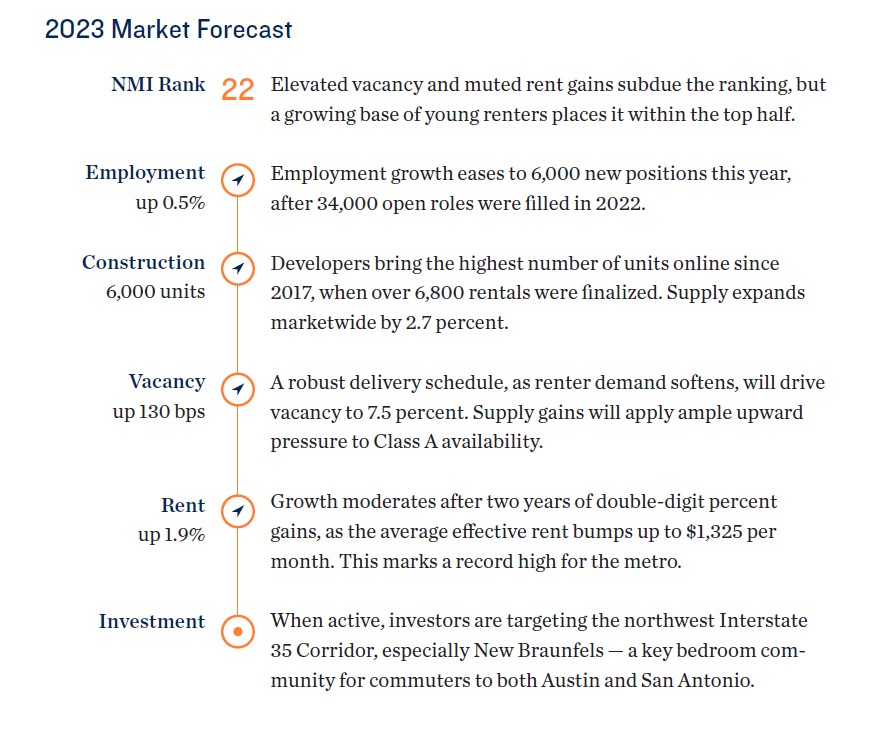

Public-Private Initiatives Help Metro Weather Inbound Headwinds as Multifamily Performance Moderates

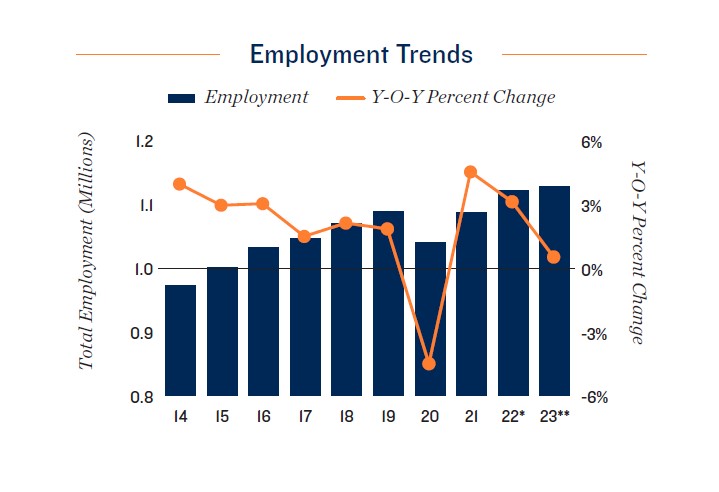

Public sector and related employers mitigate demand hurdles. Due to a high concentration

of recession-resistant industries, San Antonio is uniquely poised to withstand an

economic downturn. Aside from a plethora of state government organizations, the region

boasts a substantial national defense sector — including a regional NSA headquarters.

This agency underscores San Antonio’s notable cybersecurity segment, which constitutes

the second-largest cluster of category firms nationwide. Concerns stemming from rising

