US Commercial Real Estate Market Outlook for 2022

CBRE recently released the 2022 US Property Market Outlook (U.S. Real Estate Market Outlook 2022), its optimistic forecast for economic and commercial property in 2022, although the novel corona virus variants will affect the timing of American workers to return to the office, and the potential impact of other risks, US financial and monetary policy still highly support economic growth.CBRE believes the commercial real estate market in big cities in 2022 will be surprising, and for ESG, demographic changes, digital and carbon emissions will have new importance in this recovery.

CBRE expects record U. S. commercial property investments, thanks to new investors attracted by high levels of low-cost debt availability and attractive risk-adjusted returns on real estate debt. At the same time, during the COVID-19 period, with the rapid development of e-commerce, the development of industrial real estate and logistics was almost not interrupted. As the value of commercial properties rises, investors will focus more on popular industrial properties and long-term rental apartments, but also on emerging opportunities in office and retail properties for better returns.

Photo & Source: CBRE Research

Economy & Policy

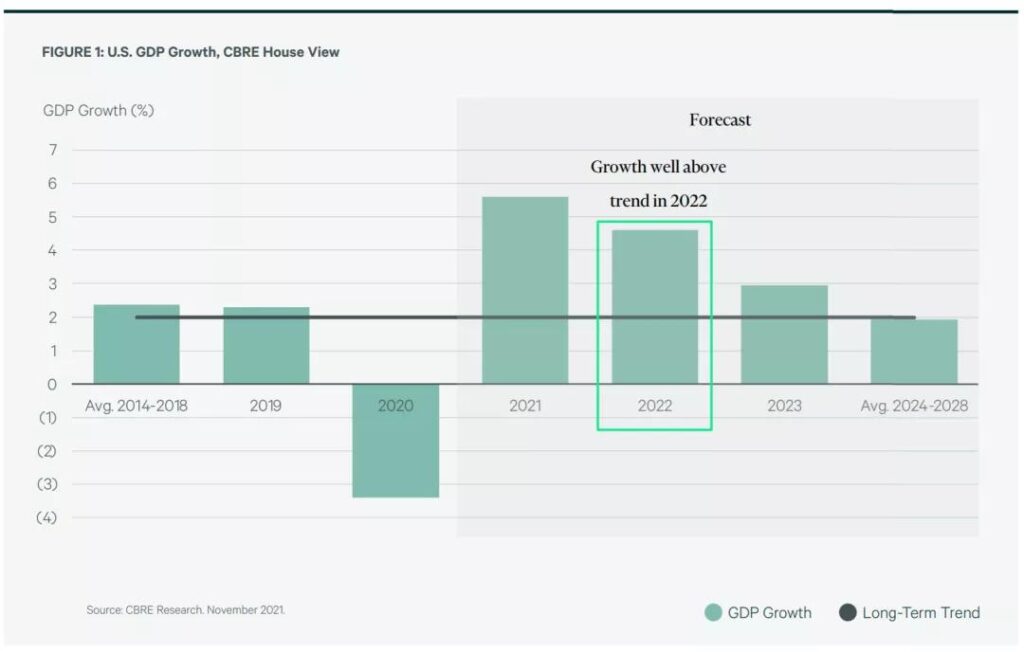

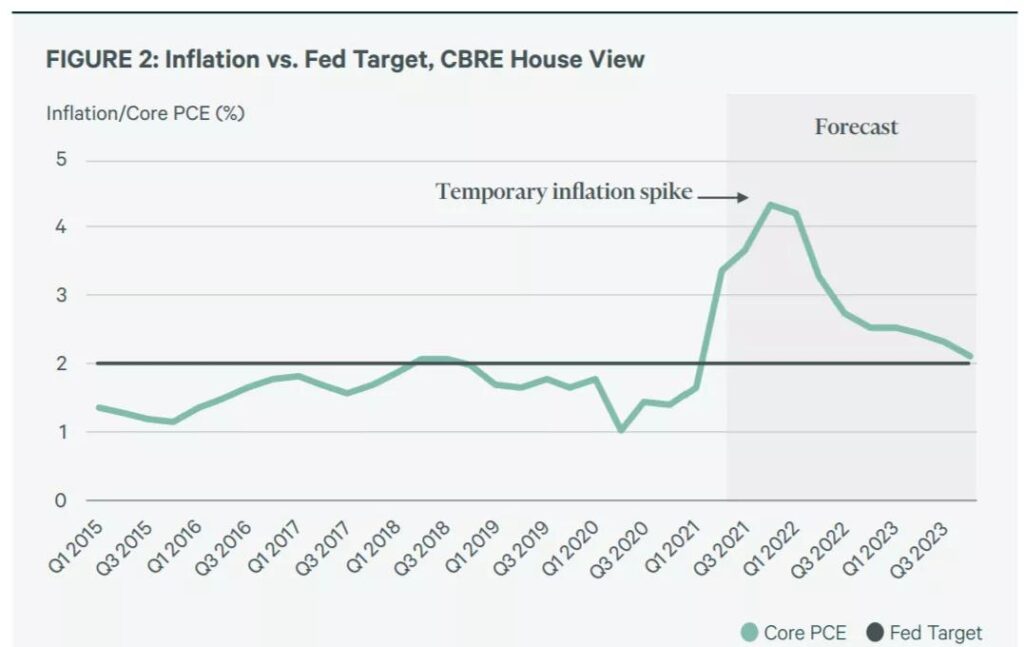

Inflation (Inflation) is expected to remain above the Fed’s 2% annual target by the first half of 2022, but it increases by only 2.5% in 2022 as supply chains and other economic drag weakens. Despite the impact of COVID-19, the US economy remains bright, with gross domestic product (GDP) expected to reach 4.6% in 2022.

01. Economic growth has revived the commercial real estate market

