Austin’s Nation-Topping Population Growth

Mitigates Long-Term Supply Wave Impact

Growing millennial and Gen Z populations backstop demand.

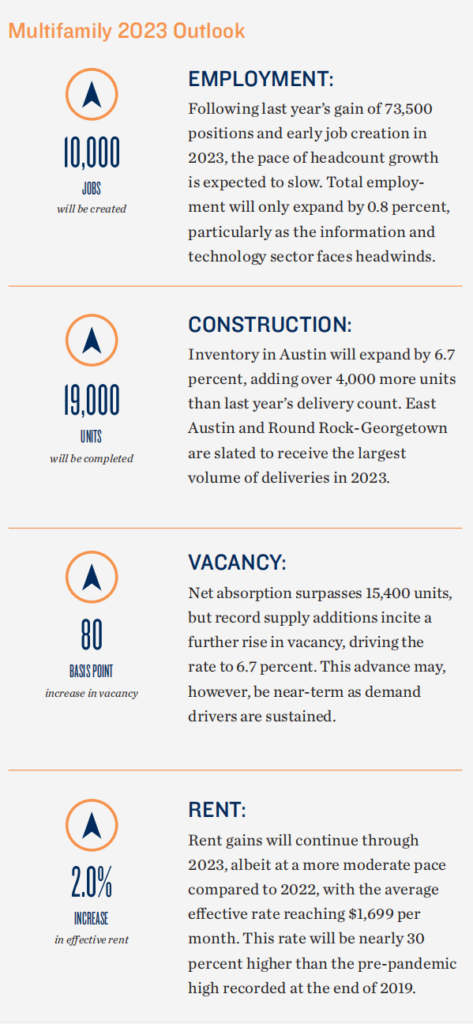

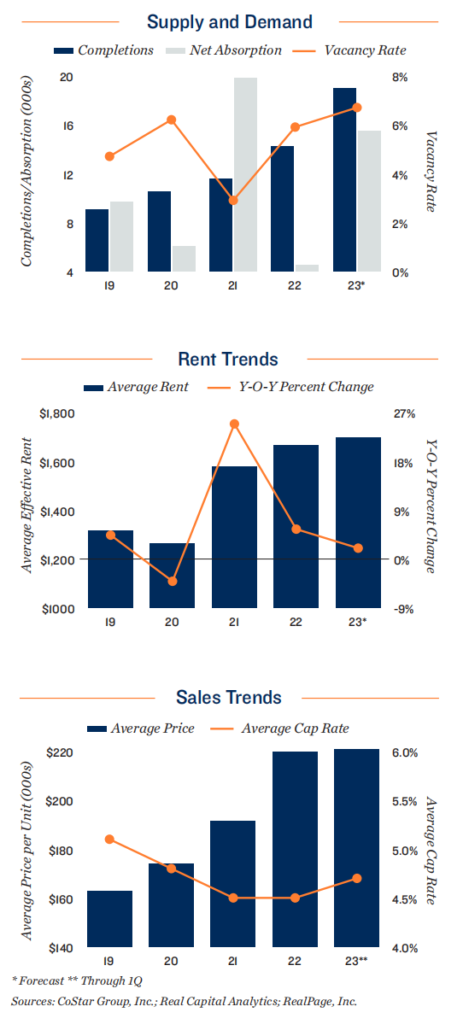

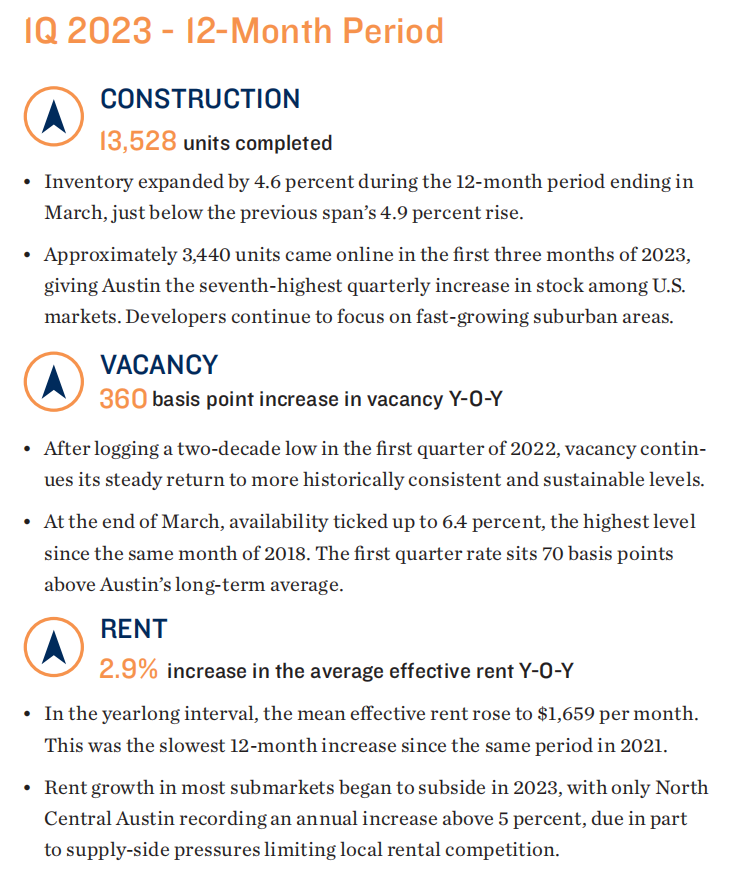

Similar to last year, an incoming supply wave will place upward pressure on vacancy as new units are added at an elevated pace. In 2023, the metro is set to record its highest year-over-year inventory change since at least 2000. This increase in available units will create near-term pressure on vacancy, raising the rate from record lows reached in the first half of 2022. Austin is also expected to note the greatest pace of population growth among all major U.S. markets in 2023. The age 20 to 34 cohort makes up a significant portion of this gain. Given that younger people are historically predisposed to renting — a preference strengthened by Austin’s heightened homeownership costs — this expanding residential group will likely stay in the renter pool for longer, aiding property performance long-term and validating the ample construction pipeline. Total net absorption in Austin will still be higher than most other major markets in 2023.

Lower-cost areas poised to receive demand.

Strong net in-migration to Austin has benefited outer cities connecting the market to San Antonio as the metros become increasingly intertwined. In March 2023, San Marcos had both a vacancy rate under the overall metro and the lowest mean effective rent, exhibiting the draw of well-connected, cost-efficient locales. Some urban areas with limited pipelines are also well-positioned, such as Northwest Austin, where Apple is expected to begin Phase 2 of its campus in September, creating high-paying jobs and benefiting Class A and B rentals.