little knowledge

retail real estate is designed to accommodate any business that sells products and services directly to consumers and is usually made up of institutions that build, develop, and develop shopping and entertainment properties, including shopping centers, shops, clothing stores, florists, and so on.

in 2020, the u.s. retail real estate market is facing great challenges and changes

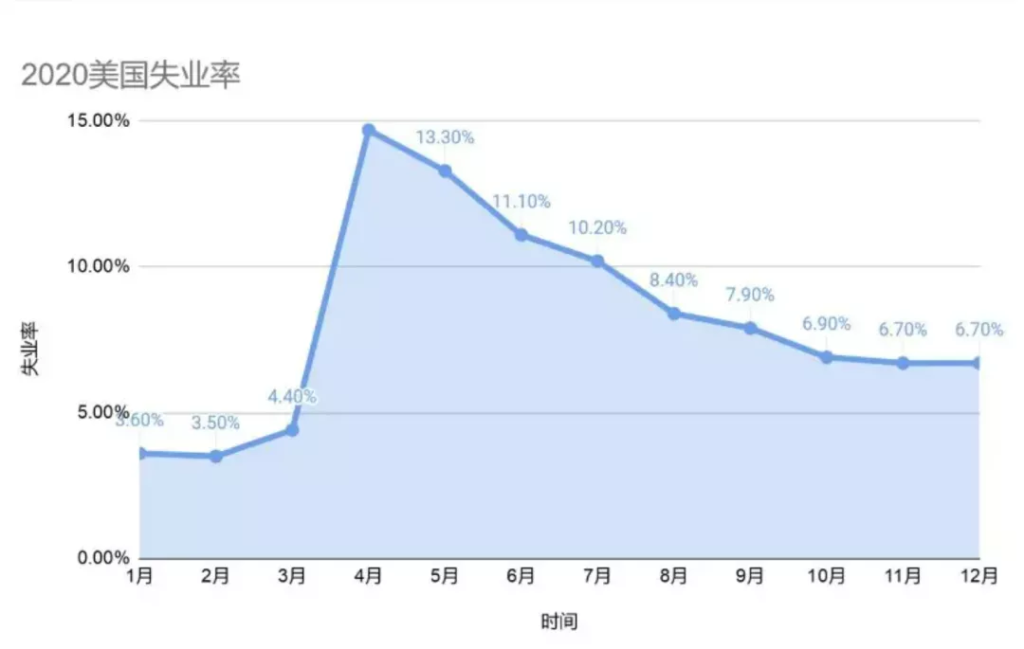

According to the U.S. Department of Commerce, real gross domestic product contracted at an annualized rate of 5% in the first quarter of 2020, influenced by factors such as the large-scale “pause” of the U.S. economy caused by the new outbreak; GDP contracted at an annualized rate of 32.9%in the second quarter, the biggest decline since records began in 1947. Unemployment surged in April to nearly 15%, the highest level on record in 2020. Since then, the U.S. unemployment rate has fallen month by month, but remained above 6 percent in December.

source: u.s. department of commerce

photo credit: north american money saving letters

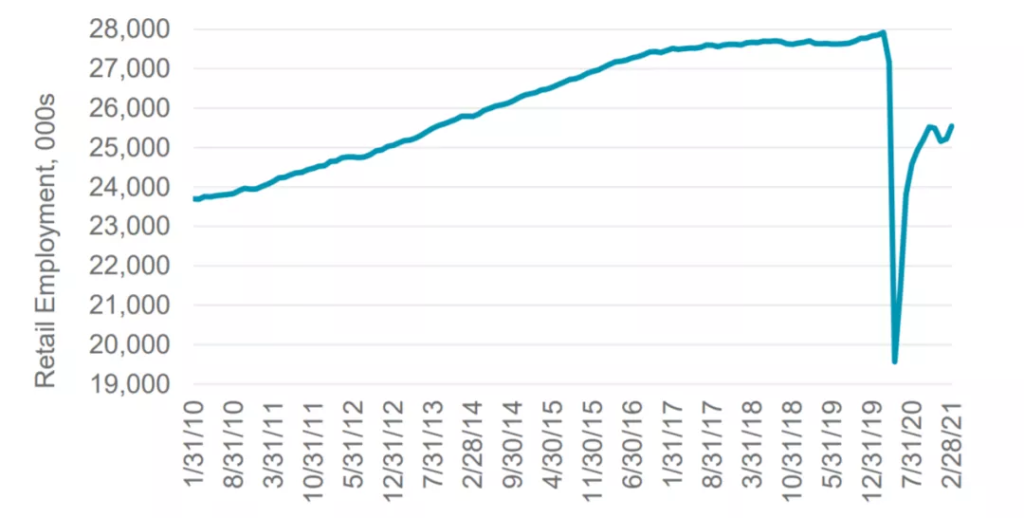

before the outbreak began, 12.2 million people in the u.s. were in the restaurant industry, according to the bureau of labor statistics. during the new crown epidemic, as most people work from home, the number of office workers, students and tourists who frequent retail real estate such as retail stores, restaurants, shopping centers, etc., has plummeted, and businesses and owners of retail properties have lost their daily stable sources of funds or rental, unable to afford rent, utilities, staff wages, etc., and have laid off or closed shops to maintain the day-to-day operations of their stores/companies.

in march and april 2020 alone, the u.s. restaurant industry cut 8.3 million jobs, indoor dining was almost completely shut down, and some small retailers and some big brands couldn’t afford the day-to-day operations of their stores, closing offline stores, and some declaring bankruptcy and restructuring.

