“Over the next few years, the shortage of U.S. housing will continue, with annual growth in home prices between 10% and 15%.”

How do we judge whether the extremely hot U.S. real estate market is a bubble?

According to the latest data released at the end of September, the accelerating U.S. housing market showed no signs of cooling down: the S&P Case-Shiller index showed that the average U.S. home price rose by 19.7% year-on-year, setting a new record and the largest increase in the U.S. housing market in more than 30 years.

Is this a counter-cyclical purchase driven by the epidemic, or just a need?

In fact, a small detail may reverse the entire sand table prediction: along with having children and independent living, the post-80s and post-90s generations in the United States have to buy houses for themselves.

This round of the epidemic is the catalyst for the booming real estate market, but in the past ten years, the imbalance between supply and demand caused by the lack of real estate construction in the United States is the main cause. In addition, the American “millennials” who once postponed their home purchases have entered the market by a large margin in the past two or three years which further detonated the market.

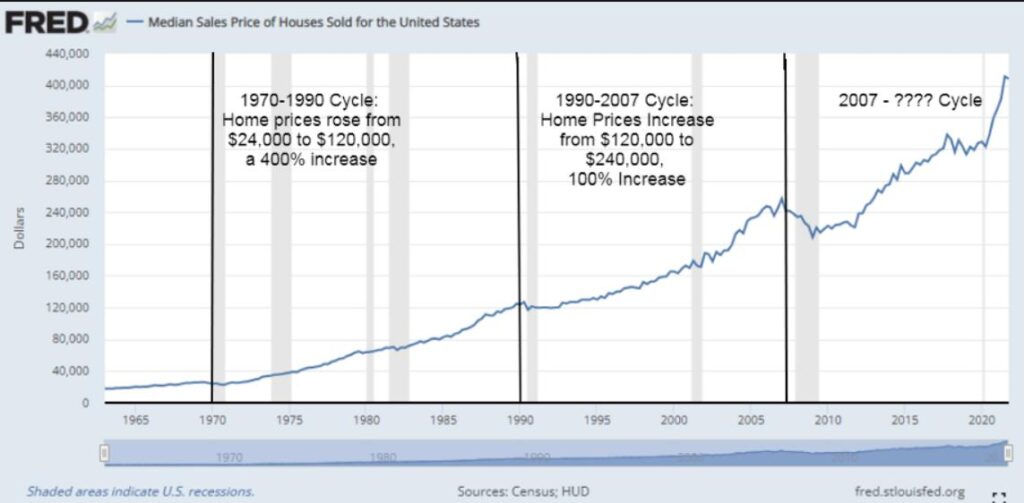

The real estate fluctuation cycle in the United States is relatively long, starting in 1970, with a cycle of 18 to 20 years, usually 14 years for the bull market and 4 years for the bear market. This cycle started in 2007, and the low point appeared in 2012. Since then, we have experienced a 9-year real estate bull market which is not yet over, and it is predicted that housing prices will reach the next peak after 2026.

Three important indicators for judging whether the real estate market is full of bubbles are: first, the supply of US real estate inventories; second, the lending situation of US banks; third, the market sentiment and entry of retail investors. At present, in these three aspects, there are no signs of investors clearing the market and exiting.

In the short term, the supply of U.S. housing will rise while the shortage will be partially alleviated, and the rate of house price growth will slow to about 15% from the current rate of nearly 20%. In the next few years, the shortage of U.S. housing will continue, and the annual growth rate of house prices will remain between 10% and 15%.

MEDIAN SALES PRICE OF HOUSES SOLD FOR THE UNITED STATES

Source: US Census Bureau

Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MSPUS

Who is buying houses?

The main market of house-buyers in the United States is the millennial generation. The subprime mortgage crisis in 2007 and 2008 caused a significant delay for millennial individuals from buying a house for 10 years.