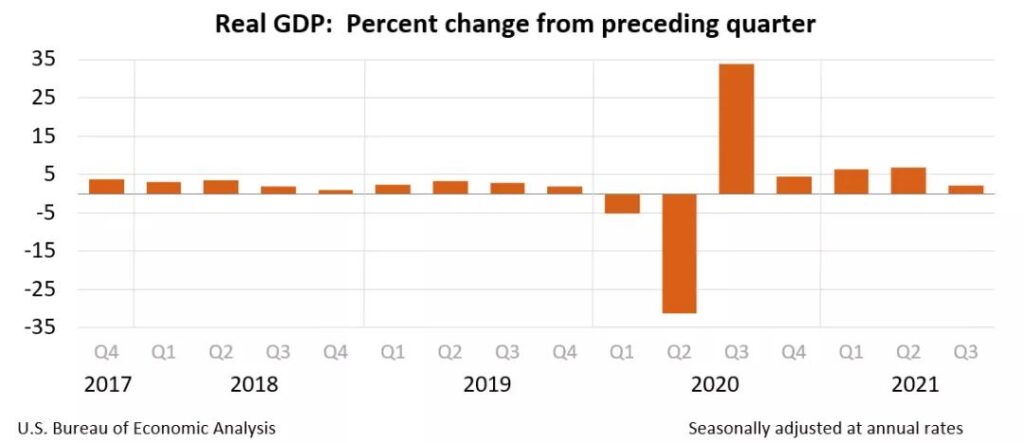

In terms of GDP, the United States has fully recovered from the recession caused by COVID-19 in 2020.The recovery in the US real estate industry is generally in full swing, with some industries progressing faster than others.

Recently, the US Department of Commerce (U.S. Bureau of Economic Analysis (BEA) announced that the first three quarters of 2021 (GDP) rose to about $16.9 trillion, up 5.7% year on year.

- GDP in the first quarter was about $5.3 trillion, up 0.3% from a year earlier;

- GDP in the second quarter was about $5.7 trillion, up 12.6% year on year;

- GDP in the third quarter was about $5.8 trillion, up 4.7% from a year earlier.

Photo & Source: U.S. Bureau of Economic Analysis

In 2022, the US GDP growth rate will slow from an abnormal high in 2021, but with a low interest rate (Interest Rates), the US GDP will still exceed the long-term trend (long-term trend), and strong economic growth will power the U. S. commercial real estate market.

02 The outlook for COVID-19 remains uncertain, but it is more optimistic.

With the rapid global spread of the major variants of the novel coronavirus, Delta and Omicron, it is difficult to predict.For the foreseeable future, the novel coronavirus may long-exist in some form.However, countries are currently learning “how to coexist with novel coronavirus”, due to the wide vaccination of vaccines, the lethality and serious illness of newly variant strains have also decreased significantly, and their ability to cope with their impact has been greatly improved.So, while the novel coronavirus will continue to exist in 2022, it should impact on humans, the health care system and more modestly on the economy than in 2020 and 2021.

