little knowledge

Long-term rental apartment Multifamily, commonly referred to as a multi-unit unit unitary apartment in the United States. As an important branch of commercial real estate, long-term rental apartments have been in the real estate market in the United States and around the world for more than a century.

Photo: Google

at the beginning of 2020, a sudden new crown epidemic swept the world, structurally changing people’s lives, work, entertainment, vacation, food and shopping styles, lifestyle changes will directly affect all types of supply and demand characteristics in commercial real estate, and even to a certain extent changed the future development trend of the commercial real estate industry and competitive landscape.

the changes brought about by the new crown outbreak challenge investors’ long-standing investment standards and provide investors with a unique investment environment that will reshape each investor’s investment strategy in 2021 and allow investors to look at the entire commercial real estate sector from a broader perspective, promising to open the door to new opportunities.

Photo: Google

looking back at 2020, the u.s. long-term rental apartment market is booming

the resilience of long-term rental apartment cash flow is a key theme in 2020, with the overall performance of the long-term apartment market significantly better than other commercial property types.

The long-term rental apartment market has been on a steady upward trend in the first quarter, with the vacancy rate at around 4.4 percent in the first quarter of 2020, the annual average, according to RealPage.

many buyers were on the sidelines during the shutdown in the second quarter as a result of the outbreak and weak trading. at the same time, high unemployment has hit demand for long-term apartments, resulting in a 30 percent drop in the rate of transactions at the same volume in 2020 compared to 2019.

The market for long-term rental apartments slowly recovered in the third and fourth quarters, with rents rising at or slightly below historical averages. According to Real Capital Analytics (RCA), the U.S. long-term rental apartment market totaled $26.3 billion in the third quarter of 2020;

As in previous years, the five largest apartment deals in the U.S. occurred in the fourth quarter of 2020 in Chicago in the Midwest and in San Diego, New York, Seattle and Washington, D.C., gateway cities on.C the East and West coasts.

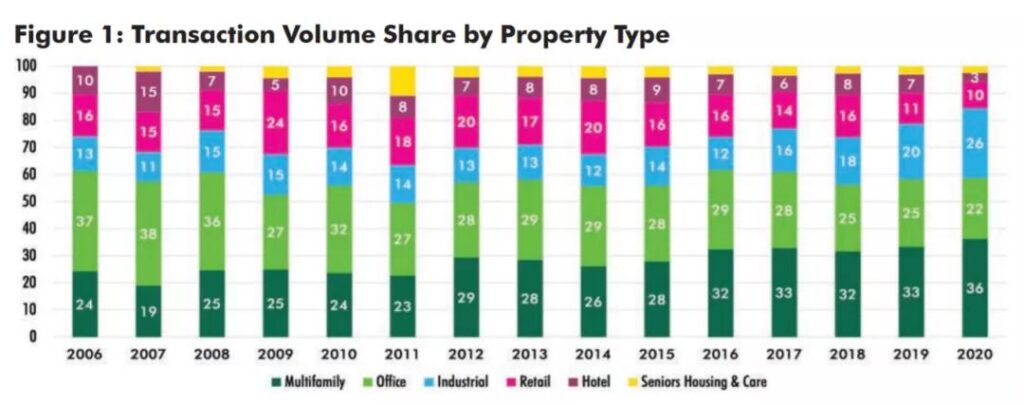

Picture: Real Capital Analytics (RCA)

ACCORDING TO RCA, THE U.S. LONG-TERM RENTAL APARTMENT MARKET IS STRONG IN 2020, ACCOUNTING FOR 36 PERCENT OF ALL COMMERCIAL REAL ESTATE TRANSACTIONS, THE LARGEST SHARE OF COMMERCIAL REAL ESTATE TRANSACTIONS SINCE 2001. IN TOTAL, ABOUT 6,500 UNITS WORTH $138.7 BILLION WILL BE SOLD IN THE U.S. LONG-TERM RENTAL MARKET IN 2020, AND RENTS WILL FALL 4.2 PERCENT OVERALL IN 2020.

But according to69 long-term apartment markets tracked byCBRE Econometric Advisors,45 markets will see positive rent growth in 2020. The fundamentals of the U.S. long-term rental apartment market are expected to begin to recover by mid-2022, with the secondary market leading the recovery, followed by metropolitan areas.

Picture: Real Capital Analytics, Q4 2020

2021: the u.s. long-term rental apartment market is steadily recovering

the u.s. epidemic situation has improved and the pace of vaccination has accelerated

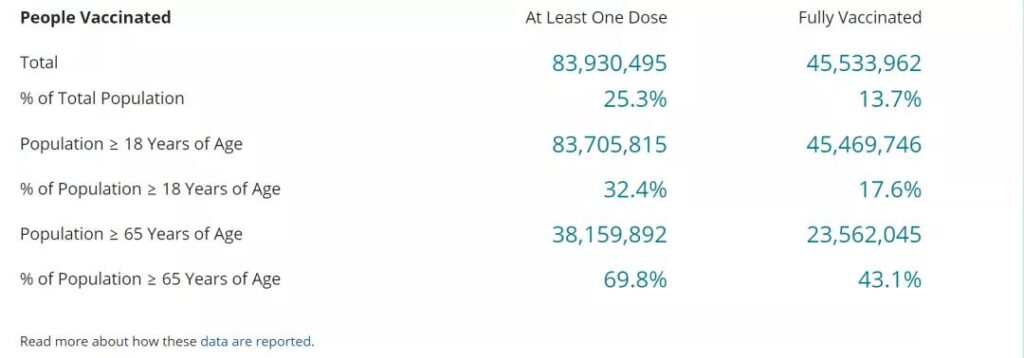

According to the Centers for Disease Control and Prevention (CDC), the number of new confirmed cases in the U.S. has slowed significantly since mid-January 2021, and the Biden administration’s efforts to strengthen epidemic prevention measures and promote vaccinations have shown signs of effect. In terms of vaccination, the global new crown vaccination continues to advance, the United States is leading the global vaccination progress, more than 25% of the population has been vaccinated against at least one dose of the new crown vaccine.