Source: U.S. Bureau of Labor Statistics

Photo credit: Cushman and Wakefield Research

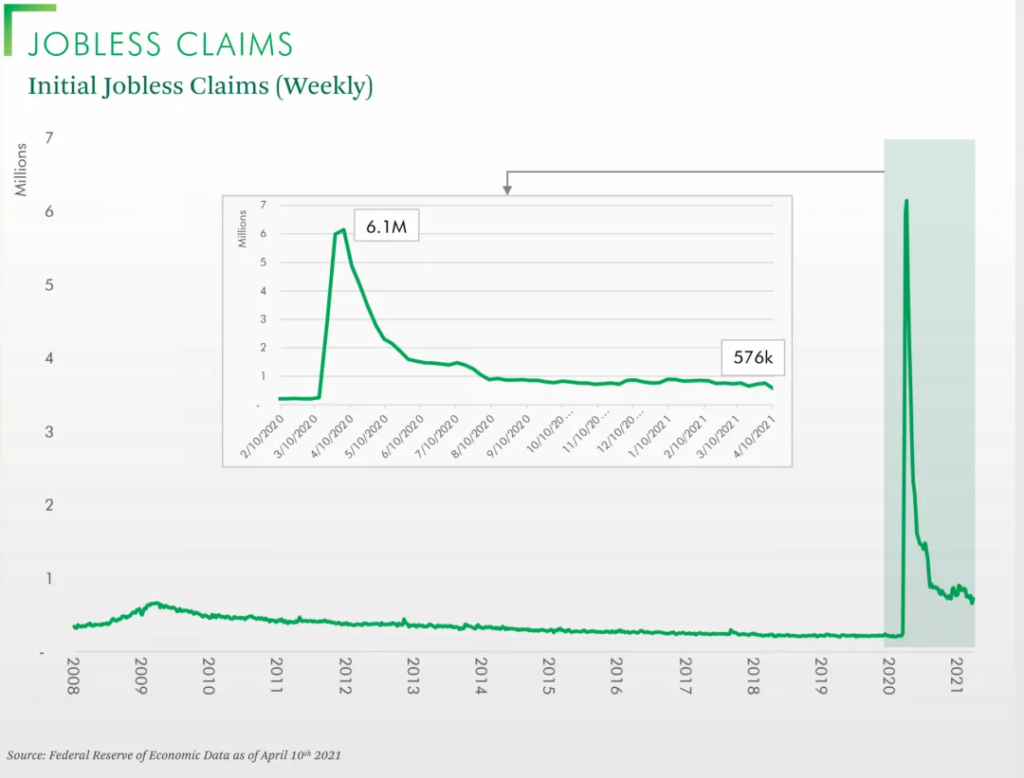

According to CBRE’s U.S. Retail Recovery Indicators May 2021, the number of first-time jobless claims (per week) in the second quarter of 2020 was about 6.1 million, the highest since 2008, and then declining month by month, but still higher than before the outbreak.

Source: Federal Reserve of Economic Data as of April 10th 2021

PHOTO CREDIT: CBRE

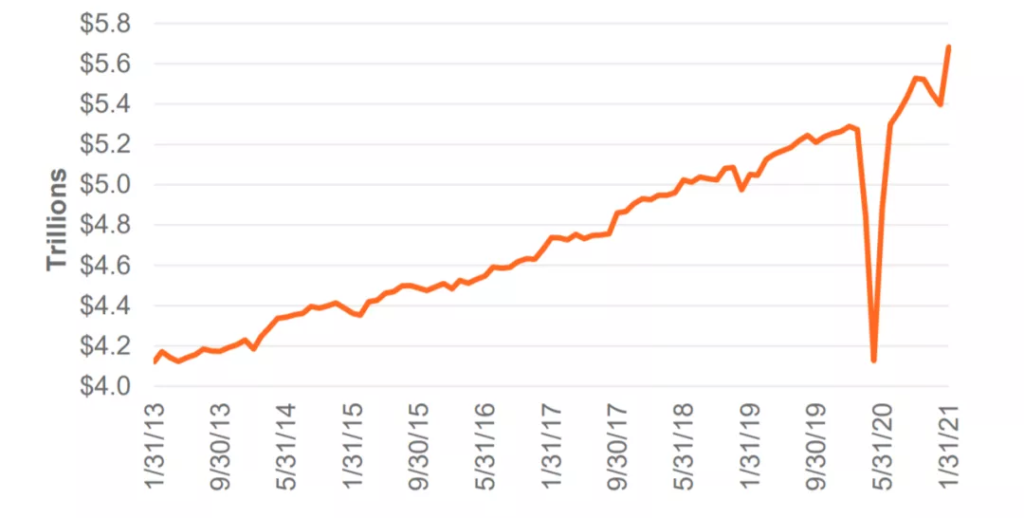

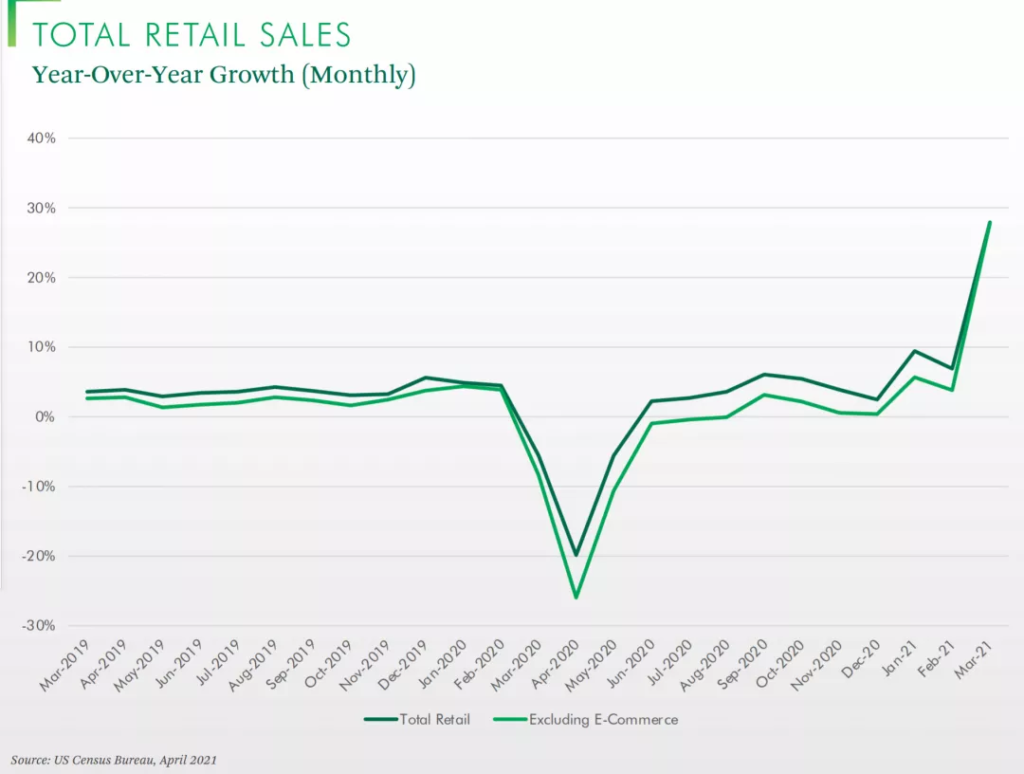

In its March 2021 report, U.S. Retail Market Outlook, Cushman and Wakefield noted that in April 2020, as the new crown epidemic raged and the “home-order” blockade took effect, most people were working from home, unable to move to retail stores, shopping centers, restaurants and other retail properties, retail owners and employees were unable to work in shops. That led to a sharp drop in total retail sales in the second quarter of 2020 to below $4.2 trillion, the lowest level since 2013.

