital (Average cap rates) fell to 6.5%.

Sales in the office market were $17.4 billion in the first quarter, including Boston, Chicago, Los Angeles, New York and San Francisco Francisco) and Washington, D.C. (D.C. Washington), which accounted for more than half of the first-quarter office sales, reached $16.3 billion.

Photo: Colliers International

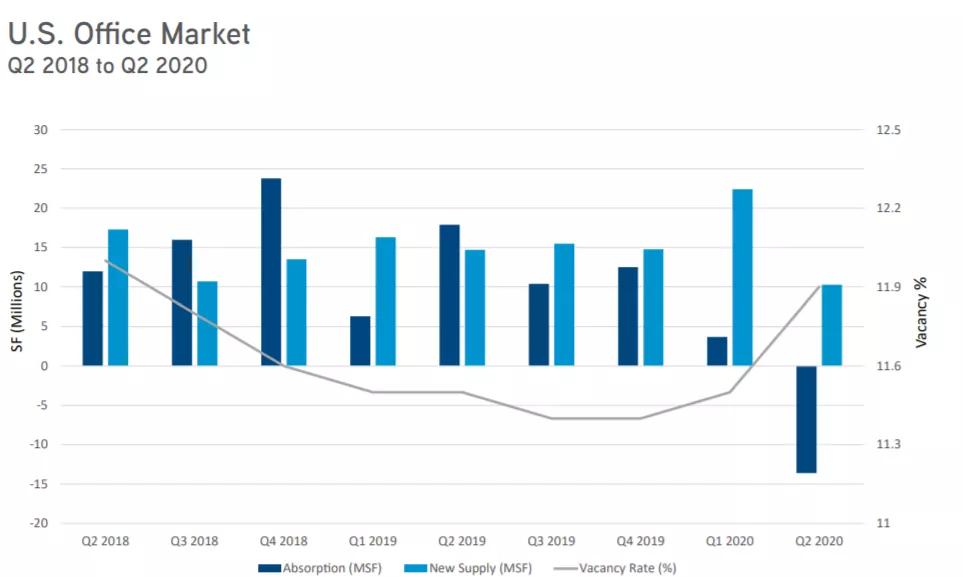

Vacancy rates in the U.S. office market rose to 11.9%in the second quarter of 2020, the highest quarterly increase since the first quarter of 2010. Average rents for Category A office space edged up to $39.63 per square foot.

Photo: Colliers International

the u.s. office market saw its first negative growth in 10 years, down 86% year-on-year to about 13.6 million square feet, and the area under construction increased by 1 million square feet to 156.7 million square feet the average return on capital remained at around 6.6%.

due to the uncertainty caused by the new crown outbreak, buyers suspended their investment options and waited, with investment activity in the office market falling sharply in the second quarter, with sales in the office buying and selling market at just $11 billion. boston, chicago, los angeles, new york, san francisco and washington, d.c. continued to lead the office sales market in other cities, accounting for more than half of second-quarter sales to $5.9 billion.

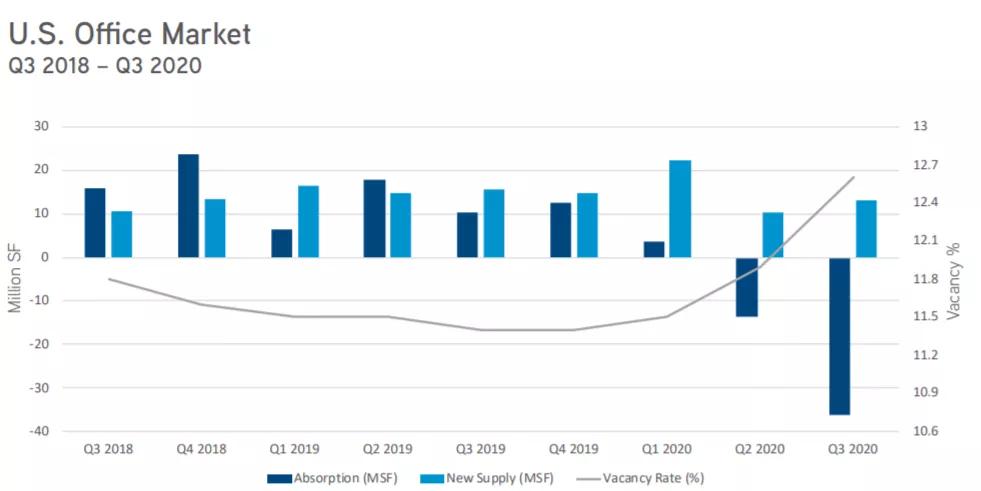

Photo: Colliers International

Vacancy rates in the U.S. office market rose to 12.6%in the third quarter of 2020. Average rents for Category A office space decreased slightly to $39.06 per square foot. The U.S. office market continues to decline sharply, to about -36.1 million square feet;