Source: U.S. Centers for Disease Control and Prevention (CDC).

the decline in new arrivals and the continued expansion of vaccinations have led to the gradual opening up of parts and cities in the united states, resulting in a full recovery of the u.s. economy, a return to work and life in big cities, a large number of tenants in the metropolitan area’s long-term apartment rental market, and huge rental demand will help the u.s. long-term rental housing market recover.

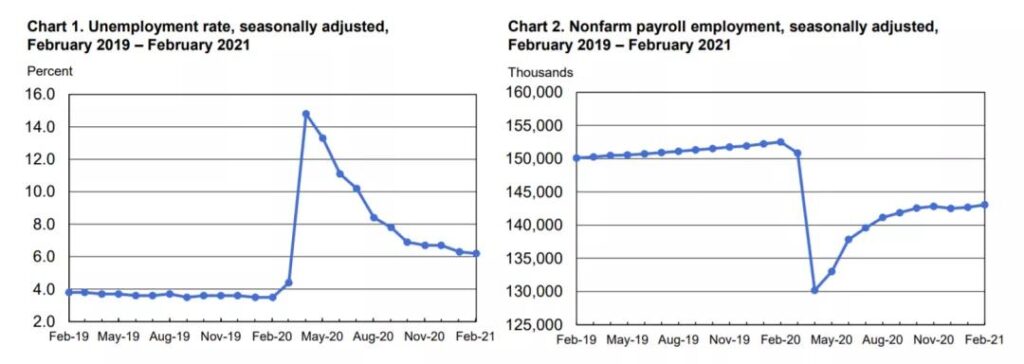

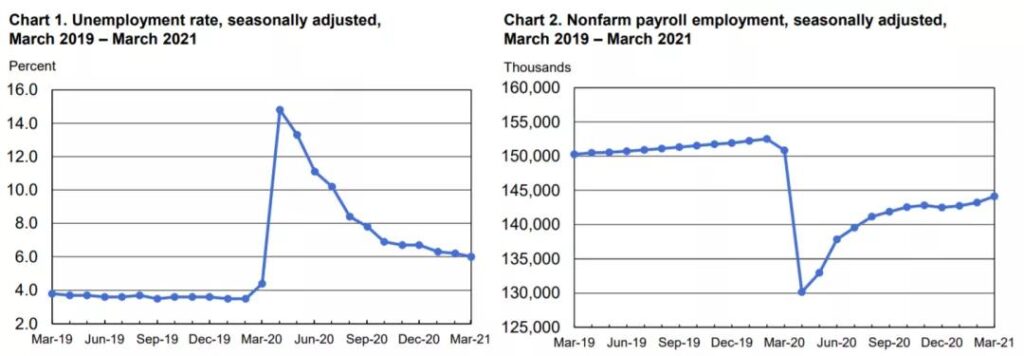

in 2021, u.s. employment in february and march exceeded expectations

u.s. nonfarm payrolls rose 379,000 in february, the biggest increase since october and well above previous market expectations of 210,000, and the unemployment rate fell to 6.2 percent, according to data released by the labor department on march 5 。

u.s. non-farm payrolls fell to 6 percent in march from 916,000, the lowest level since the outbreak began last march, according to data released on april 2.

Source: Bureauof Labor Statistics

as unemployment falls, the overall trend in the u.s. job market is positive, reflecting the continued recovery of the u.s. economy from the effects of the new crown epidemic, and the ability of most americans to pay for housing/renting. a large and steady increase in rental income will bring stable cash flow to long-term rental apartment owners, giving investors optimism about the investment prospects in the long-term rental apartment market, prompting investors to invest more in the u.s. long-term rental apartment market and further boosting the recovery of the long-term rental apartment market in the united states.