Photo: U.S. Census Bureau; Cushman & Wakefield Research

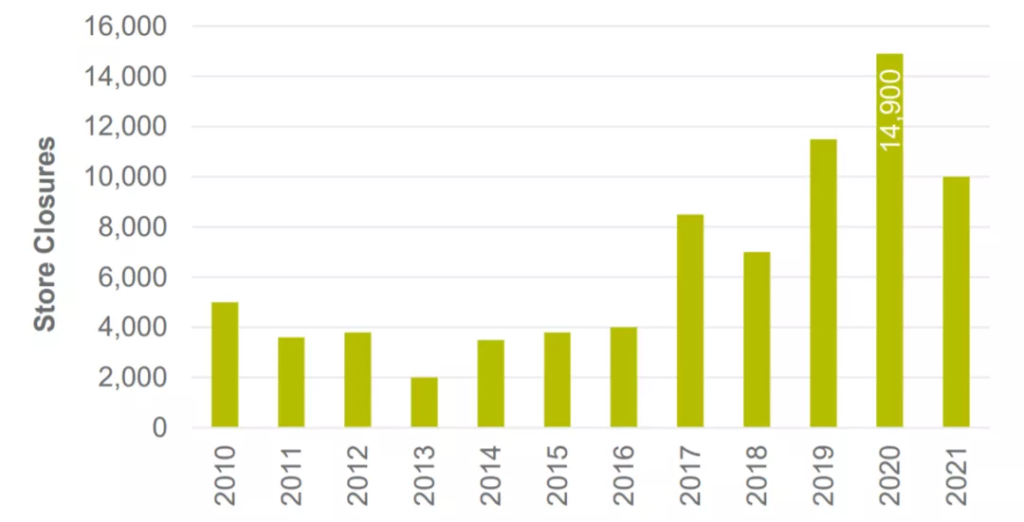

in 2020, when the new epidemic raged, the u.s. retail industry experienced tremendous challenges and changes. nearly 15,000 u.s. stores will close in 2020, nearly 51.8 million square feet of new retail space will be vacant, and the number of store closures will be at an all-time high since 2010.

Photo: Company Filings, Media Reports, Department of Commerce, Cushman and Wakefield Research, CoreSight Research. 2020estimate-BDO, 2021 forecast by CoreSight Research 1/28/21

during the new outbreak, u.s. brick-and-mortar retail stores and brands cut jobs, closed offline retail stores or went bankrupt, people lost their source of wages, were unable to maintain their daily lives, consumer confidence declined, and no one went to retail stores because of the “home order” and the new cap, and the surge in unemployment and rising numbers of people filing for unemployment benefits in the u.s. retail market, particularly in the real retail sector.

at the same time, due to the outbreak and weak trading, most investors to ensure that they have sufficient funds to deal with the impact of the new crown epidemic, reduce investment on the sidelines, brands, retailers and other retail real estate rental market demand, the impact on the retail real estate market, the u.s. retail and retail real estate is facing great challenges.

Photo: Google

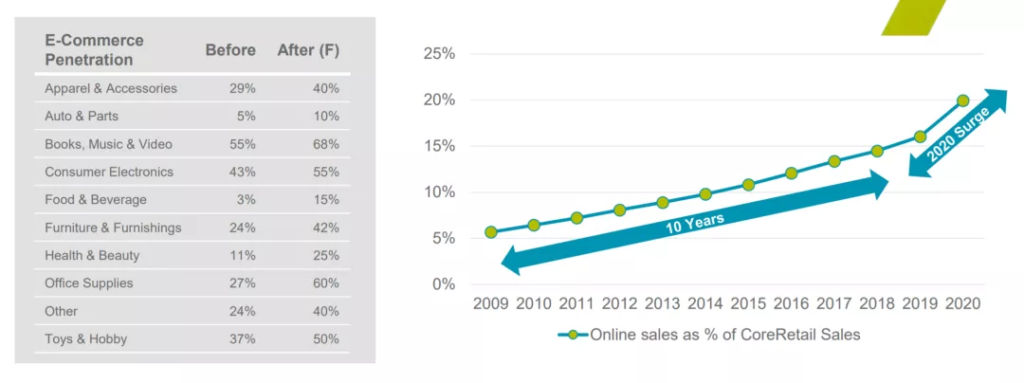

the u.s. retail industry is facing challenges and change. during the new crown epidemic, the rapid development of the u.s. online consumer market, mainly due to the increase in people’s home time, consumption from offline to online transfer, e-commerce has made a major breakthrough. therefore, the physical retail off-line store transformation and brand expansion of online sales of multiple channels become critical.

Total U.S. retail sales rose 6.7 percent to $4.06 trillion in 2020, according to the bank, and despite the challenges of the outbreak, U.S. e-commerce online sales will account for more than 20 percent of core retail sales in 2020, up nearly 5 percent from a year earlier and the highest pace since 2009. During the year, more and more Americans turned to websites and apps to buy groceries, comfortable clothing and homewares.

u.s. e-commerce as a percentage of core retail sales

Core Retail Sales ( excluding car dealers, gas stations, and restaurants)

Photo: U.S. Department of Commerce, ShawSpring Partners, Bank of America

faced with the impact of the outbreak, the u.s. congress passed two rounds of anti-epidemic bail-outs in march and december 2020 that included bail-outs for eligible u.s. taxpayers, an extension of unemployment benefits, an increase in unemployment benefits, and corporate loans and vaccine payments to help businesses and the unemployed tide over the difficulties while boosting the u.s. economic recovery.