cybercrime could keep segment employment steady, even as downsizing is observed

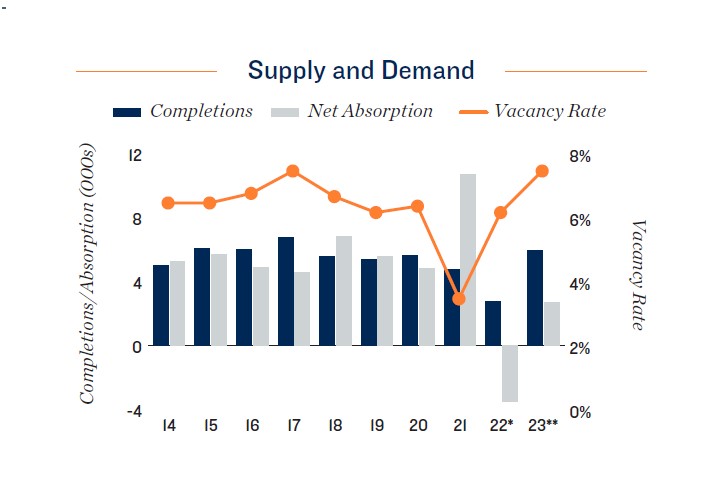

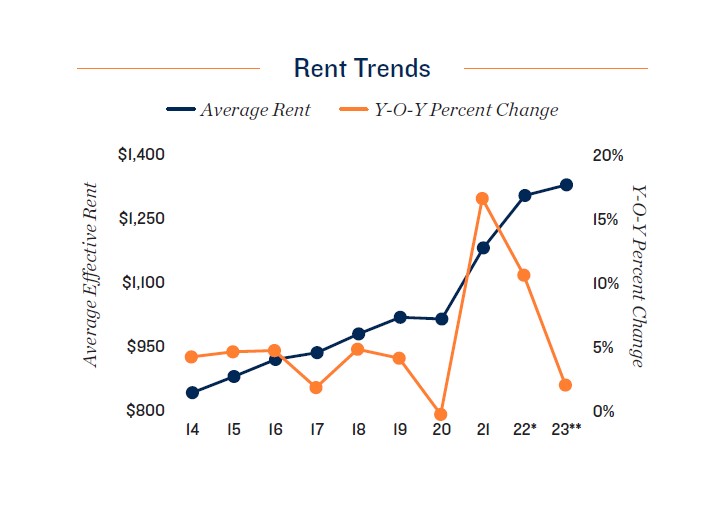

elsewhere. Easing overall job growth is contributing to falling renter demand and moderating

fundamentals, after record-low vacancy was observed early last year. In 2022, the

market reported its first year of negative net absorption in over two decades. Availability

is expected to continue trending upward this year, pushed up by a five-year high of supply

growth. Vacancy appears to be returning to levels typical during the pre-pandemic economic

cycle, when rates in the mid-6 to mid-7 percent range were often observed.

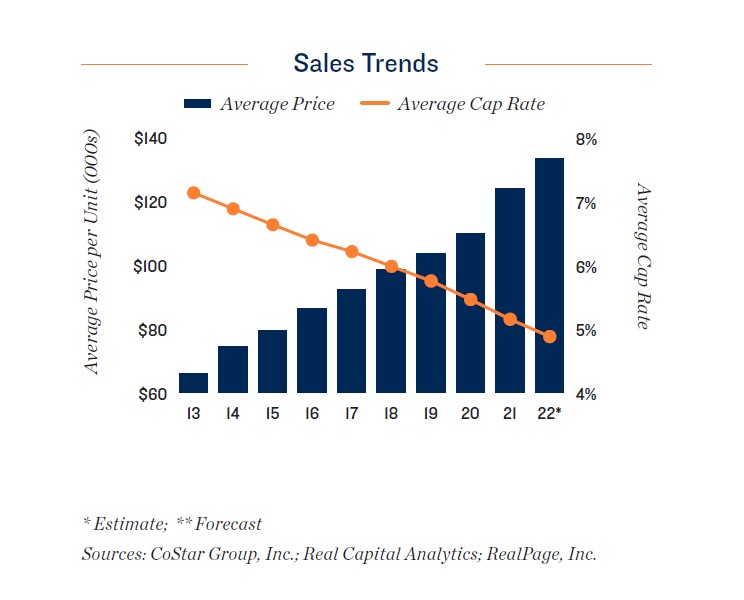

Investors seek assets proximate to metro’s economic drivers. Prompted by the rapid

growth of Texas markets, institutions are increasingly acting in partnership with smaller

local parties to ease the acquisition process, although mounting financing headwinds will

likely complicate this. Active investors are mostly targeting opportunities in San Antonio

proper, with remaining focus concentrated to the city’s north and east. Prominent locales

include New Braunfels, Boerne and Converse, which offer entry costs well below market

average. Near the core, investors are pursuing opportunities in northern areas around the

1604 Beltway. So far, buyers have been active near the intersection of this roadway and

Interstate 10, which offers proximity to a number of major employers, in addition to the

University of Texas at San Antonio. Rapid development in the metro’s northwest should

provide investors with ample capital placement opportunities here moving forward.