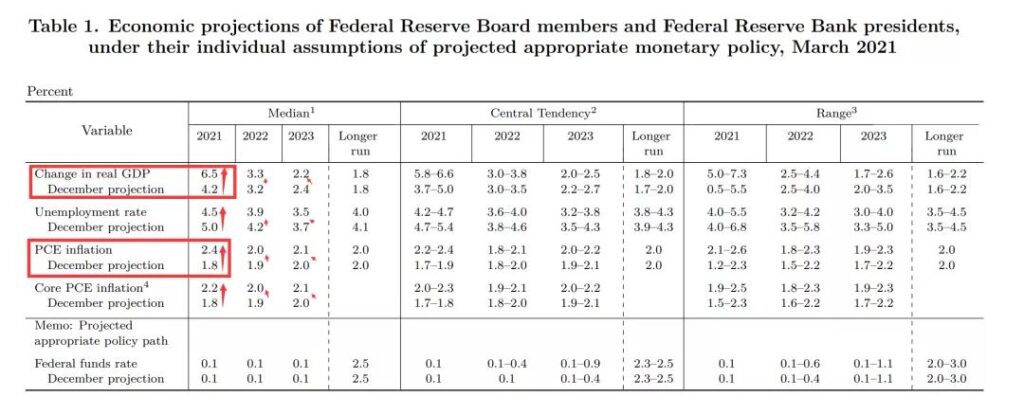

the fed significantly raised its forecast for the economic outlook

At the Fed’s March 17 meeting, the Fed significantly raised its forecast for the economic outlook, predicting that U.S. GDP will grow to 6.5 percent in 2021,the fastest pace since 1984 and up sharply from the 4.2 percent forecast in December 2020. The unemployment rate is forecast to fall from 4.7 to 5.4 per cent in December to 4.2-4.7 per centin this forecast; Meanwhile, all Fed members agreed to leave the benchmark rate unchanged at 0-0.25%.

picture: source: federal reserve

u.s. 10-year treasury yields briefly jumped to 1.67 percent after the federal reserve’s interest rate decision. on march 18th the yield on the 10-year treasury note jumped to 1.75 per cent, a 14-month high.

Jim Caron, global fixed income portfolio manager at Morgan Stanley, said the rise in 10-year Treasury yields was justified and reflected growing confidence in the outlook for the US economy and strong US economic growth.

Picture: Marcus Millichap

Changes in the Fed’s benchmark interest rate will have a direct impact on U.S. 10-year Treasury yields, which are in line with lending rates. The rise in the yield on the 10-year Treasury note pushed the 30-year fixed loan rate (30-year fixed-rate mortgage, FRM) up to 3.18 per cent at the end of May, according to data released on April 1st by Freddie Mac.

higher interest rates on loans will lead to higher real estate investment costs, which will affect the speed of investment by u.s. long-term apartment investors, and it will also change the purchase budget of some middle-class american families, which will have some impact on the recovery of the u.s. long-term rental apartment market.

Picture: Freddic Mac

$1.9 trillion stimulus bill, $2.3 trillion infrastructure plan

U.S. President Joe Biden signed the American Rescue Plan into law in mid-March 2021. The latest round of stimulus, $1.9 trillion, is the second-largest in U.S. congressional history, and it covers a massive package of bailout cash, accelerated vaccinations, expanded unemployment benefits and corporate aid that will spur a full recovery in the U.S. economy.

Photo: Google

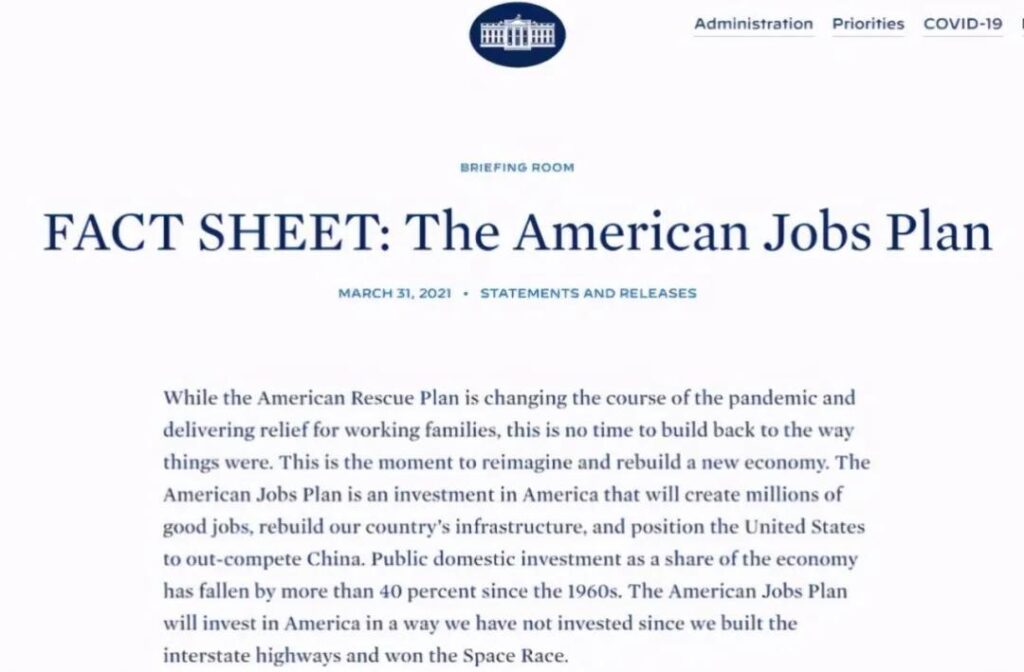

on march 31st u.s. president joe biden unveiled a $2.3 trillion infrastructure plan that will focus on repairing roads and bridges, expanding broadband internet access and increasing research and development funding, which will last eight years.

biden’s infrastructure plan includes:

1. invest us$621 billion in transportation infrastructure such as bridges, roads, public transportation, ports and electric vehicle development;

2. direct allocation of $400 billion for the care of home caregivers and the elderly and disabled;

3. more than us$300 billion has been invested in improving drinking water facilities, expanding broadband access and upgrading the power grid;

4. invest more than $300 billion in the construction and upgrading of 2 million affordable housing units and the construction and improvement of schools;

5. invest us$580 billion to revitalize manufacturing, research and development and employment training.