According to Research data from CentreSquare Investment Management, U.S. mall operators received only about 15 percent of their rent in April 2020, and after the first round of the anti-epidemic bail-out, a turnaround took place in June and July, with nearly 65 percent of tenants starting to pay rent.

At the same time, rental arrears from owners of a large number of retail properties are about to expire in the third and fourth quarters of 2020. In September, retailers across the country paid about 86 percent of their rent, down 10 percent from 2019, but up 83 percent month-on-month. For example, Duke Realty, a large U.S. retail real estate developer, whose tenants have less than 100,000 square feet of floor space, could delay paying rent until the end of 2020.

the release of the two bail-outs has given a big boost to the u.s. retail market, giving consumers extra money to meet their daily needs and slowly picking up consumer confidence. as the pace of social vaccination in the united states accelerates in the third and fourth quarters of 2020, cities slowly enter the reopening phase, new unemployment claims decline, employment continues to expand, rental payments continue to rise, and the u.s. economy slowly recovers, all of which are driving the recovery of the u.s. retail real estate market.

Source: US Census Bureau, April 2021

PHOTO CREDIT: CBRE

in 2021, the retail real estate market is starting to take a new turn

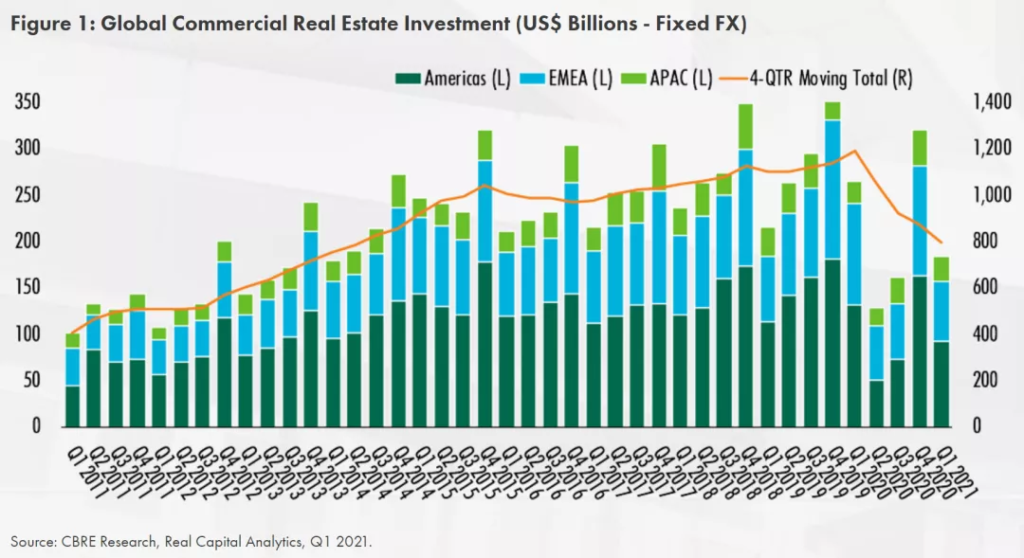

In its Global Market Flash: Global Investment Activity Soft But Outlook Brightens report, CBRE noted that investment in the global commercial property market fell 31 per cent year-on-year to $184bn in the first quarter of 2021, with volumes down 33 per cent from 2020 and remaining weak compared to 2019.

the united states, one of the countries with the highest vaccination rates, outperformed other countries in investment in the first quarter of 2021. based on the current pace of vaccinations in the united states and the economic recovery in the consumer market, investment in the commercial real estate market will approach pre-epidemic levels in the second half of 2021.

Picture:CBRE Research, Real Capital Analytics, Q1 2021

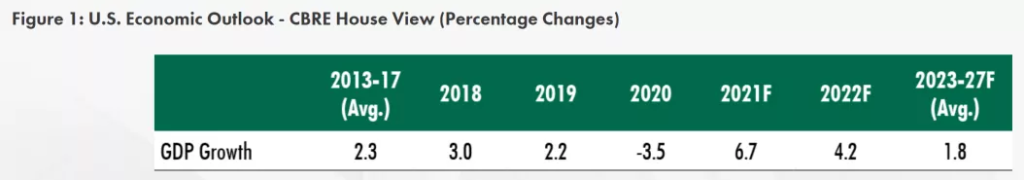

U.S. gross domestic product grew 6.4 percent in the first quarter of 2021,driven by government and consumer spending and business investment, according to a report in CBRE’s April report.

With strong growth in the U.S. economy, U.S. gross domestic product growth is expected to accelerate further to 10.1 percent in the second quarter of 2021 and then slow in the second half of the year, withU.S. gross domestic product growing 6.7 percent in 2021,according to the company. After that, U.S. gross domestic product will return to long-term levels of about 1.8 percent.

Picture:CBRE Research. Bureau of Economic Analysis.

as vaccinations continue to advance in 2021, the reopening of states and cities has given confidence to return to normal daily work and entertainment, consumer confidence has risen sharply, and the outlook for the u.s. retail market is strong.

FWP Frewin expects a full recovery in retail sales to follow in the second half of the year, with increased demand for rental properties, which will encourage investors to be optimistic about the outlook for the retail real estate market and encourage investors to invest more in the U.S. retail real estate market.