investment activity in the office market remained sluggish in the third quarter, with sales in the office market at $13.6 billion in the third quarter, down 52% year-on-year. the office market in boston, chicago, los angeles, new york, san francisco and washington, d.c., generated $6.5 billion in sales, or about 48 percent of third-quarter sales.

Photo: Colliers International

Vacancy rates in the U.S. office market continued to rise to 13.2%in the fourth quarter of 2020. Average rents for Category A office space edged up 0.9 percent to $39.53 per square foot.

absorption in the u.s. office market continued to decline, totalling about 40.9 million square feet;

investment activity in the office market increased in the fourth quarter, with sales in the office buying and selling market at $27.6 billion.

Photo: Colliers International

In 2020, annual sales in the U.S. office market fell 40 percent year-on-year to $86.1 billion. Among them, the suburban office market attracted the most capital in 2020, with investors spending $57.6 billion in the suburban office market and $28.5 billion in the CBD.

Photo: Google

as congress passes two rounds of anti-epidemic bail-outs to help businesses and the unemployed, vaccinations are accelerating, cities are slowly re-opening, new jobless claims are falling, employment continues to expand, rental rates continue to rise, and the u.s. economy is slowly recovering.

the significant increase in investment activity in the fourth quarter of 2020 indicates that many investors are actively seeking office acquisitions , and investors are optimistic about the investment prospects of the u.s. office buying and selling market , prompting investors to invest more in the u.s. office buying and selling market and promoting the overall recovery of the u.s. office market .

Photo: Google

in 2021, the office market will recover slowly and face change

According to Cushman and Wakefield Research’US Office MarketBeat Q1-2021, CBREQ1 2021 US Office Figures FINAL SECURE .pdf, and Colliers International Three reports from Q1 2021 US Office Outlook Report state:

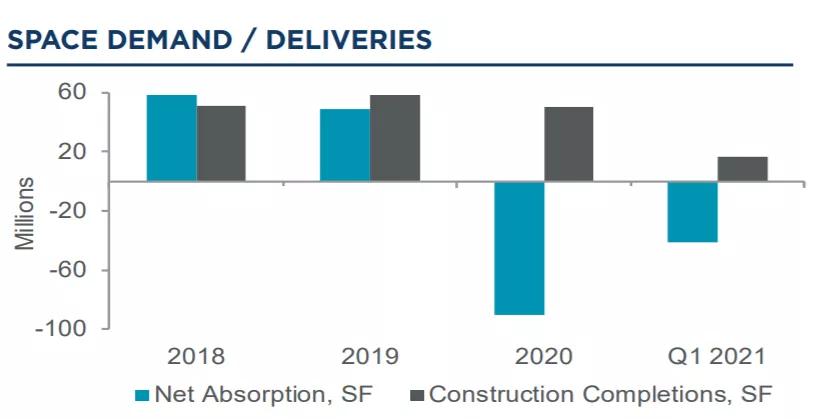

the u.s. office market has lost a total of 138.4 million square feet of office space since the new crown rampage. net absorption in the u.s. office market was about 46 million square feet in the first quarter of 2021, a quarter-low.