Picture: TheWhite House

the $2.3 trillion is expected to be spent over eight years, meaning an average of $287.5 billion a year in budget spending. but the new spending won’t have much economic pull for at least two years, with the us government pumping $5 trillion into the economy last year to this year, and about $300bn a year less than that astronomical figure. that’s why capital markets have been rational since biden’s “big infrastructure” plan came out.

if biden passes the plan, the price of hard assets, such as infrastructure and commercial real estate, will continue to rise, and the value of investments in hard assets will come from long-lived fixed assets. in today’s low interest rate environment, hard assets such as infrastructure and commercial real estate provide long-term stable returns and will be the most rewarding assets. this will make investors, especially institutional investors with long-term liabilities, such as pensions, increasingly dissatisfied with the return on traditional bonds, and will look to hard assets and invest more aggressively, which will boost the u.s. commercial real estate market and help revive the u.s. long-term rental apartment investment market.

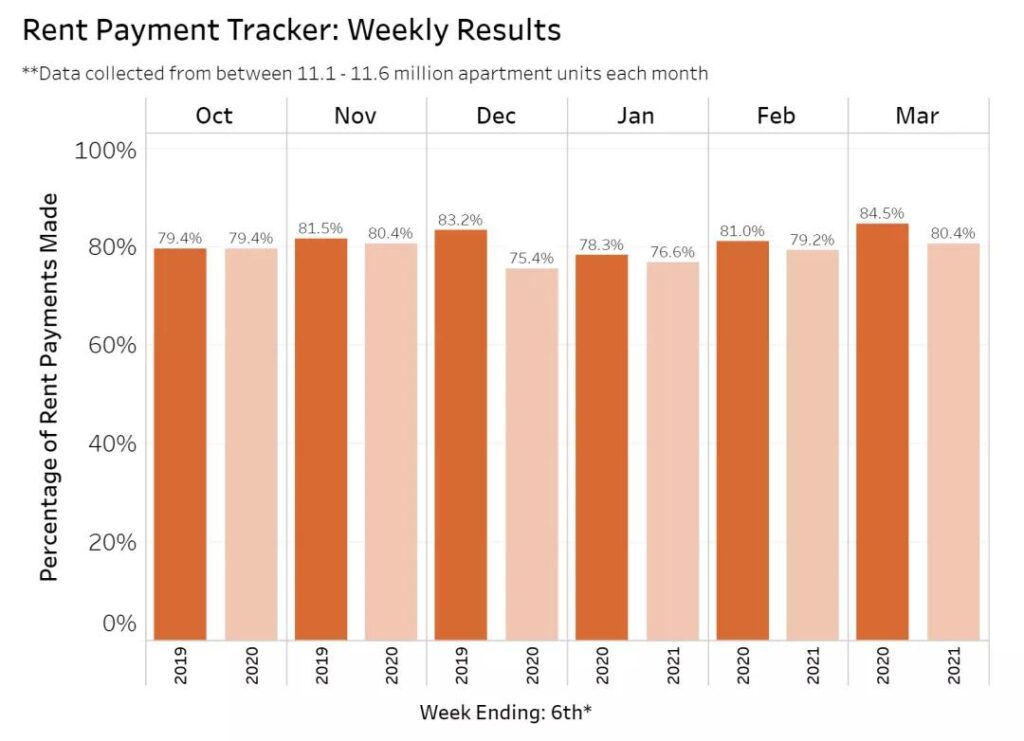

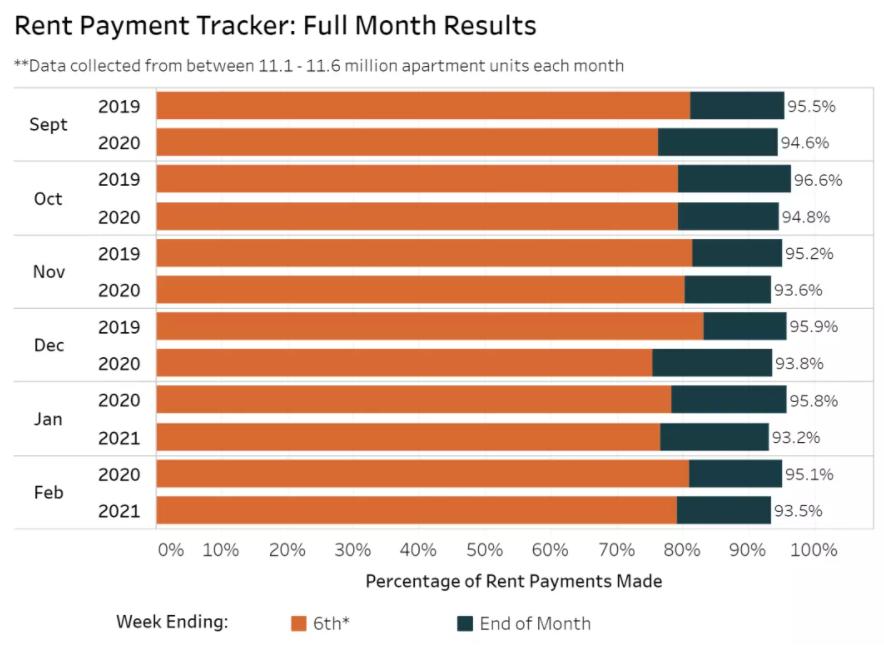

extending unemployment insurance benefits the owners

According to the National Council on Long-Term Apartment Housing, NMHC’s first quarter 2021 data, 80.4% of renters paid their rent in full or in part in a March 6 survey of 11.6 million professionally managed apartment units in the United States The share of rent paid on 6 February was 79.2 per cent. Although it declined year-on-year, the overall increase was steady.