Photo: Google

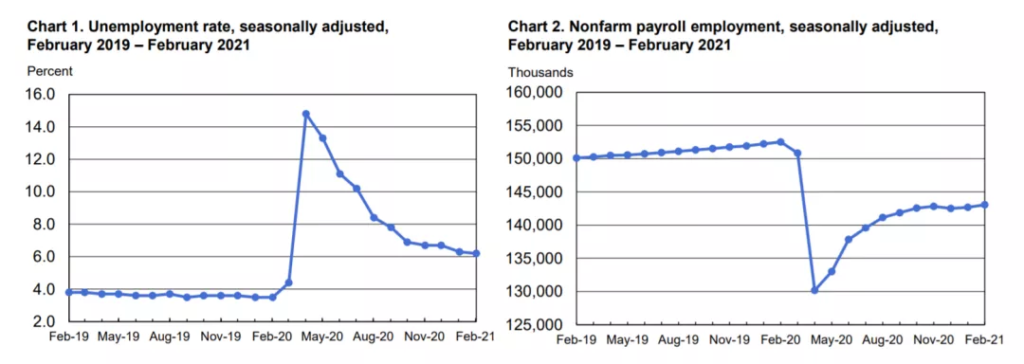

According to the U.S. Department of Labor and CBRE, nonfarm payrolls grew by 379,000 in February, the largest increase since October 2020, well above previous market expectations of 210,000, and the unemployment rate fell to 6.2 percent 。

Source: Bureauof Labor Statistics

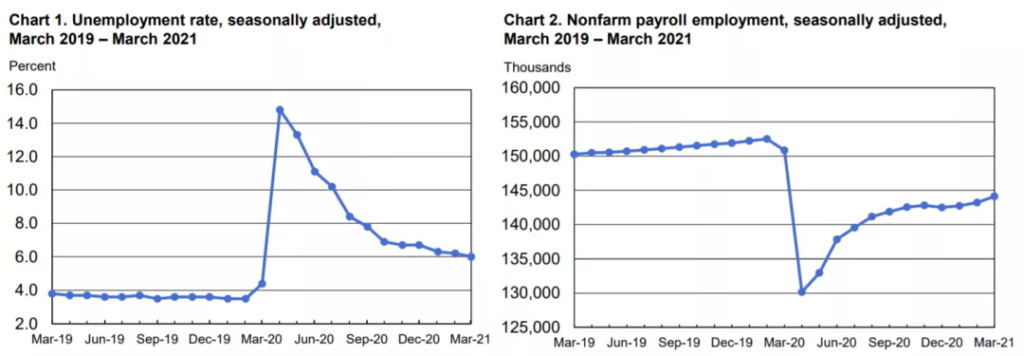

nonfarm payrolls in the u.s. fell to 6 percent in march from 916,000, the lowest level since the outbreak began last march.

Source: Bureauof Labor Statistics

nonfarm payrolls rose to 266,000 in april, below expectations of 1 million. the unemployment rate rose to 6.1 per cent and the labour participation rate rose to 61.7 per cent.

nonfarm payrolls rose to 559,000 in may, below expectations of 671,000. the unemployment rate fell to 5.8 per cent and the labour participation rate fell to 61.6 per cent.

for now, 7.6 million fewer americans are employed than they were before the outbreak, with labor participation 1.7 percentage points lower than before the outbreak and average hourly earnings rising by just 1.9 percent, supporting the fed’s low interest rate stance that any impact of rising inflation will be short-term. on june 7, the yield on the 10-year treasury note fell to 1.567 per cent, reflecting investor support for that view.

photo: wall street insights

CBRE FORECASTS THAT THE U.S. ECONOMY WILL MAINTAIN STRONG GROWTH MOMENTUM IN THE SECOND QUARTER OF 2021, WITH 5.5 MILLION NEW JOBS EXPECTED BY THE END OF THE YEAR AND THE UNEMPLOYMENT RATE FALLING TO ABOUT 4.5 PERCENT.

the continued improvement in vaccination, the improved public health environment, overall job growth, the decline in unemployment and the issuance of three rounds of bail-outs in the united states, against the backdrop of strong growth in the u.s. economy, the overall trend in the u.s. job market is positive, most americans are able to meet daily consumption, consumer confidence is growing, which will continue to stimulate the u.s. retail market demand, which will further promote the overall recovery of the u.s. retail real estate market.

Photo:Google

In its 2021 U.S. Retail Market Outlook and U.S. S. SHOPPING CENTER MARKETBEAT REPORTS reports, Cushman and Wakefield noted that retail market conditions improved in the first quarter of 2021 after a challenging 2020. With three bail-outs, faster vaccinations, additional sources of funding for consumers, retaliatory spending after the outbreak began to show, shoppers became more active and retail began to improve. Total retail sales in the U.S. retail market rose 28 percent year-on-year to the first quarter of 2021, to more than $5.4 trillion, the highest level since 2013.

Net Absorption was about 740,000 square feet in the U.S. mall market as of the first quarter of 2021, the smallest negative absorption recorded since the start of the new crown epidemic, with rental activity falling slightly to 25 million square feet, up from a low in the second quarter of 2020. Vacancy rates in the U.S. mall market were higher, at 7.3 percent, higher than before the new crown outbreak.

Photo: Cushman and Wakefield Research

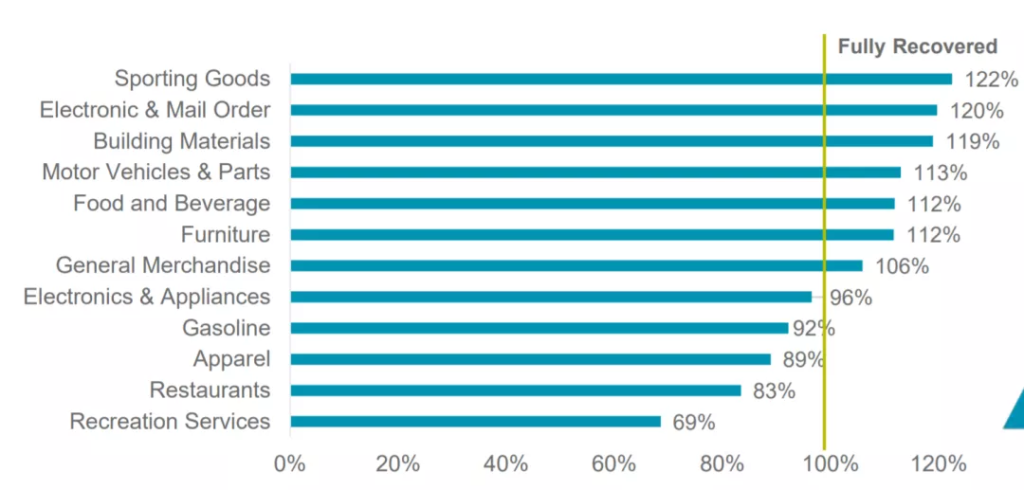

However, the rebound in the U.S. retail sector has been unevenly distributed, with retail sales rising sharply in February 2021, surpassing the levels seen before last year’s new outbreak, as a result of a strong overall recovery in retail sales of sporting goods, e-mail, building materials, motor vehicles and components, food and beverage, furniture and general merchandise. Electrical appliances, gas stations, Retail sales, such as clothing and restaurants, recovered more quickly, recovering to more than 80% of the same period last year; Retail sales related to entertainment services, such as shopping malls, shopping centers and concept experience stores, recovered more slowly, recovering only to 69% inthe same period last year and notexpected to return to the same level until the end of 2021.