03 The US economy has maintained growth

- S. GDP is expected to maintain strong —— growth of 4.6% in 2022. All will double the next four quarters, higher than the long U. S. trend of 2%.Meanwhile, the $1.2 trillion President Joe Biden signed and released the Infrastructure Investment and Employment Act (Infrastructure Investment and Jobs Act) signed and released and the social spending proposals that states are considering both add some upside potential to the U. S. growth forecast for 2022 and have a greater impact in 2023 and beyond.

Photo & Source: CBRE Research

04 Inflation and interest rates are in the focus

U. S. inflation reached decades-long highs in 2021, largely due to strong economic growth, labor shortages and stagnant supply chains, which increase the costs of goods and services. Prices are expected to continue to rise in the first half of 2022 (as measured by the Fed’s preferred core PCE index *), but by only 2.5% for the year amid cooling economic growth and reduced supply chain restrictions.

Core PCE: The Core Personal Consumption Consumption Price Index, Core Personal Consumption Expenditure Price Index, is a key measure of private consumption inflation in the United States, measuring the prices people buy goods and services in the United States, excluding food and energy prices.The core PCE is the Fed’s preferred inflation index.

Photo & Source: CBRE Research

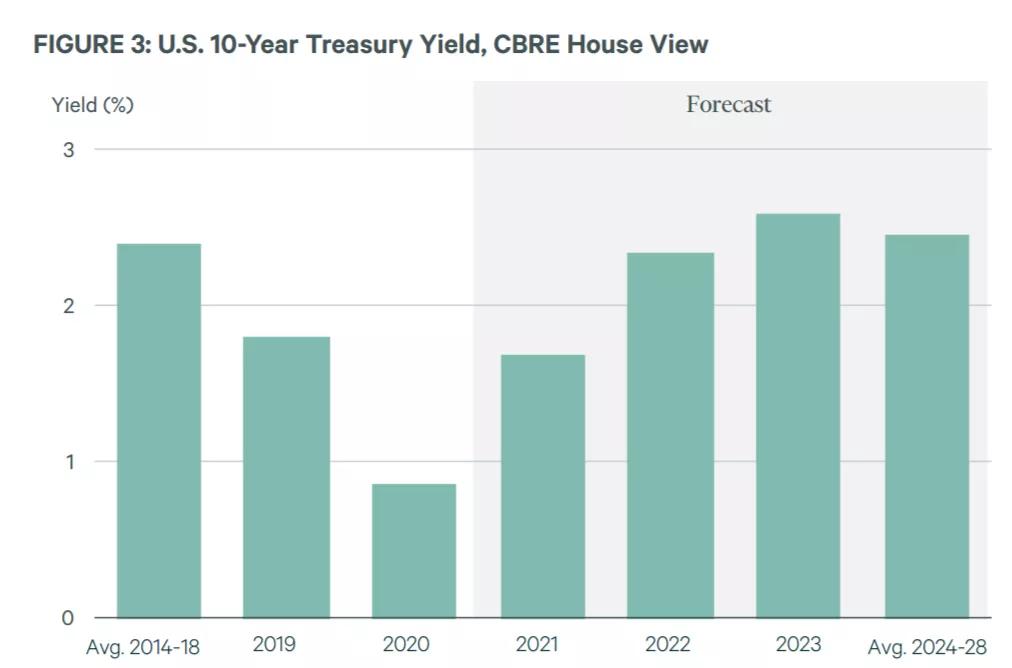

Given the strong economic recovery and inflationary pressures, the Fed is expected to end its emergency quantitative easing * (Quantitative Easing) policy, ——, in mid-2022, which is a key policy response to increasing capital liquidity and improving market operations during the COVID-19 pandemic.That will lay the foundation for raising the federal fund rate (Federal Funds Rate) and possibly multiple rate increases by the end of 2022. But interest rates are not expected to rise sharply enough to disrupt the property market, with the 10-year Treasury yield yielding 2.3% by the end of 2022 (1.4% in early December).

Quantitative easing: Quantitative Easing is a non-traditional monetary policy operated by a country’s monetary authority (usually central banks) through the open market to increase the money supply in the real economic environment.