Picture: National Multifamily House Council (NMHC)

the latest stimulus bill extends federally funded unemployment insurance until september for $300 a week. unemployment insurance will help some tenants be able to pay part of the rent, and the gradual opening up of cities and the combination of federal unemployment assistance will help the u.s. economic recovery, as well as help stabilize the u.s. long-term rental rental market, further boosting the u.s. long-term rental and investment markets.

demand for long-term rental apartments in the united states is strong

low interest rates in the u.s. market during the new boom have made the residential real estate market too hot, and a large number of americans have chosen to buy a home, leading to a sharp rise in home prices in 2020.

in 2021, because residential real estate is too hot and prices are too high, many u.s. families will choose to put their purchases on hold and continue renting in long-term apartments, waiting for home prices to return to reasonable levels and keeping enough disposable cash to cope with unforeseen market fluctuations, which will keep demand for long-term rental apartments growing steadily.

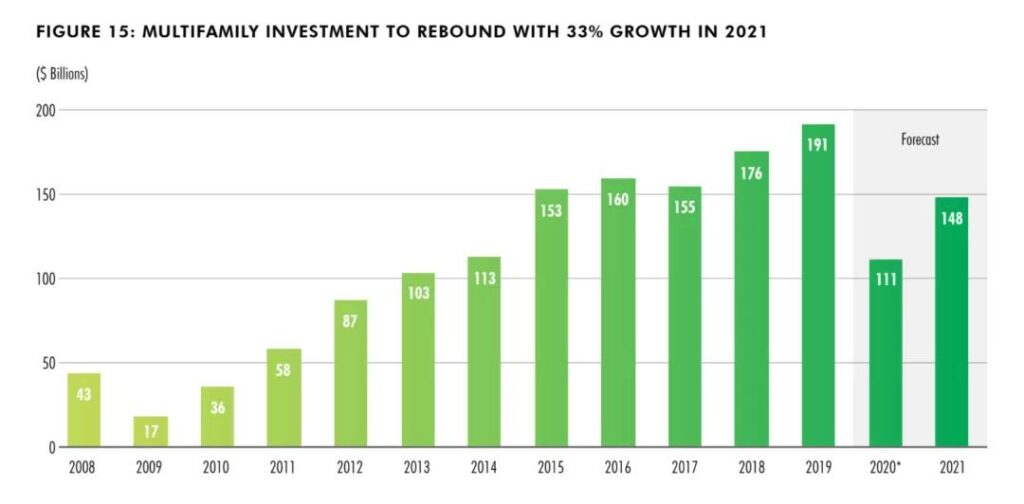

CBRE FORECASTS THAT INVESTMENT IN LONG-TERM APARTMENTS IN THE U.S. WILL GROW 33 PERCENT TO $148 BILLION IN 2021, AND THAT MARKET FUNDAMENTALS AND INVESTMENT ACTIVITY IN LONG-TERM APARTMENTS WILL RECOVER STEADILY.

PICTURE: CBRE

Source: CBRE Research, Real Capital Analytics

migration changes the long-term rental apartment market

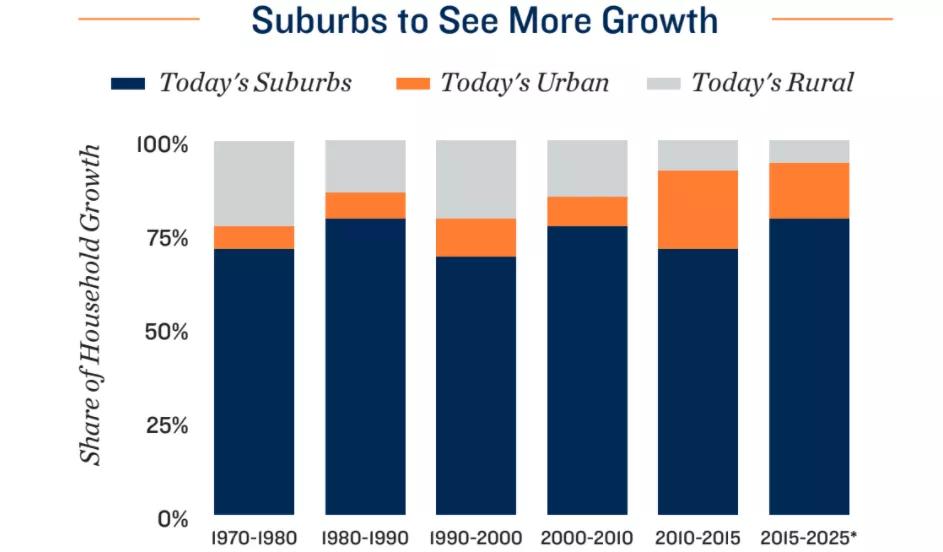

during the new outbreak, the release of the “home order” closed restaurants, bars, cultural facilities, entertainment and sports activities, most people stay at home for long periods of time to work remotely, out of the door and do not want to take public transport. rising unemployment in the united states, and higher risk of infection with new coronary pneumonia in large cities, have forced some people to move to the suburbs, prompting many to reassess their housing/rental options and needs.

renters want to lower the cost of living without having to pay expensive rents and parking fees; have more room to live and enjoy the outdoors; stay away from crowds and reduce the risk of contracting new coronary pneumonia. this has led to a surge in demand for long-term rental apartments in the suburbs, which will encourage investors to invest more in the suburban long-term rental market.

the impact of the new crown outbreak on the urban long-term rental apartment market is much greater than the suburbs, should have led to a slowdown in the rental demand for long-term apartments in large cities, but due to the suburban market ushered in migration, and the suburban housing supply is small, purchase/rental demand surge, resulting in the suburbs rental costs and the cost of buying a house rose sharply.