Retail Sales: Recovery Percentage

:: %Recovered – February 2021 retail sales as a percentage of February 2020 retail sales.

Photo: Census Bureau; Cushman & Wakefield Research

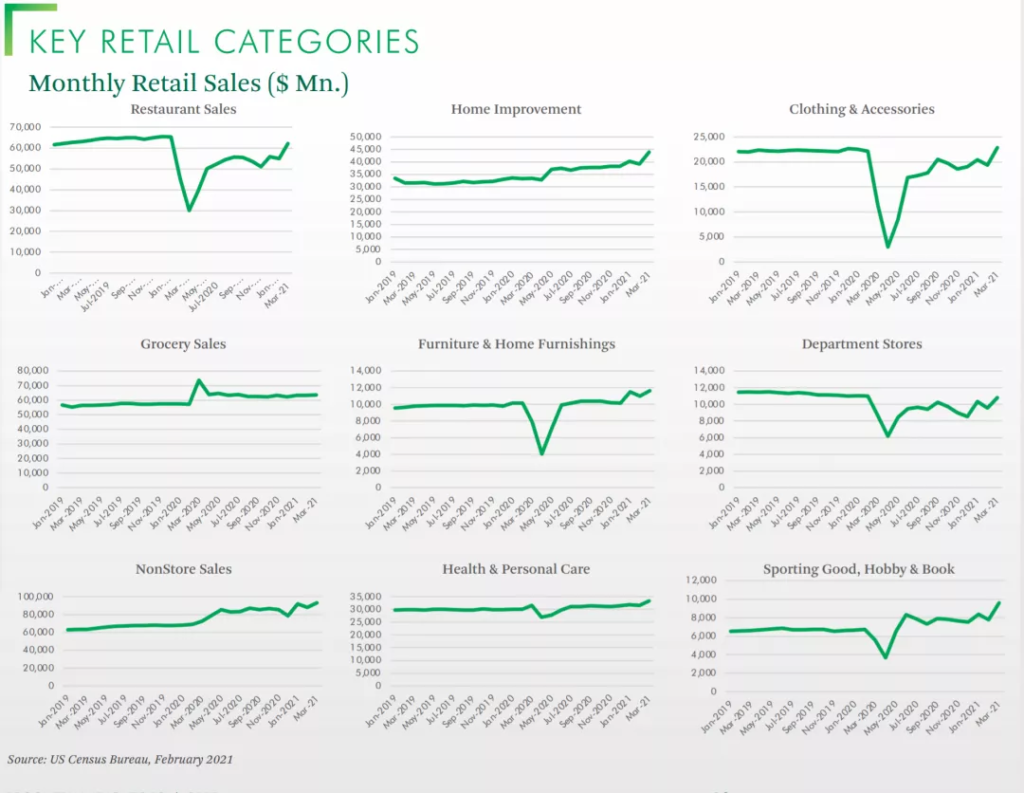

Each retail category tracked by the U.S. Census Bureau reported positive monthly sales growth in the first quarter of 2021, driven by rising consumer confidence, three rounds of U.S. Congressional bail-outs, and the reopening of cities and the phasing of retail stores.

Source: US Census Bureau, April 2021

PHOTO CREDIT: CBRE

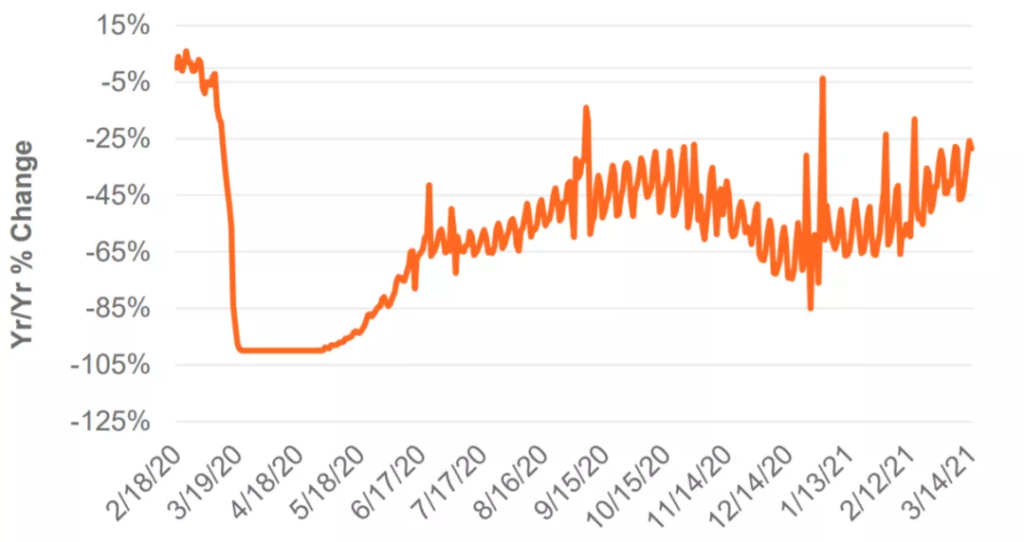

In its March 2021 report, U.S. Retail Market Outlook, Cushman and Wakefield noted that restaurant bookings have risen rapidly as vaccination efforts have advanced, consumer confidence has rebounded and restaurant bookings are eager to go out and spend. Restaurant bookings have increased by 40% since January 2021.