Photo & Source: CBRE Research

05 Policy changes and commercial real estate

The recently enacted Infrastructure Investment and Employment Act includes $550 billion in new spending on tangible infrastructure over the next 10 years, which will drive the commercial real estate market in 2022 and beyond.A positive impact is the acceleration of short-and long-term economic growth, which translate into more demand for the commercial property market as new projects start up and for the long-term productivity increases.In the local market, new development areas can be opened up, and better infrastructure will also support the development of local businesses.

Some of the nearly $2 trillion Social spending and Climate Act (Social Spending and Climate Bill) led by President Joe Biden will also benefit the U. S. commercial real estate market, increasing tax credits and health subsidies will support consumer spending for low-and middle-income workers; massive investment in green and affordable housing will increase market demand for some property industries and regions / cities, and vigorously popularizing preschool education and expanding Pell grants * can expand workforce participation over time.

Pell Grant: Pell Grant, Pell Grant is a subsidy from the federal government for students who need to pay for college tuition.The Federal Pell grants are limited to students in financial need and who have not received their first bachelor’s degree or registered certain post-bachelor’s programs through a participating institution.

Figure source: CBRE

The bill also has some impact on US tax laws and commercial real estate.The most notable changes were an increase (including rent and capital income) of the 3.8% net investment income tax (NIIT) *, additional taxes on taxpayers with adjusted gross income of over $10 million, and new tax incentives for clean energy infrastructure and building improvements.But it is important that many of the proposed tax reforms that were originally most detrimental to the property market are now not under discussion, including reforms affecting the 1031 transaction * and incidental interest processing and raising the capital gains rate *.

Net investment income tax: Net Investment Income Tax, NIIT, and the net investment income tax is levied by section 1411 of the Internal Revenue Code (Internal Revenue Code).The NIIT tax rate is 3.8%, and individuals, estates and trusts must pay required net investment income tax for gross income (MAGI) exceeding the limit.The tax is generally aimed at high-income people with investment income.

1031 Transaction: 1031 exchange, named from Section 1031 of the Internal Revenue Code, which allows investors to avoid capital gains tax when selling investment property and to reinvest the proceeds from the sale in one or more similar, equal or greater properties within a specific time limit.

Capital gains tax: Capital gains tax is a tax levied by the US federal government on the sale or exchange of capital assets.The company that sells or exchanges capital assets such as stocks, bonds, machinery and real estate is the taxpayer, takes the tax rate of the actual income of the sale or exchange minus the balance of the original account value of the assets as the basis, and the proportional tax rate is 28%.

06 Increasing Focus on Environmental, Social, and Corporate Governance (ESG)

In 2022, the environmental, social and corporate governance (Environmental, Social and Corporate Governance, ESG) program will play a bigger role in the property sector. According to the 2021 US Investor Intention Survey (2021 Americas Investor Intention Survey) data released by CBRE, more than 75% of investors said they have adopted or are considering ESG standards, a trend that will continue in 2022.

The plan will not only come in the form of legislation, such as President Joe Biden’s $1.75 trillion social spending bill, but also accept regulation from the federal government.Specific rules and templates will be issued by the U.S. Securities and Exchange Commission (U. S. Securities and Exchange Commission, SEC) in order to improve the reliability and consistency of ESG information in all reports disclosed to investors.

Figure source: Google

These rules will involve each ESG principle, including climate change, HR management, and board diversification.This will make investors and tenants more concerned about whether their property portfolios comply with ESG regulations.It is worth noting that most besides the federal government, US state and local leaders have begun to focus on ESG and have already developed significantly influential policies in this regard, which will be the focus of investors and tenants in 2022.

In commercial real estate, ESG will increase the market demand for efficient building and renovation. Since commercial real estate buildings account for 16% of US CO 2 emissions, the commercial real estate portfolio will play an important role in achieving the U. S. ESG targets in the next few years, according to the U.S.Department of Energy (U.S.Department of Energy).

Photo & Source: Google

07 Trends worth watching

Other countries have slowing growth and normalizing monetary policy

CBRE noted that economic development and supply chain problems in other countries will affect US inflationary pressures and affect monetary policy in 2022.If other countries beat expectations and supply chain problems remain, the resulting inflationary pressure could accelerate the Fed’s first rate hike since 2018.Or slowing Asian growth and resolution to supply chain problems could slow the Fed’s reduced monetary stimulus policy.These factors are the main factors that, together with COVID-19, could affect the overall US economic environment in 2022.