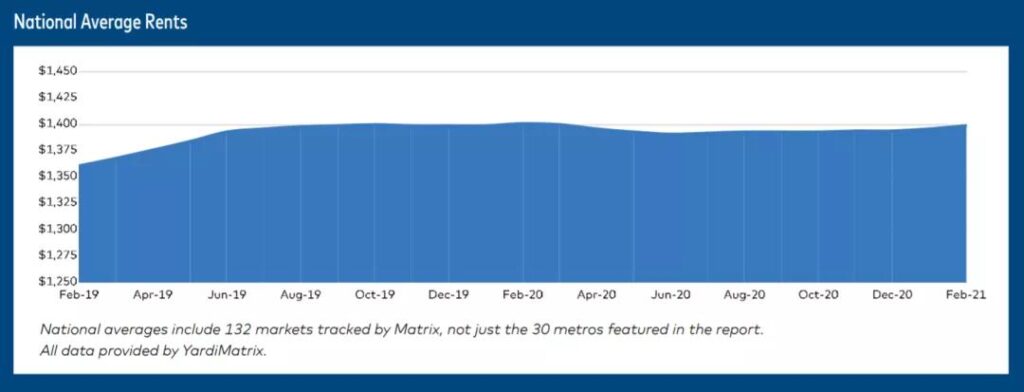

city → suburbs → cities

According to Yaddi Matrix’s latest Multifamily National Report,the average rent forlong-term apartments in the U.S. rose 0.2 percent, or $3, to $1,399 between January and February 2021. This is the ninth consecutive month that average rents have risen or remained stable. The steady rise in rent reflects the steady demand for long-term rental apartments.

Source: Yardi Matrix

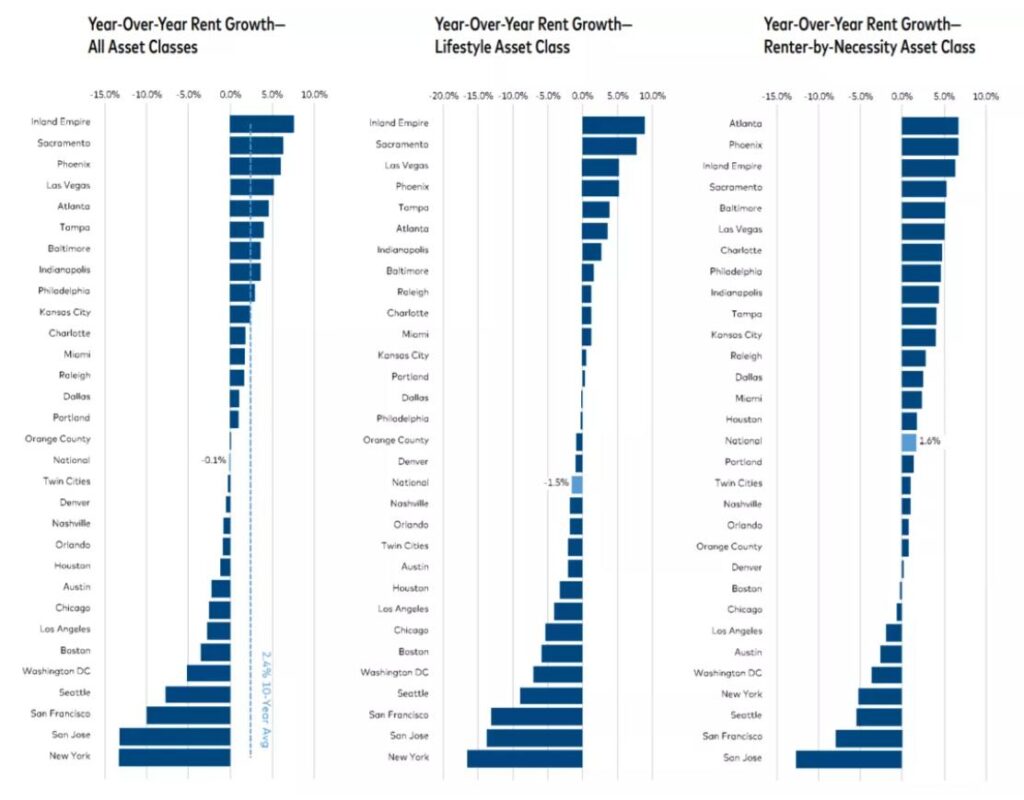

According to Yardi Matrix’s February 2021 data, monthly rents are growing positively in 111 of the 133 long-term apartment markets surveyed. The suburban long-rent apartment market is doing well, and the big-city long-rent apartment market is still slowly recovering from the impact of the new crown outbreak.

in the top 30 markets for rent growth in the long-term rental market, 23 markets saw positive month-on-month rent growth, while rents for long-term apartments in the suburbs all showed a significant month-on-month increase. however, there are still 16 markets remaining stable or negative year-on-year rental growth, the downward trend has gradually weakened.

