Orlando Solidly-Positioned to Weather New Supply as Standout In-Migration Provides Momentum

Robust household formation guides metro through flux period.

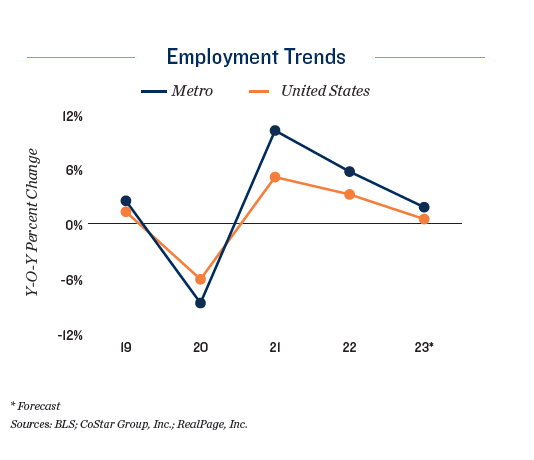

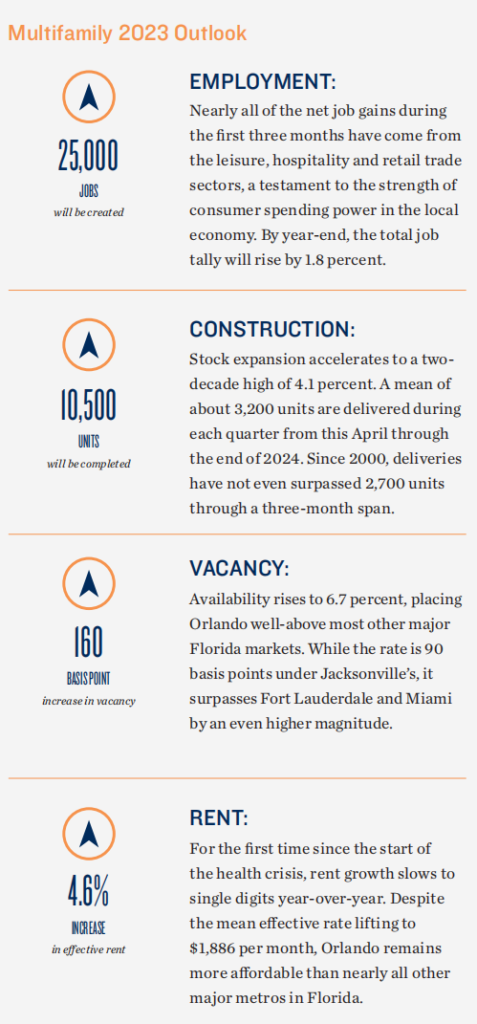

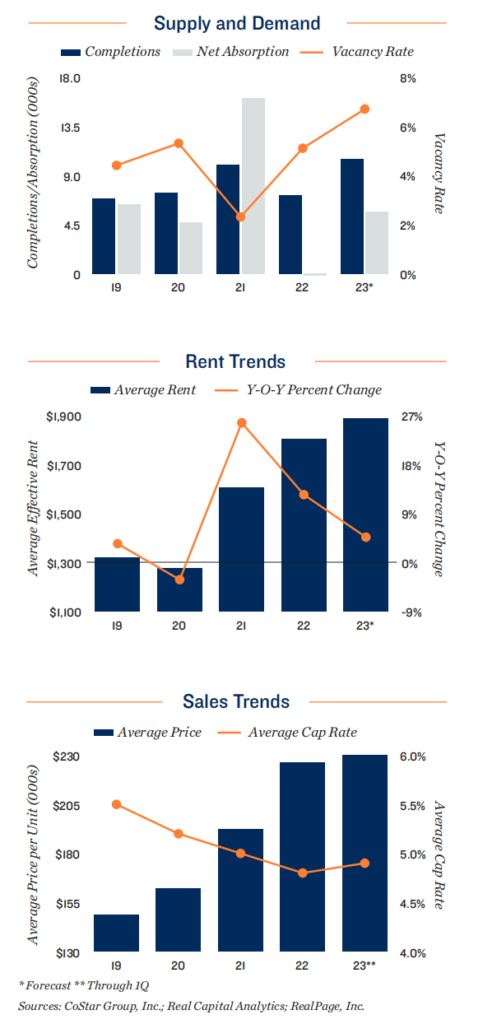

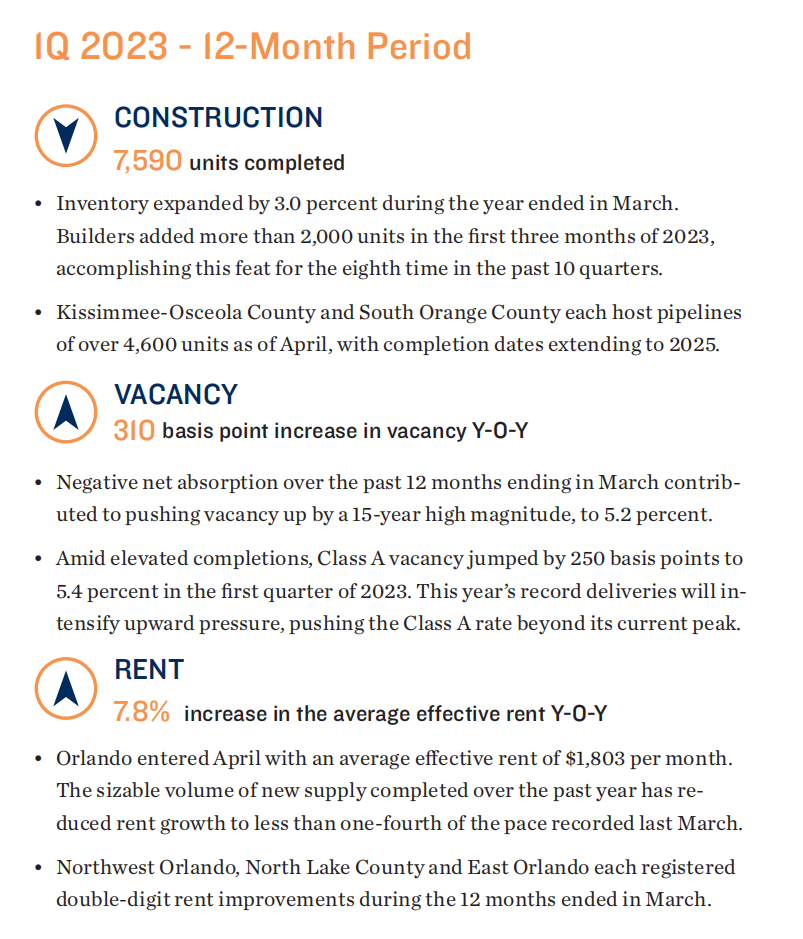

Far from March 2022’s low, vacancy has more than doubled over the past 12 months. Up to 5.2 percent in April, further rises are likely, as the metro welcomes a record volume of deliveries. Supply pressures are exacerbated as cornerstone employers, such as Disney, commence with large-scale layoffs and soften the near-term employment

outlook. Despite such headwinds, household gains remain strong. As of April, the metro was on pace to add a net of over 49,000 new residents this year, stoking a 2.5 percent household expansion — one of the fastest paces among major markets. This should backstop property performance during this transitional period. Orlando will have the strongest age 20 to 34 population gain among major Florida metros, a potential driver of near-term apartment demand as this group typically falls into the renter pool.

Construction sidesteps emerging job hubs.

Areas with the strongest economic growth prospects have sparse development pipelines. This positions their respective local vacancy rates to tighten in 2023 as healthy net absorption returns metrowide. Northwest Orlando, for example, receives less than 150 new units this year, despite recently hosting sizable operational move-ins, including Medline’s expansion into its largest facility west of Texas this April. Meanwhile, Winter-Park Maitland’s deliveries fall under 200 units, even with notable health services sector growth, highlighted by ScionHealth’s sizable hospital move-in here in July.