Photo & Source: Google

Capital Markets

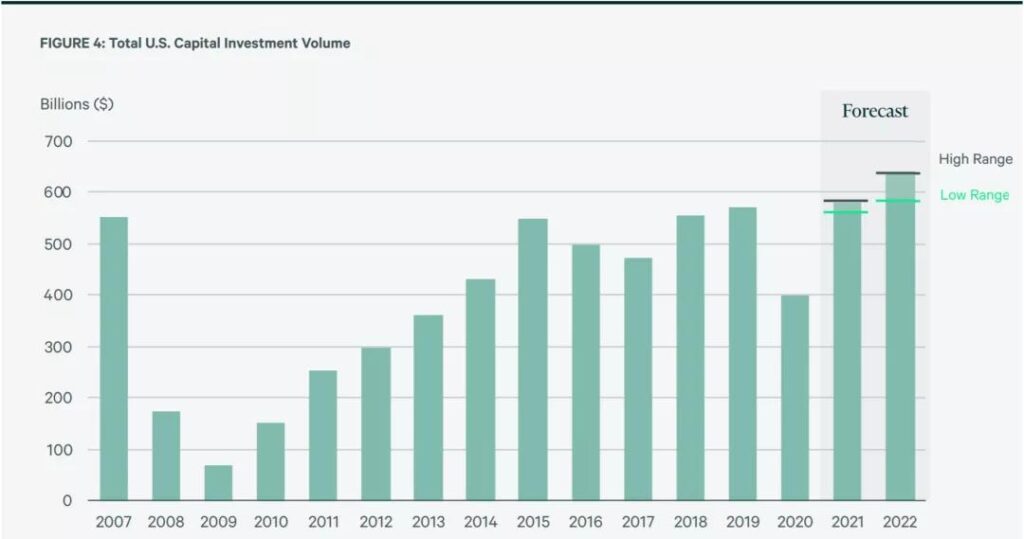

Investment activity in 2022 is expected to reach its highest level before COVID-19, with return on capital (Cap Rate) set to remain stable or slightly lower, even if interest rates rise, with strong investor demand and ample capital.

Return on capital: Cap Rate, refers to the yield used in the commercial real estate field to indicate the investment of real estate property.

01 Investment is close to record levels

Commercial real estate investment in 2021 thanks to strong investor demand and ample capital flows.By 2022, available capital will continue to support the active commercial property acquisition market (Buoyant Acquisition Market), and equity capital * (Equity Capital) will target the near-record high property market and have easy access to low-cost financing.As international travel restrictions ease and the costs of hedging against the weaker dollar remain low, more investors in other countries are expected to focus on U. S. commercial property in 2022.

Equity capital: Equity Capital is the capital that investors pay to the business in exchange for common or preferred shares.This represents the core capital of the enterprise, which can have debt funds added.

Total investment in 2022 is expected to increase by 5% to 10% at the 2021 level, roughly the pre-COVID-19 investment (2019 is currently the highest annual total investment on record). While interest in industrial properties and long rental apartments will continue to attract most investors, given the rapid growth of e-commerce and demographic changes in the U. S., investment in office and retail properties will also pick up.

Sales of industrial properties and long-term rental apartments are expected to grow by 10% to 15% over 2021, while sales of office and retail properties will grow by 5% to 10%.Meanwhile, hotel sales in the first three quarters of 2021 returned to pre-COVID-19 levels, a positive signal that the industry enters 2022.