Photo: Ded Liang Bank Cushman and Wakefield Research

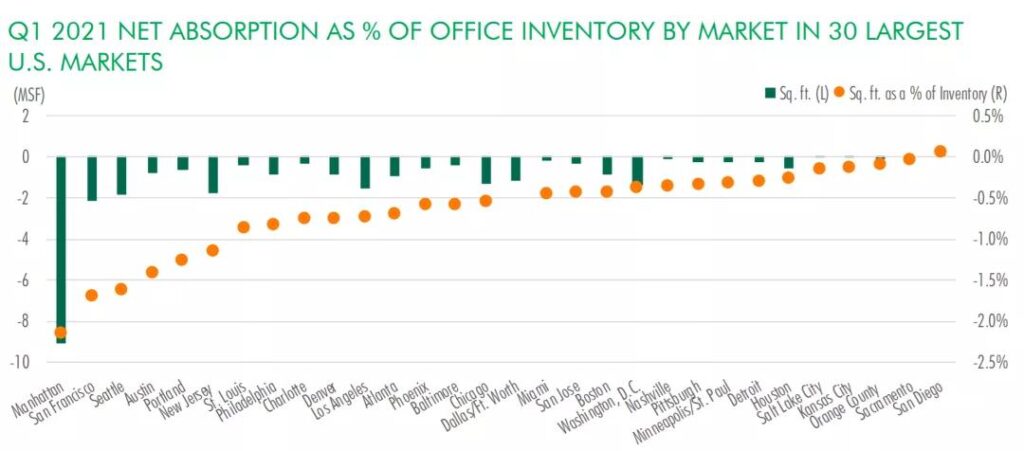

In the U.S. office market, which Colliers International tracks,only 5 percent of the metropolitan office market absorbed more than 100,000 square feet in the first quarter of 2021. The southern city of Huntsville leads the way with about 4.47 million square feet of capacity.

the northeast has the largest decline in absorption, exceeding -19 million square feet. the western region is -12.5 million square feet, followed by the south and midwest.

The CBD office market absorbed -23 million square feet, the fifth consecutive quarter of negative net absorption. Manhattan again recorded the biggest drop in absorption, at -10.9m square feet. This was followed by San Francisco, Chicago, Washington D .C and Boston.C, where the office market was negative by more than 1m square feet.

The total absorption of the suburban office market is -22.9 million square feet, with eight office markets with negative absorption of more than 1 million square feet. Los Angeles was the highest at -3.3 million square feet, followed by Dallas/Fort Worth (2.5 million square feet) and Atlanta (2.2 million square feet)

Photo: Colliers International

In CBRE’s tracking survey of the nation’s top 30 office markets, net occupancy of the U.S. office market as a percentage of inventory in the first quarter of2021 is shown in the following graph, where cities in the following areas are relatively unaffected by the decline in office market demand:

Midwest: Kansas City, Detroit, Minnesota/St. Paul, Pittsburgh, Nashville

South: Houston, Miami

West: San Diego, Sacramento, Orange County, Salt Lake City, San Jose

Northeast: Boston, Washington, D.C.)

the office market in the following regional cities experienced a slight decline in demand:

Midwest: Chicago, Denver, St. Louis Louis)

South: Dallas/Fort Worth, Atlanta, Charlotte

West: Phoenix, Los Angeles

Northeast: Philadelphia, Baltimore

the office market in the following regional cities has experienced a sharp decline in demand:

Western Region: San Francisco, Seattle, Portland

Northeast: Manhattan, New Jersey

South: Austin

Photo: CBRE

the new crown outbreak has accelerated the evacuation of people from first-tier cities on the east and west coasts, attracting young people, office workers and businesses from first-tier cities on the east and west coasts due to the rich talent resources and low-cost, cost-effective real estate market in the midwest and south, as well as the advantages of convenient business conditions.

the midwest and south will also have more jobs than cities on the east and west coasts, where the office rental market will recover faster than the east-west coast cities, rental incomes will stabilize, and office owners will benefit from these trends, laying a solid foundation for the city’s future office market development, which is a direction that many investors need to focus on.

