In-Migration and Challenging Homeownership Environment Mitigate Apartment Supply Wave’s Pressure

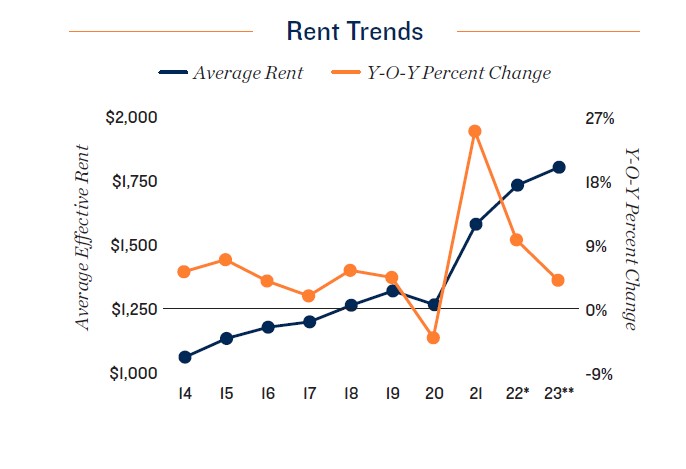

Barriers to buying a home to help moderate vacancy decompression. In 2023, the metro

is expected to see the sixth-largest volume of new residents among major U.S. markets, supporting

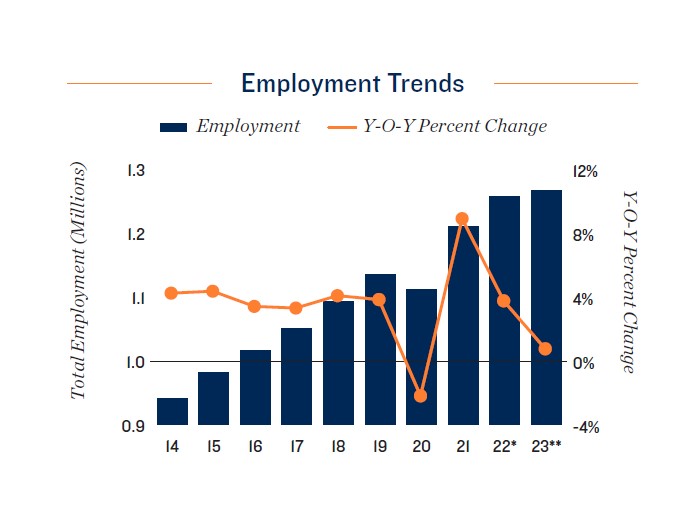

the local labor force. Even with some companies rebalancing staff counts amid economic

turbulence, higher-wage personnel from Austin’s growing tech industry may favor

high-end apartments amid elevated local home prices. The metro’s affordability gap — the

difference between the mean monthly mortgage payment on a median priced home and an

average effective apartment rent — is the seventh-largest in the U.S., highlighting some of

the benefits of staying in the renter pool. Technology firms are also still making long-term

commitments to Austin. Apple begins construction on a 133-acre campus this February

to house 5,000 employees on completion of the initial phase. Population and employment

gains will, however, be slightly offset as Austin ties for third among major U.S. markets by

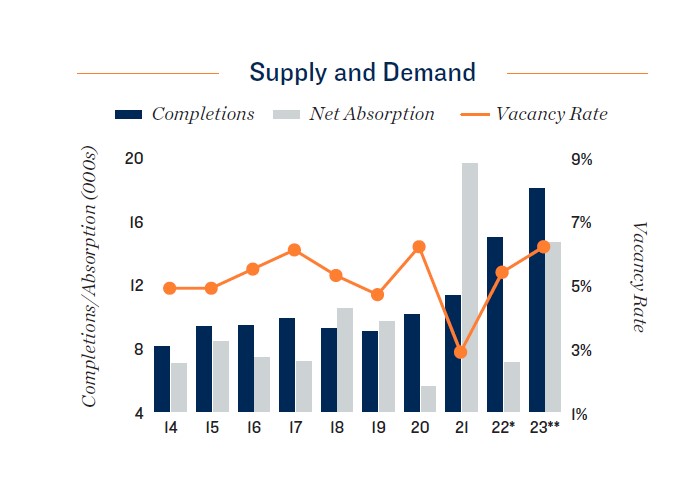

rate of inventory expansion in 2023. Following significant household formation during the

preceding two years, local apartment availability in the metro will slacken as construction

outpaces net absorption. Economic uncertainty is also contributing to slower household

creation and increasingly frequent renter consolidation, placing upward pressure on vacancy

in the near term.

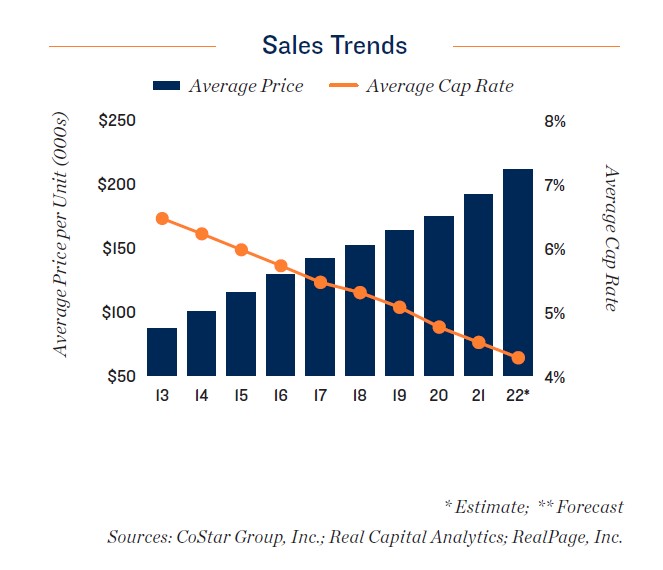

Tech company expansions aid submarkets with sparse pipelines. Moderating expectations

for rent growth amid an influx of supply have coaxed investors with lower-risk

tolerances to focus on Class A and B properties in employer-dense areas of the market.

Northwest Austin is one such locale, following PayPal’s announcement that it would be relocating

500 employees here by spring 2023 after signing a 10-year lease. Suburbs with few

units slated for delivery, such as Far West and Northwest Austin, may note deal flow as well.

Meanwhile, the fast-growing Interstate 35 Corridor, including San Marcos, saw persistently

tight Class A vacancy last year, appealing to investors targeting new builds.