According to previous surveys by American media from 1970 to 2017, more and more young Americans (millennials) in their 20s and 30s chose to live with their parents. In 2017, more than 40% of 25-year-old men chose to live with their parents, and more than 33% of 25-year-old women did the same.

But in the past two or three years, they began entering the real estate market, because many people have reached the stage of getting married and having children, now requiring them to live in a house, while the epidemic accelerated the process of separation. Due to the low supply of real estate in the United States and the imbalance between supply and demand in the past ten years, this trend is not new. For example, in 2018, a well-known financial publisher in the United States published an article called “The Next Crisis of the U.S. Housing Market”: Unprecedented New Home Shortage”. At the time, he had noticed the extreme shortage of new homes in the United States, which was only exacerbated by the epidemic, bringing it to the highest point in history.

How much housing shortage is there in the United States?

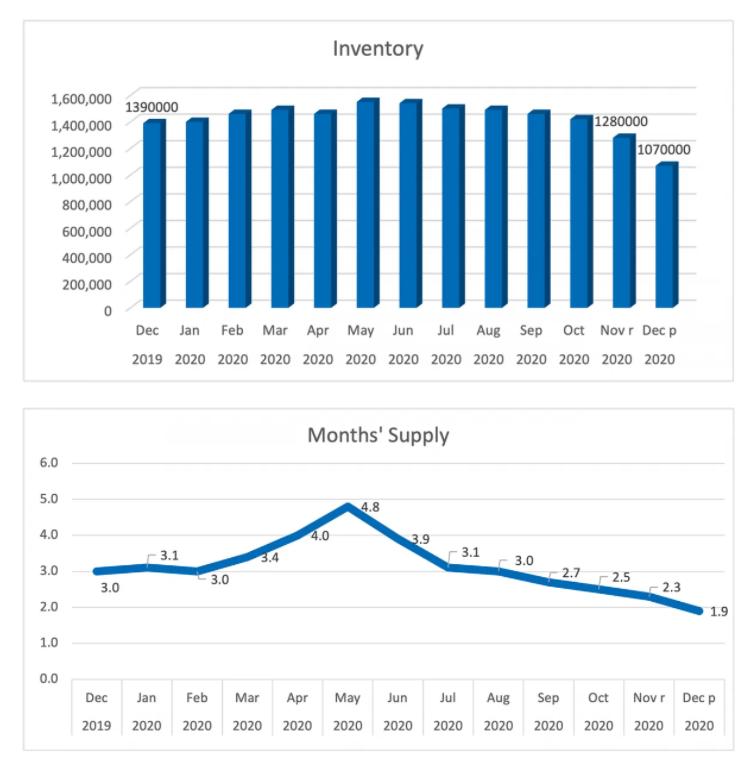

According to the National Association of Realtors, housing sales in the United States in 2020 totaled around 6 million units, but in December 2020, inventory was only 1.07 million units, which was only a 1.9-month supply, a record low.

Source: American Association of Realtors Website

Latest data show that while inventory has risen at the current pace of sales, the current supply of homes in the U.S. can only cover 2.6 months of sales as of the end of September. Typically, in a market where supply and demand are in balance, this duration should be 6 months.

If you make a comparison, when the U.S. housing market crashed in 2007, supply reached 10 months.

So why is the U.S. housing market so low? This is mainly due to the real estate market bubble burst after the subprime mortgage crisis.

Since the 1980s, the number of new homes built in the United States has averaged 1 million single-family homes per year, and peaked at 1.6 million units per year in 2006. After the subprime mortgage crisis in 2007, the U.S. real estate market collapsed, followed by the number of new homes built. The number fell drastically, falling to 400,000 units, a 70% drop in one year, and then hovering between 400,000 and 600,000 units. In the past three or four years, the number of new homes built in the United States has slowly rebounded, returning to 1.6 million units per year in 2019 before the epidemic. However at the same time, since the 1980s, the population of the United States has increased by nearly 60%, reaching 330 million people. In order to achieve a balance between supply and demand, the original real estate demand should also increase by 60%. However, in the past ten years, the number of new homes built in the United States has been relatively low, causing a very large gap in the supply side of the real estate market.