Photo: Google

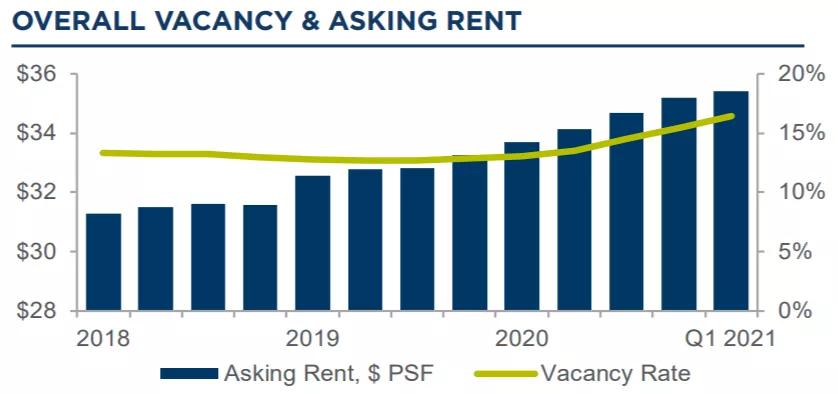

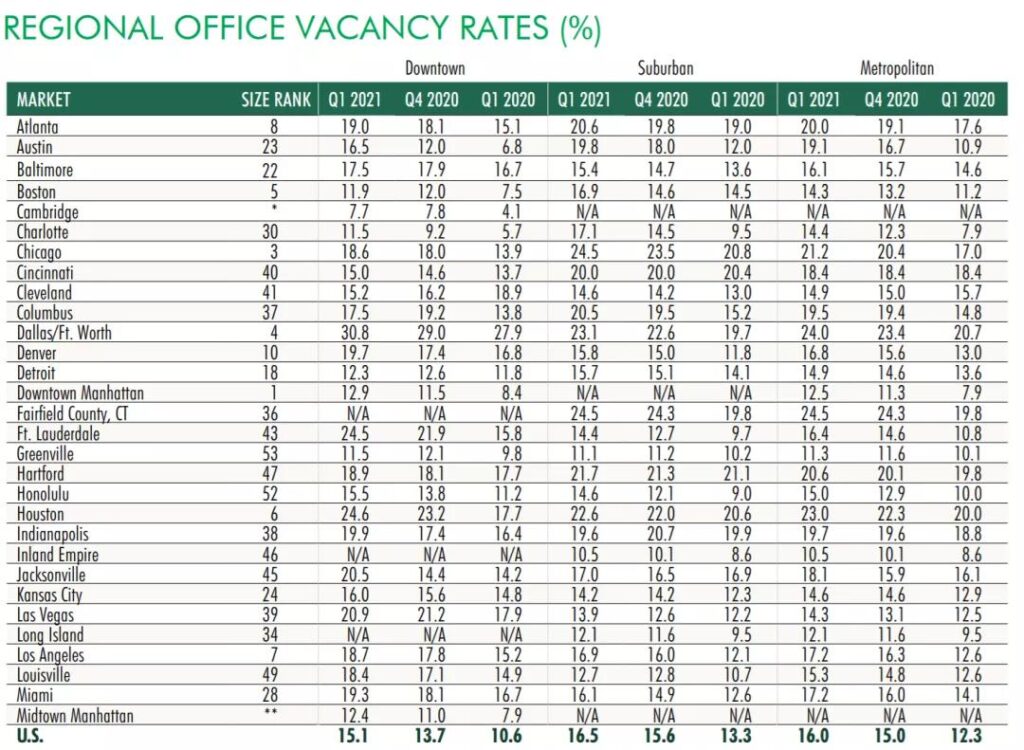

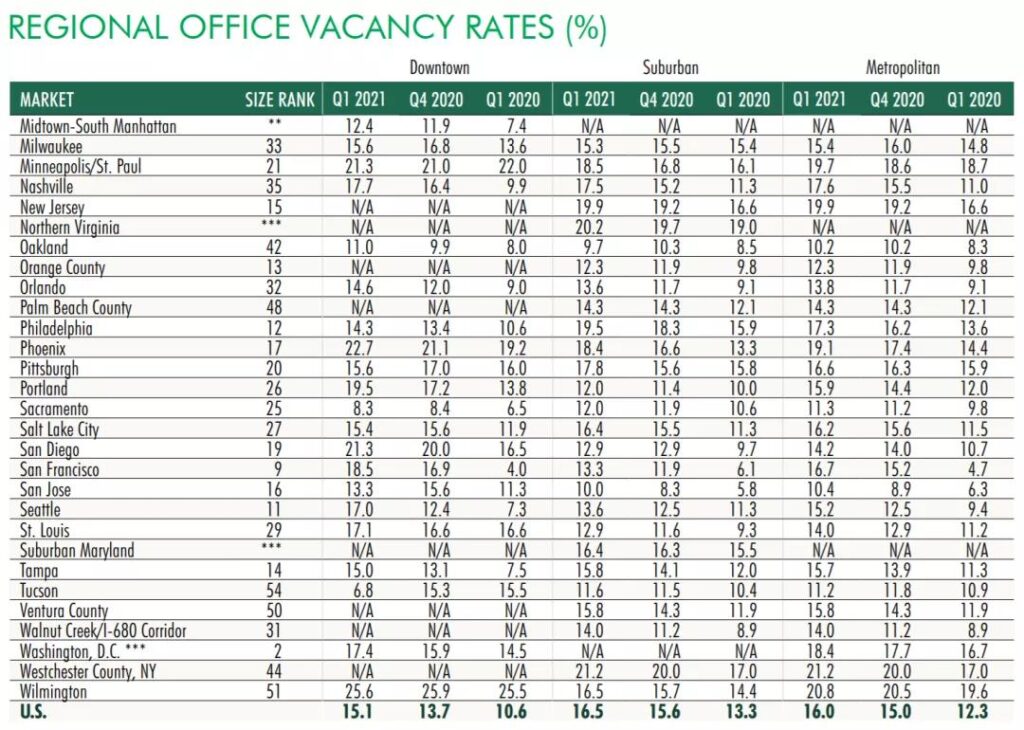

In its report, Cushman and Wakefield Research noted that vacancy rates in theU.S. office market reached 16.4 percent in the first quarter of 2021,the highest level since the fourth quarter of 2011.

Photo: Ded Liang Bank Cushman and Wakefield Research

Rents in the U.S. office market rose about 5 percent year-on-year to $35.4 per square foot, compared with $40.74 per square foot for Category A office space.

Western Region: Rents rose the most, up about 8.4 percent year-on-year to $39.85 per square foot, while Class A office rents were $46.06 per square foot.