Percentage of Open Table bookings in the United States

Source: OpenTable

https://www.opentable.com/state-of-industry

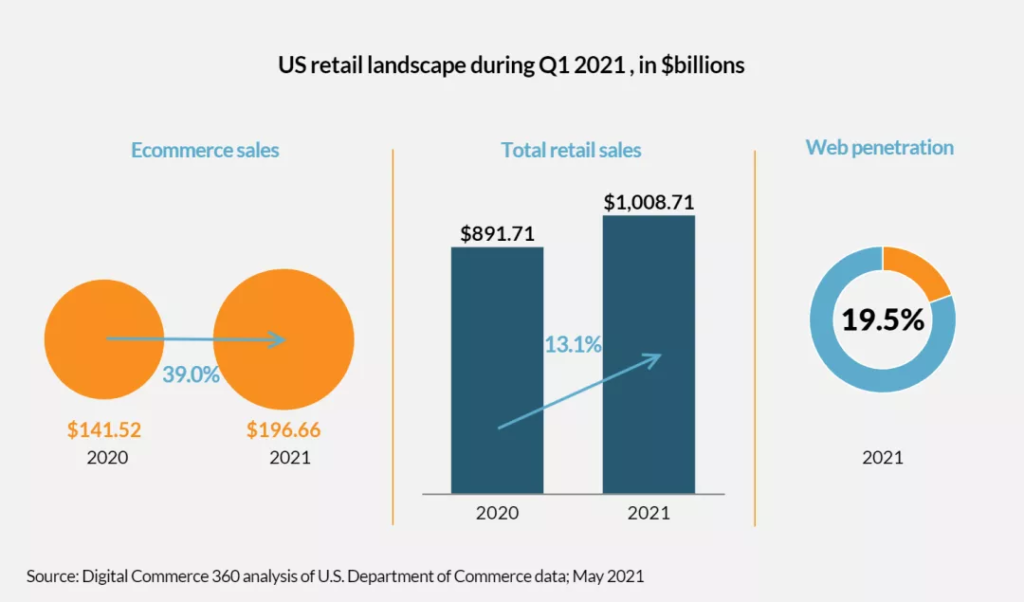

u.s. e-commerce grew at a rate of 39 percent in the first quarter of 2021, nearly three times the 13.8 percent growth rate in the first quarter of 2020, helped by three rounds of anti-epidemic bail-outs and additional money for consumers, according to data released by the commerce department on may 18, 2021.

despite rising vaccination rates, declining daily confirmed cases and the reopening of more cities and states, americans still prefer to shop online and consumer behavior has changed.

Source: Digital Commerce 360 Analysis of U.S. Department of Commerce data; May 2021

E-commerce reached $196.66 billion in the first quarter of 2021, up 39.0 percent from $141.52 billion in the same period in 2020, according to Digital Commerce 360. Nearly $1 in every $5 in retail spending comes from online orders, and nearly a fifth of retail spending in the first quarter comes from online orders, fueling an in-store spending boom.

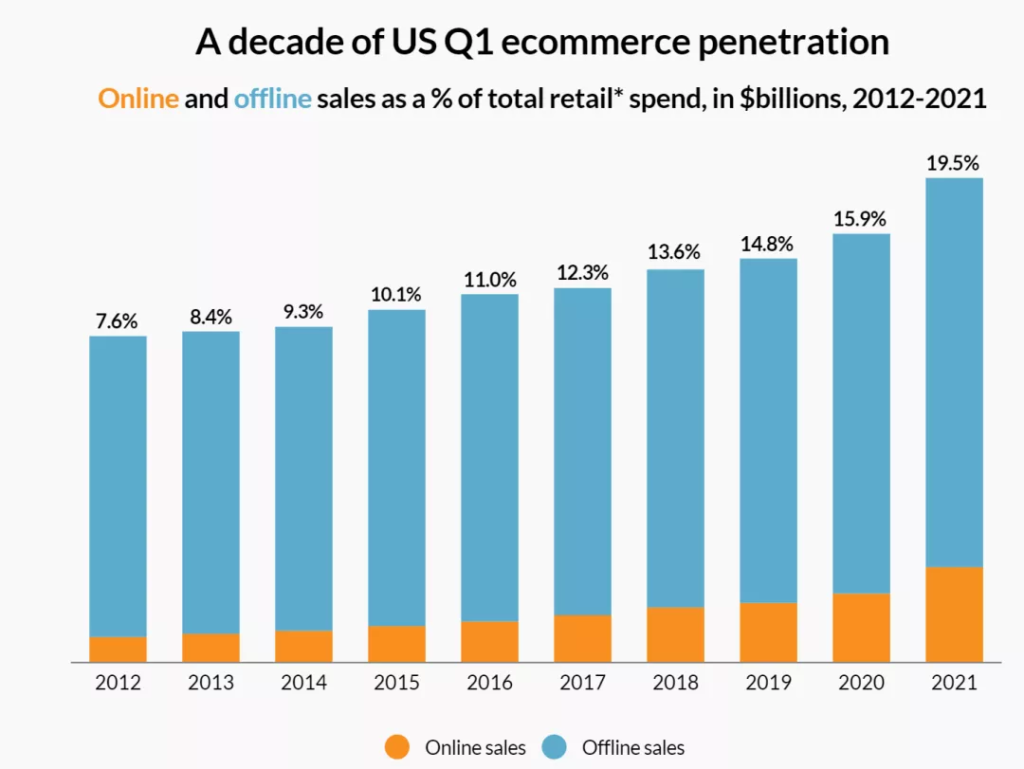

as shoppers become more accustomed to online shopping, and retailers adjust their e-commerce operations to deliver goods faster and more efficiently, e-commerce’s share of total retail sales is increasing year by year, a trend exacerbated by the new crown outbreak.

Source: DigitalCommerce 360 Analysis of U.S. Department of Commerce data; May 2021

e-commerce driven retail sales growth of 47.1% in the first quarter ended march 31, 2021. this represents an 8.2% year-on-year increase in offline sales, compared with 4.8% in the first quarter of 2020. offline sales growth in the first quarter of 2021 was the highest on record. by contrast, the median quarterly growth in offline sales in the five years to 2020 was just 2.2 per cent year-on-year.

