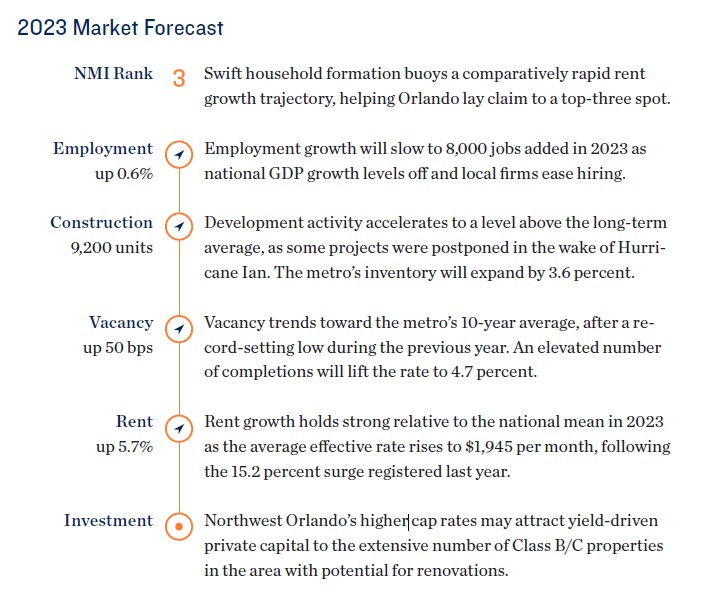

Favorable Living Costs, Tourism Backbone and Corporate

Relocations Fortify Demand-Supply Balance

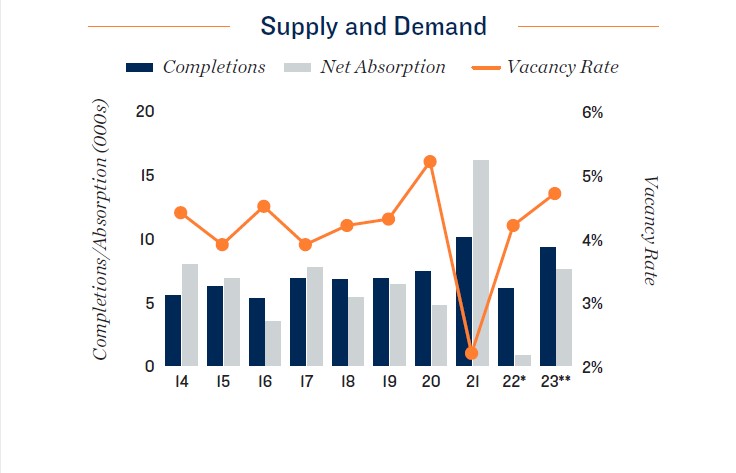

Desirable living conditions keep rental market leveled. Completions will elevate in

2023 as last year’s postponed projects populate the pipeline. An above-average period of

supply additions will help bring the market back to equilibrium, even with the stronger

demand for rentals expected this year. Robust population growth is sustaining a household

formation pace that nearly triples the national rate. Net in-migration is being driven

by lower living costs compared to the Northeast and solid job availability, especially in

the leisure sector. Orlando boasts the second-largest arts, entertainment and recreation

employment base in the nation. Other aspects of the local economy are also expanding.

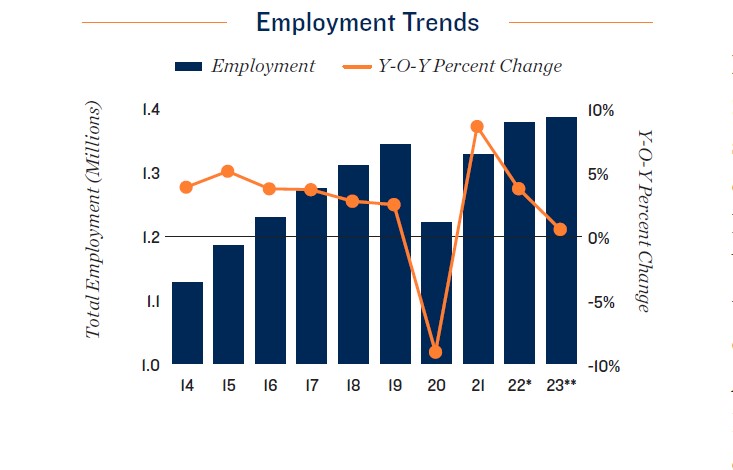

A bevy of corporate relocations and expansions from Amazon, Astronics Test Systems,