The long-term rental apartment market in gateway cities continued to recover slowly, with rental prices rising 0.6 to 0.7 per cent in Chicago, Boston, Los Angeles and San Jose, while rents rose in San Francisco, New York, Washington, D.C., .C.). Prices in Seattle rose 0.1 per cent to 0.3 per cent.

The long-term apartment market in the suburbs adjacent to Gateway city grew strongly, with rents in California’s suburban inland empire rising the most, to 7.6 per cent year-on-year, and occupancy in January up 2.2 per cent year-on-year. Sacramento was close behind, with rents up 6.4 per cent year-on-year, while occupancy in January was up 1.2 per cent year-on-year.

The best in the Midwest long-term rental market was Indianapolis, which led the way with a 3.6 per cent increase in rents, followed by Kansas City, Missouri, with a 2.3 per cent rise in rents.

The Inland Empire is a metropolitan area of Southern California. The official name used by the U.S. Census Bureau is riverside-San Bernardino-Ontario.

Source: Yardi Matrix

The suburban long-term rental apartment market is benefiting from a migration trend and is booming. Suburbs such as Will County, Merrillville, Portage and Valparaiso around Chicago’s Metropolitan Area are affordable and affordable, attracting residents from Chicago. Vacancy rates in these areas will be as low as 4.8 percent and 3.1 percent, respectively, in 2020; California’s Inland Empire has been attracting residents from the Bay Area and Los Angeles to work remotely. Lower living costs and larger living spaces are making the suburban long-term apartment market more attractive, with suburban cities within a drive if employees need to travel to the company’s metropolitan area.

Picture: Marcus Millichap

Source: CoStar Group, Inc.; Department of Education; John Burns Real Estate Consulting; RealPage, Inc.

there is still a lot of uncertainty about the sustainability of this situation, as most companies will return employees to their offices after the outbreak. for young americans, convenient living conditions and transportation, colorful entertainment and sports activities, a wide variety of gourmet restaurants and more job opportunities will still attract them back to big city life.

With the spread of vaccines, many tech giants are also asking employees to return to work. Amazon, Facebook, Microsoft Corp. and Google, for example, announced plans at the end of March to return to the office, giving employees the option of returning to work or continuing to work from home, and most companies are considering the feasibility of a hybrid approach.

At the same time, the Biden administration’s policy toward international students will be friendly and will encourage more international students to study in the United States, with more universities in Chicago, New York and Los Angeles metropolitan areas ushering in a wave of young people returning home.

Yardi Matrix predicts that by the end of 2021, the long-term rental apartment market in the Midwest and Southeast will outperform the rest of the world, leading the recovery in the U.S. long-term rental apartment market and providing a favorable investment environment.

east-west coast → sun belt

the new crown outbreak has accelerated the evacuation of people from first-tier cities on the east and west coasts. at present, the two major trends of population movement are the migration of west coast residents to the central part of the country, while the east coast population flows to the south.

Due to the rich talent resources and low-cost, high-performance real estate market in the central region. Since 2008, 115 companies have moved to downtown Chicago, including Walgreens, McDonald’s, GE Healthcare and Kraft Heinz. In recent years, big companies such as Google, Amazon and Salesforce have expanded their chicago offices, and more than 150,000 workers are now employed by technology companies such as Google, Facebook, Salesforce, Uber and LinkedIn. Many smaller Bay Area companies have moved their headquarters to Chicago, such as BlueCrew, Okta and Afirm.

Low tax rates in the south have attracted big banks and silicon valley tech giants to move their corporate headquarters. HP, for example, moved its headquarters from San Jose, California, to Houston, Texas, and Oracle moved its research and development base from Redwood City, California, to Austin, Texas. In addition to Texas, Arizona, Nevada and Colorado are also destinations for western migration. In the east, high taxes, high rents and strict financial regulation have led many of Wall Street’s biggest banks to move from New York to Florida.

The movement of population from the east and west coasts to the Midwest and south contributed to the rise of metropolitan areas in those regions. Chicago, Denver, Phoenix, Las Vegas and the Texas Triangle stand out.

The Texas Triangle: Refers to the four metropolitan areas that pass south from Dallas/Fort Worth and Austin through Houston and San Antonio.

The trend towards migration is southward, increasing job opportunities in southern cities. Second-tier cities such as Dallas/Fort Worth, Austin and Phoenix have been periods of high employment and population growth. The influx of large labour forces has contributed to the development of the job market in southern cities and to the recovery of labour markets in those cities, which will contribute to the overall economic recovery of southern cities. During the new crown outbreak, the long-term rental apartment market in these cities outperformed the long-term apartment market in most East and West Coast cities, which bodes well for a relatively smooth and rapid recovery in the Sunbelt region.