Take e-commerce giant Amazon.com Inc., which topped the list of 1,000 north American home appliance makers, according to The 2021 Top 1000 Report-Analytic North America’s Leading 1,000 Online Retailers, released by Digital Commerce 360.

amazon reported rapid growth in e-commerce sales so far in 2021, with first-quarter revenue reaching $60.44 billion, up 42.3 percent from $42.48 billion a year earlier. (this data includes sales of amazon’s own products or first-party inventory, plus commissions and fees the company receives from market sellers, amazon premium memberships, and other subscription services.) )

that means amazon alone accounted for 30.7 percent of u.s. e-commerce sales in the first quarter of 2021, accounting for nearly a third of online business growth in the january-march period.

during the outbreak, the online retail industry, supported by digital technology, developed rapidly, enhancing the resilience of emerging economies and promising future market development. with the change of consumption pattern and environment, the global retail industry is in the digital transition period.

Source: Digital Commerce 360 Analysis of U.S. Department of Commerce data; May 2021

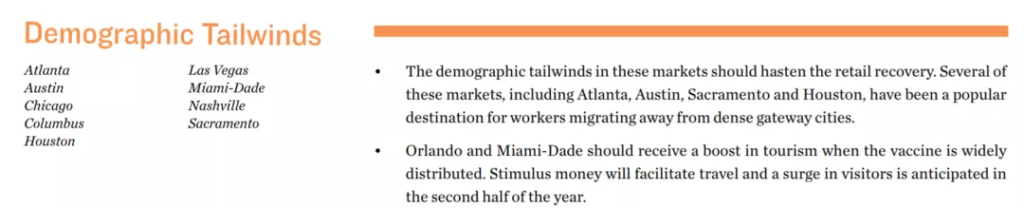

Marcus Millichap, in its 2021 Marcus Millichap Investment Forecast report, notes that the new crown outbreak has accelerated the evacuation of people from first-tier cities on the east and west coasts, attracting businesses and office workers from many gateway cities due to the abundant talent resources in the central and southern regions and the low-cost, cost-effective real estate market. For example:

Chicago, Columbus, Nashville, Midwest

Atlanta, Austin, Houston, Miami-Dade, South

Las Vegas and Sacramento on the West Coast

These cities have long been popular destinations for migration of first-tier cities on the east and west coasts. Marcus Millichap expects the retail market to recover first in the second half of 2021 as the U.S. epidemic improves, driving a full-blown rebound in the region’s retail real estate market due to their large labor force and excellent demographics.

Photo: Marcus Millichap

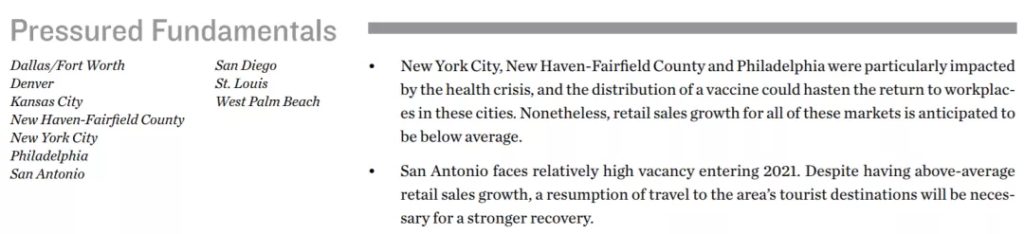

although many u.s. states, cities and counties have announced full opening dates, many cities are still affected by the new outbreak, and vaccination distribution and vaccination efforts in some cities will be slow, resulting in a slow recovery in the retail real estate market in those cities, as well as a slow recovery in the retail real estate market in those areas, such as:

Dallas/Fort Worth, San Antonio,

Denver, Kansas City, St. Louis, Midwest. Louis)

New Haven-Fairfield County, New York City, Philadelphia, East Coast

San Diego, West Palm Beach, West Coast

Marcus Millichap expects retail sales growth in these markets to be below average in the second half of 2021. In the case of San Antonio in the south, the tourist city, the region’s retail property market faces relatively high vacancy rates. Although its retail sales grew above average, a stronger recovery would require a resumption of travel to tourist destinations in the region

Photo: Marcus Millichap

after more than a year of outbreaks and strict restrictions on food, entertainment and travel, consumers have shifted most of their discretionary spending to physical consumption. these include items that keep them comfortable and entertained while staying at home, such as sports equipment, home office furniture, terrace and garden decorations, and swimming pools and toys for children.

now that the u.s. is relaxing its mask requirements for vaccinated individuals, consumers are receiving more and more positive news about returning to normalcy, and the pendulum is likely to shift in part to pre-epidemic spending habits in the coming months. given the huge pent-up demand dynamics that consumers had during the outbreak, the desire for entertainment items such as in-store shopping, restaurant reservations, concerts and vacations could show a different retail landscape in the second half of 2021.

Photo credit:REUTERS/Shannon Stapleton

As more Americans get vaccinated, the U.S. economy is reopening faster than previously forecast. The National Retail Federation (NRF) on Wednesday raised its forecast for U.S. retail sales growth in 2021 to between 10.5 percent and 13.5 percent to $4.44 trillion to $4.56 trillion. This forecast includes store and online sales, but does not include car dealers, gas stations and restaurants. Earlier, the NRF forecast in February that retail sales would grow 6.5 per cent to 8.2 per cent this year to more than $4.33 trillion.

despite the upbeat forecasts, retailing faces challenges, including inflation, port congestion and a shortage of workers. it’s unclear how much of consumers’ wallets will shift to services and other priorities, such as hotel stays, airline tickets and eating out, not just consumer goods.

With many retailers, including Home Depot, Macy’s and Walmart, recently reporting strong first-quarter results, the company raised its forecast for this year’s results. Jeff Gennette, macaquale’s chief executive, said on a performance conference call in May that “repressed consumer demand” was expected to continue as shoppers bought alternative consumer goods such as suitcases, new shoes, new clothing and cosmetics, and did not see it as short-term retaliatory.

Government stimulus, high consumer appetite and the introduction of vaccines are important indicators of the continued prosperity of the U.S. retail industry. FWP Frewin expects demand for space in retail, such as shopping malls, high-end restaurants, grocery stores, entertainment, home improvement, electronics and experience concept stores, to rise in the second half of 2021 as stores, restaurants and entertainment venues reopen and consumer spending increases, and investors to invest more in the retail real estate market. The next few years will be a period of strong growth in the retail property market.

Photo: Google