Midwest: Rents rose the second-highth, up about 4 percent from a year earlier to $25.9 per square foot, while Rents for Category A office space were $30.31 per square foot.

Northeast: The highest rental prices were up about 3.7 percent year-on-year to $43.56 per square foot, while Class A office rents were $49.74 per square foot.

Southern Region : Rents rose the least, by about 1.5% year-on-year to $30.46 per square foot, while rents for Category A offices were $35.29 per square foot.

Photo: Ded Liang Bank Cushman and Wakefield Research

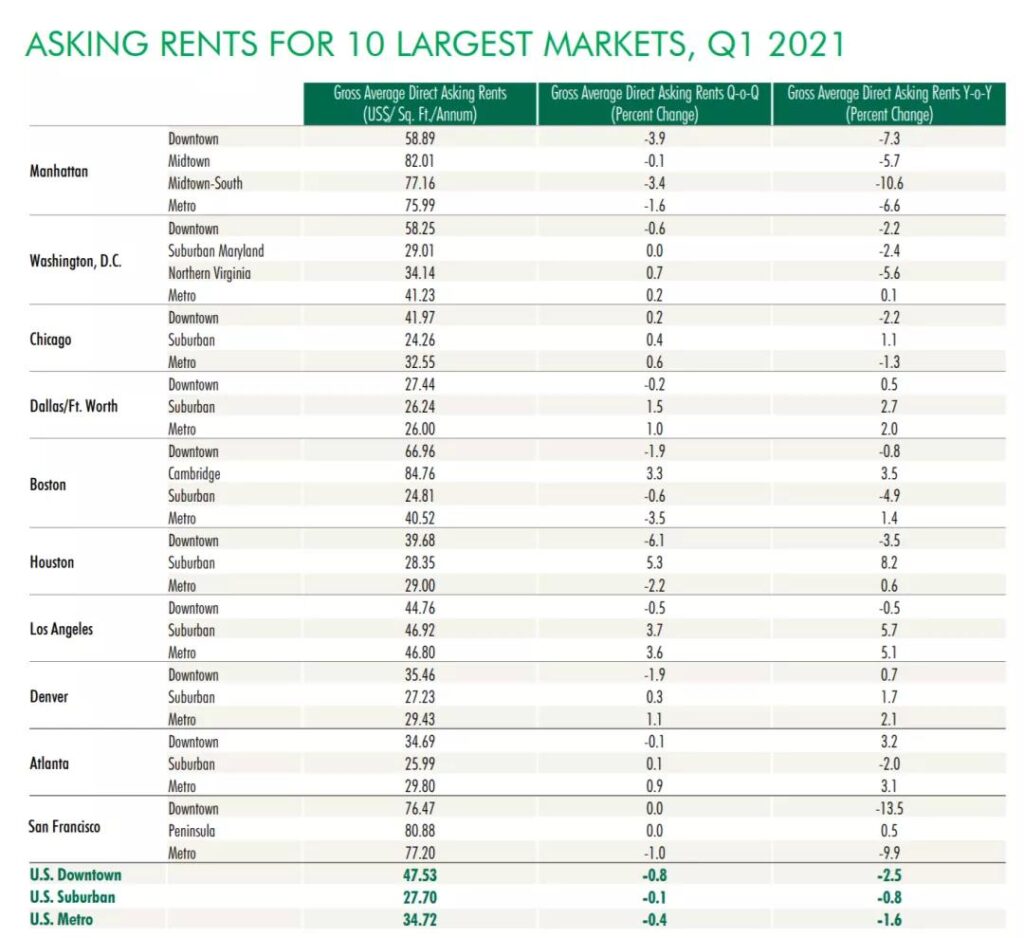

According to CBRE, which tracks the nation’s top 10 office markets:

Total average rents in downtown downtown fell 2.5 per cent year-on-year to $47.53 per square foot, with a vacancy rate of 15.1 per cent.

Total average rents in the suburban office market fell 0.8 per cent year-on-year to $27.7 per square foot, with a vacancy rate of 16.5 per cent.

Total average rents in the Metropolitan office market fell 1.6 per cent year-on-year to $34.72 a square foot, with a vacancy rate of 16 per cent.

Among the highest increases in the Downtown area were:

Southern: Atlanta saw the biggest year-on-year increase in average rents, up 3.2 percent to $34.69 per square foot, with a 19 percent vacancy rate.

Midwest: Denver and Dallas/Ft. Worth ranked second and third, respectively, with year-on-year increases of 0.7% and 0.5% to $35.46 per square foot and $27.44 per square foot, with vacancy rates of 19.7% and 30.8%.

the smaller declines were:

Midwest: Chicago’s total average rent fell 2.2 percent from a year earlier to $41.97 per square foot, with a vacancy rate of 18.6 percent.

West: Total average rents in Los Angeles fell 0.5 per cent year-on-year to $44.76 a square foot, with a vacancy rate of 18.7 per cent.

Northeast: Total average rents in Boston and Washington, D.C. (D.C. Washington) fell 0.8 percent and 2.2 percent year-on-year, respectively, to $66.96 per square foot and $58.25 per square foot, with vacancy rates of 11.9 percent and 17.4 percent.

SOUTH: Total average rents in Houston fell 3.5 per cent year-on-year to $39.68 per square foot, with a vacancy rate of 24.6 per cent.

the biggest declines were:

WESTERN: San Francisco saw the biggest year-on-year decline in total average rents, down 13.5 percent to $76.47 per square foot, with a vacancy rate of 18.5 percent.

Northeast: Total average rents in Manhattan fell 7.3 percent year-on-yearto $58.89 per square foot, with a vacancy rate of 12.9 percent.

File : U.S. national totals provided by CBRE Econometric Advisors, all other other figures compiled by CBRE Research, Q1 2021.

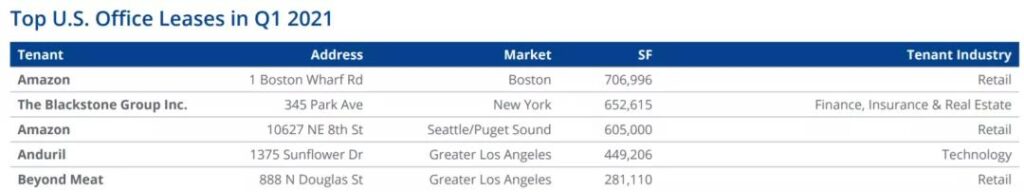

Amazon’s office leasing deals accounted for two of the top five office rentals in the first quarter of 2021, as shown in the chart below.

at the top of the list was amazon’s 706,996-square-foot deal in boston.

In second place was Blackstone Group Inc., which sold 652,615 square feet in New York.

In third place was Amazon’s 605,000-square-foot deal in Seattle/Puget Sound.

In fourth place was Anduril Industries, which sold 449,206 square feet in the Greater Los Angeles area.

In fifth place was Beyond Meat, which sold 281,110 square feet in the Greater Los Angeles area.