According to data from the United States, from 2011 to 2018 (before the epidemic), the supply of real estate has dropped by nearly 50%. After the epidemic, from 2019 to 2020, the supply of real estate has dropped by 34% year-on-year, so the inventory was already low. To the extent of the addition, the supply can only meet the sales of 2.5-2.6 months, and there is a serious shortage. If it is to exceed the supply balance point, it will take about 4 to 5 years. In other words, if a real estate bubble is to form and supply exceeds demand, it will take at least 4-5 years.

Why can’t the low supply be relieved?

Data released by the U.S. Department of Commerce at the end of September showed that the rate of U.S. single-family home construction fell for the second consecutive month in August, to an annual rate of 1.08 million units, as builders continued to struggle with material and labor shortages. The combination of high demand and the inability of builders to ramp up production of single-family homes has pushed up prices, deterring some first-time buyers. However, housing construction overall rose 3.9% in August to an annualized rate of 1.62 million, driven by a 20.6% increase in new multifamily housing construction.

The combined data shows that builders are slowing down. Note, however, that the pullback in home sales has a high starting point, and even an indication of a slowdown in home purchases may be a return to normality rather than a breakdown.

Although the demand is huge, the supply side still faces three major problems: first, the land supply in the hands of builders needs to be accumulated for many years, and the development cycle is very long; second, there is a serious shortage of labor in the United States, and now there is a large number of construction workers; third, the supply of raw materials has problems, and the price of construction materials such as lumber, copper and steel have skyrocketed.

Although lumber prices have fallen from an all-time high of $1,711 per thousand square feet in May to around $600 today, construction costs remain an issue. Wholesale prices for a class of home building components including windows, roof tiles, doors and steel have risen 22% over the past 12 months, according to an analysis of labor department data by the National Association of Home Builders (NAHB). Such aggregate prices typically rose by a little over 1% per year until 2020.

The latest Department of Commerce data also showed that backlogs of orders continued to increase to 251,000 units in August, and the number of uncompleted single-family homes under construction rose to the highest level since 2007. Meanwhile, the number of homes approved but not yet developed rose to the highest level since 1979, a sign that U.S. builders are reluctant to take on new projects.

The bubble depends on who is discussing about buying housing

As mentioned earlier, as an institutional investor, three indicators are important when judging whether there is a bubble in the real estate market.

First of all, in terms of the supply of U.S. real estate inventory, if the market has seen a 9 to 10 month inventory supply, it may be that real estate prices are close to their peak.

Second, when every bubble is accompanied by bank lending, credit begins to loosen, and when a home loan is available to anyone who wants to buy a home, that’s a sign of a bubble, as it was during 2005-2007. Presently, the major banks in the United States are still strictly controlling lending conditions, and the credit scores of those who can get mortgages are all above 700 points, which is very high, so the quality of current mortgages is very good.

The third indicator is market sentiment and the level of retail investor entry. The real estate market usually has four stages: incubation period, awakening period, frenzy period and crash period. Presently, the U.S. real estate market is in the transition stage between the awakening period and the frenzy period, as the market is still skeptical about real estate. The US real estate market is still in the process of growing in doubt. At the same time, it can be seen that large institutional investors in the United States have begun to enter the market, but retail investors who buy houses for investment purposes have not yet arrived on a large scale. How do we judge the arrival of mania? Years of experience have taught us that if there are fewer opinions questioned in the media, retail investors start to burst into the market with enthusiasm, and the market sentiment is very positive, perhaps allowing housing prices to reach their peak.

Peter Lynch, vice chairman of Fidelity Investments once said of the “water fountain phenomenon: when colleagues in the company chat by the water fountain, they are all talking about the stock market, and then the stock market will collapse.” For example, when your rental driver or hairdresser is teaching you how to invest in real estate, that’s when the housing market may be about to crash.