Apartments.com – a CoStar Group online marketplace – released an in-depth report of multifamily rent trends for the second quarter of 2024 on July 10, 2024.

The U.S. multifamily market continued a strong rebound in demand during the second quarter of 2024, with 170,000 units absorbed, the highest number since the third quarter of 2021. And while 180,000 new units were delivered in the last quarter, this was the smallest supply-demand gap in 11 quarters. So, the vacancy rate remained steady from the first quarter to the second quarter at 7.8%. This is the first quarter in which the vacancy rate has not risen in almost three years.

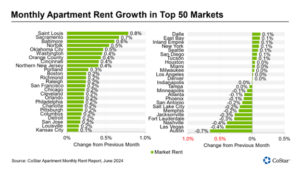

The national average annual asking rent growth dipped slightly to 0.9% in June compared to 1.0% in the four prior months. Since mid-2023, annual rent growth has hovered around 1% after a rapid deceleration in 2021 and 2022. Month-over-month rent growth decelerated to 0.1% after seeing three months in a row of 0.4% growth.

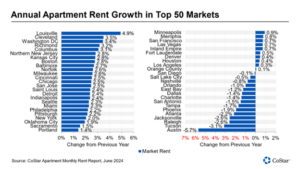

Midwest and Northeast markets have avoided oversupply conditions and tied with solid rent growth of 2.4% over the past four quarters, while markets in the West experienced rent growth of just 0.5% as weak demand and elevated completions have kept rent growth restrained but positive. Meanwhile, continued heavy oversupply conditions in the South have kept annual rent growth at zero.

At 4.9%, Louisville ended the second quarter with the strongest annual asking rent growth of the top 50 markets nationwide, with Cleveland and Washington DC close behind.

At the opposite end of the scale, rents fell by 5.7% over the past 12 months in Austin. Tucson, Raleigh, Jacksonville, and Atlanta were just a little behind, with rent losses ranging from 3.1% to 2.2% over the past 12 months. Eight of the bottom ten performing markets are in the South, where supply-demand imbalances remain challenging.

Absorption was led by 4&5-Star units, with just over 123,000 units in the quarter. However, with most new supply aimed at the luxury market, annual asking rent growth remained the weakest in that segment and finished June at 0.2%. This contrasts with mid-priced 3-Star properties, where net absorption increased from 33,000 units in the first quarter to 43,000 units during the second quarter, helping rent growth to accelerate to 1.5%. Improving consumer confidence, lower inflation, and sustained economic expansion helped boost 3-Star demand.

Improving consumer conditions can also be observed in demand for 1&2-Star properties. After two years of negative absorption, the lowest price point finally turned positive in 2024. Households at this price point struggled in 2022 and 2023 with higher housing costs and the elevated costs of everyday items, pushing some to seek alternative housing solutions such as moving in with roommates or returning to the family home. But in 2024, 1&2 Star demand has registered almost 6,000 units.

After completions of multifamily units reached a 40-year record in 2023, the outlook this year is for continued high supply. The multifamily market is projected to add 574,000 units in 2024, which is only a slight pullback from the prior year’s record. Property operations in the second half of 2024 could vary widely depending on the market and the price point. Markets in the South and luxury properties remain most at risk for weakness due to oversupply conditions, while Midwest and Northeast locations and mid-priced 3-star properties could outperform.