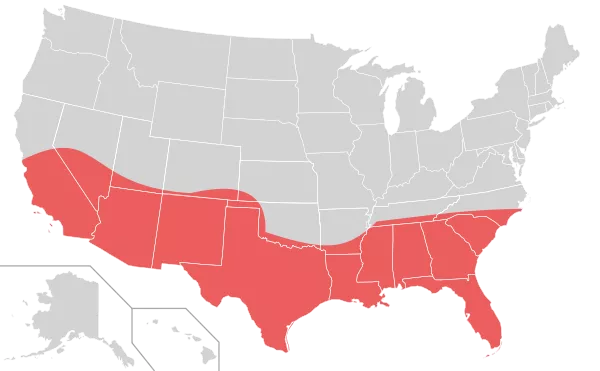

the approximate range of the solar belt

photo: source: wikipedia

Sunbelt: The Solar Belt (also known as the Sunshine Belt) is a geographical region of the United States that is generally considered to run through the southern and southwestern United States. Another rougher definition is the area south of the 36th parallel. The solar belt includes the following states: Alabama, Arizona, Arkansas, California, Colorado, Florida, Georgia, Kansas, Louisiana, Mississippi, Nevada, New Mexico, North Carolina, Oklahoma, South Carolina, Texas, Tennessee, Utah.

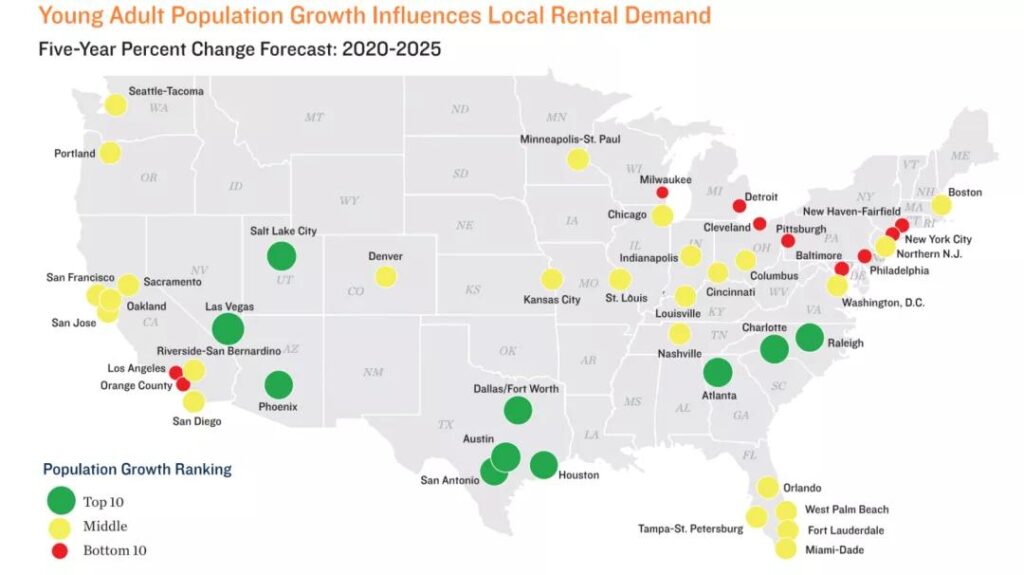

According to Marcus Millichap, only Chicago’s young population is growing at a significant rate in first-tier cities. The areas with the strongest young population growth in second- and third-tier cities are Salt Lake City, Las Vegas and Phoenix.

South: Dallas/Fort Worth, Austin, Houston, San Antonio;

South East: Atlanta, Charlotte, Raleigh;

Midwest: Indianapolis, Columbus, Cincinnati, Kansas City, Louisville.

Picture: Marcus Millichap

Source: Experian; Moody’s Analytics

the rapid growth of the young population will lead to a surge in demand in the local long-term rental rental market, which will allow owners of long-term apartments to have stable rental incomes and offer an optimistic outlook for the long-term rental apartment market, which will spur further investor investment in the long-term rental market.

The Central and Southeastern regions of the United States, with their low cost of living and convenient business conditions, attract young people from first-tier cities on the east and west coasts who would prefer to move to the Central and Sunbelt regions. There will be more jobs in these two areas than in big cities on the east and west coasts where recovery is slow, and the long-term rental market in the central and southeastern United States will recover faster than the market on the east and west coasts, and rental incomes will stabilize, benefiting long-term apartment owners. The demand for housing/rental housing brought about by the new population has laid a solid foundation for the future development of the long-term rental apartment market in the city, which is the direction that many investors need to focus on.

2021: long-term apartment investment strategy

In 2021, the overall trend in the long-term rental rental market in major U.S. cities is positive and has solid rental returns, prompting more investors to invest more in long-term rental apartments. CBRE believes the Fed’s low mortgage rates will further stimulate the long-term rental apartment market and increase investor investment. At the same time, the new administration’s openness to foreign immigrants and foreigners holding U.S. assets has encouraged a rapid return of overseas buyers, especially if travel restrictions are relaxed and offshore buyers may increase their investment activity.

the long-term rental apartment market in the midwest and southeast will attract many investors at home and abroad with its good employment environment, diversity of enterprises, rich human environment and low asset cost, which will be the two most worthwhile areas for investment in the long-term rental apartment market in 2021.

In the Midwest, Indianapolis is the best performing market in 2020. Chicago Metropolitan Area, Memphis, Detroit, Columbus, Cleveland, Cincinnati, Kansas City, Louisville and St. Louis. Louis) followed suit.

In the Southeast, Greensboro, Jacksonville, Richmond, Virginia Beach, Atlanta, Charlotte, Raleigh and Tampa are doing relatively well and are expected to do better in the long-term rental apartment market in 2021.

Photo: Google

– END –