Iceland-based SAHARA, among others, will support the metro through potential upcoming

economic volatility. All of these factors are contributing to renter demand, along

with elevated interest rates, which have caused some prospective first-time homebuyers

to postpone ownership amid a growing affordability gap between average rent and the

typical mortgage payment. Tenacious housing needs will provide a backstop for vacancy

among additional supply pressure and a cooling economy.

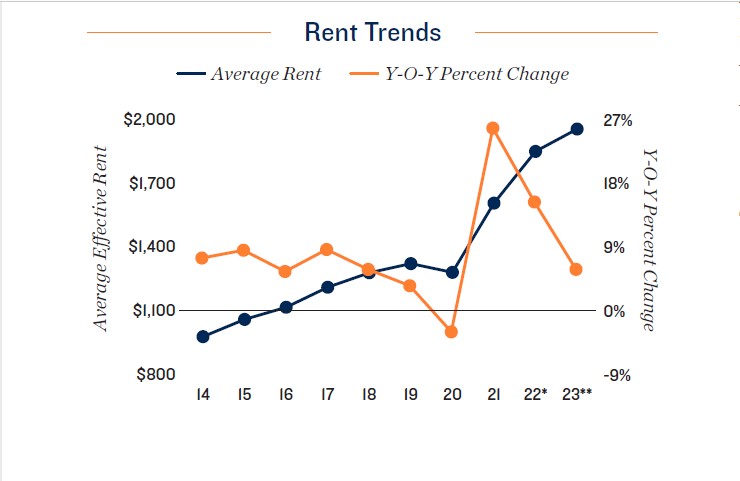

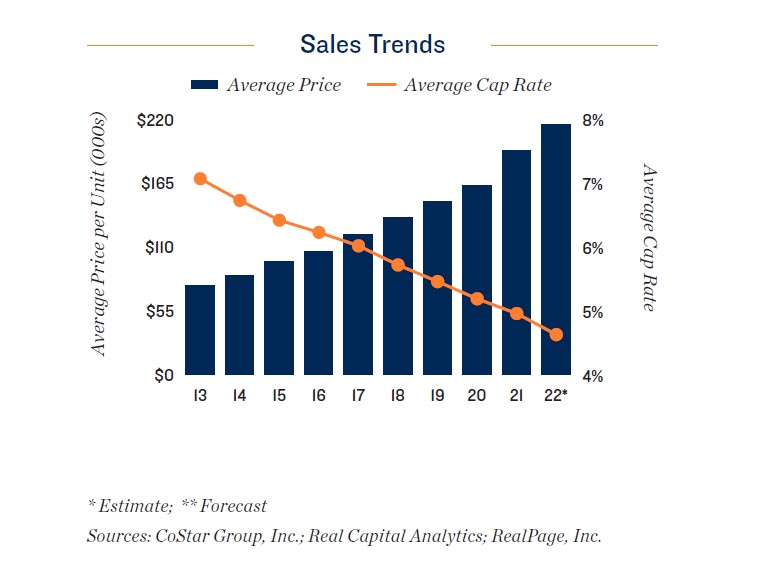

Stable investments, backed by robust fundamentals, continue to attract buyers.

Investors’ purchasing power has been constrained by the actions taken by the Fed to curb

inflation, causing some sellers to shelve deals to wait out the interest rate hikes. However,

some buyers are finding that the strong rent gains anticipated in Orlando this year could

offset increased debt costs. Low vacancy and high rent growth may temper the impact on

pricing compared to other markets amid intensified borrowing costs. The Downtown and

I-Drive areas have reported recent lifts in transactions from previous years, likely due

to the stability garnered from high median incomes and population density. Properties

trading here are typically luxury apartments with cap rates below the metrowide average.