Photo: CoStar, Colliers

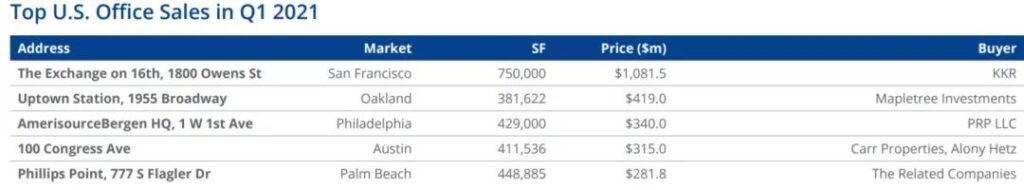

top 5 office transactions in the u.s. in the first quarter of 2021 as shown in the figure below,

At the top of the list was Kohlberg Kravis Roberts Co., or KKR, which sold for 750,000 square feet in San Francisco

In second place was Mapletree Investments, which sold for 381,622 square feet in Oakland.

In third place was the PRP LLC,429,000 square feet in Philadelphia.

In fourth place was Carr Properties, who sold 411,536 square feet in Austin.

In fifth place was The Related Companies, which sold 448,885 square feet in Palm Beach, Florida.

Photo: Real Capital Analytics, Colliers

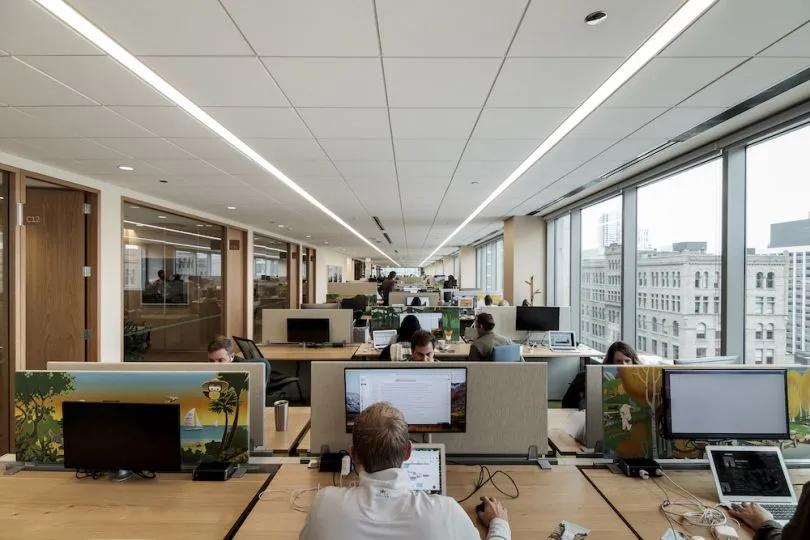

different industries face the epidemic, in the office demand reflects is very different, those who can not work at home, such as services, consulting industry, etc., still maintain high demand for office space, even because of the “social distance”, the same number of employees, the need for a larger area of office space. the travel and computer industries, in the short term, are temporarily far removed from traditional offices.

affected by the new crown epidemic, most of the u.s. city office market due to the reduction of new rental enterprises, the original tenants in the landlord continued to reduce rent to upgrade or expand the office demand is also greater than the need to relocate, resulting in the market for new supply of office buildings digested slowly, further exacerbated the office market rent decline, as well as the market destocking pressure.

Photo: Google

small and medium-sized enterprises and start-ups in various fields have saw their office demand shrink significantly under the impact of the new crown outbreak. the rapid rise in office vacancy rate, no doubt reflects the difficulties of small and medium-sized enterprises, have to reduce rent, and small and medium-sized enterprises single industrial structure, labor costs rise, resulting in the united states office market shows the phenomenon of oversupply.

Many office tenants have already come up with new demands such as flexible spaces, shared meeting rooms, improved indoor air quality and “touch zero exposure” technology. Properties that offer these advanced features will be more popular with tenants in the future. At the same time, based on the experience of previous economic crises, when the economy accelerates in 2021, Class A office buildings will recover faster than the rest of the category, confirming that high-quality engineering will be a more important determinant in the office industry.

Photo: Google

the u.s. economy is reopening faster than previously forecast, with vaccinations recommended, consumer confidence rebounding, the government’s massive stimulus package and consumer demand depressed by a year of new outbreaks.

FWP Frewin expects the U.S. economy to accelerate in the second half of this year and U.S. employment to return to pre-recession levels by the fourth quarter of 2022. However, record negative absorption, rental pressures and high-altitude rates suggest that the office market is likely to continue to face challenges this year, with priority expected in the Midwest and South, and lagging recovery in other regions or cities.

the u.s. office market is facing changes, opportunities and challenges. and after the new crown outbreak, what “new normal” will quickly fade away, and what changes will stay, investors need to seriously consider the issue.

Photo: Google