Photo & Source: CBRE Research

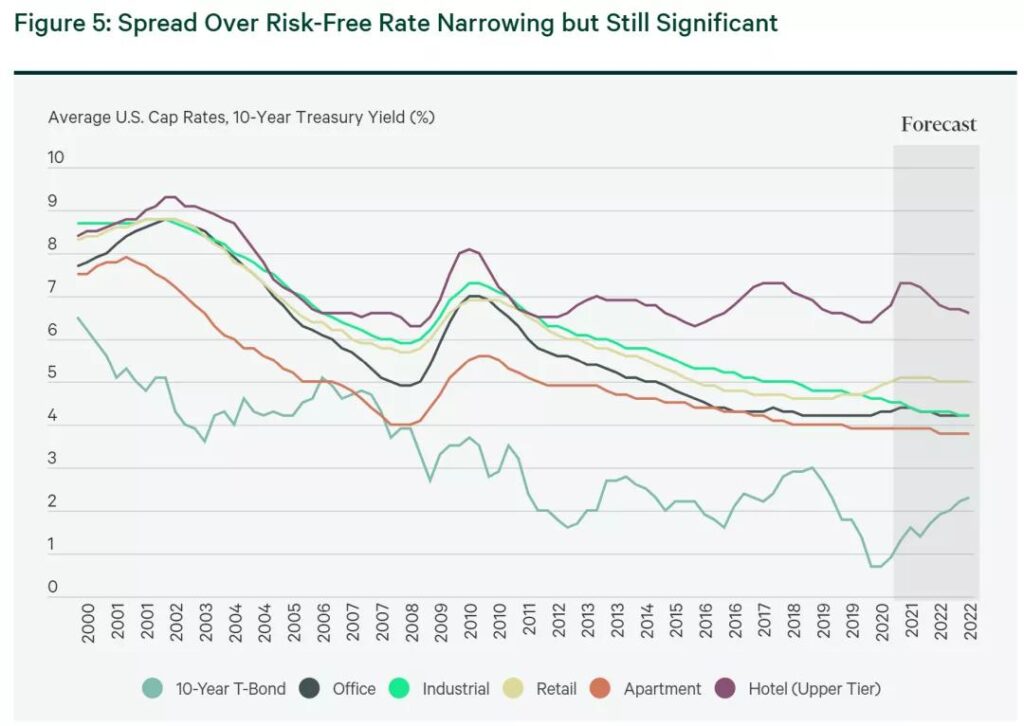

02 The return on capital has remained stable

Strong demand in the U. S. commercial real estate market will push up asset prices, and even higher long-term interest rates (long-term interest rates) will help maintain overall Cap Rate stability. The average return on capital (Average Cap Rate) is expected to be 2022 by 2.8% -3% in the first half of 10 years, matching the 2.9% average between 2013 and 2018, and then narrowing to 2.5% in the second half of 2022.

In addition, rents will continue to rise to support most types of commercial properties with higher net operating income (Net Operating Income, NOI).Although Cap Rate generally follows the direction of real interest rates in the long term, the NOI is expected to be more influential in the short term.

Photo & Source: CBRE Econometric Advisors, U.S. Federal Reserve Board, October 2021.

Despite some lingering challenges facing some retail, hotels and office buildings, the fundamentals of the property market are expected to strengthen throughout 2022.U. S. economic and job growth in 2022 will drive NOI higher as tenants fill vacancies and landlords raise rents, but that will vary by type of property, quality, and market.Overall, NOI for long rental apartments (8%), industrial (4%) and retail (2%) is expected to increase.Hotel NOI will be substantially improved, and office NOI is expected to decline slightly (-1.5%) due to the impact of Omicron, because low quality properties and quality Class A properties will compete for tenants with a mixed work system.

Overall, as the value of commercial real estate continues to appreciate, commercial real estate investors will receive returns from high-yield bond spreads (High Yield Bond Spread) and risk-free Treasury interest rate * (Risk-free Treasury Rates).In addition, average inflation is expected to be 2.4% this year, below previously predicted levels of NOI growth. Thus, relatively low-risk return opportunities, combined with the ability to hedge against inflation, will make commercial property a particularly attractive investment option in 2022.

High-yield bond spread: High Yield bond Spread is the difference between the current yield of various high-yield bonds and the percentage of investment-grade corporate bonds, government bonds or other benchmark bonds. The price difference is usually expressed as a percentage or a basis point.High-yield bond spreads are also known as credit spreads.

Risk-free Treasury bond interest rate: Risk-free Treasury Rates, the risk-free interest rate is the interest rate available by investing funds in an investment object without any risk.In the capital markets, the interest rate of US Treasury bonds (Treasury bond) is generally recognized as the risk-free interest rate in the market, because the credibility of the US government is recognized by the market that there will be no default.

03 Alternative lending institutions drive the debt market

Loan issuance (Loan Origination Volumes) will continue to rise in 2022, based on a significant increase in 2021, as borrowers want lower lending rates before the Fed tightened monetary policy.

In 2021, trading activity at the alternative lending institution * (Alternative lenders) surged, especially in debt funds utilizing mortgage obligations * (CLO).This shift reflects an increasing risk appetite (Risk Appetite) for borrowers seeking transitional loans and other transitional financing and for investors eager for higher yields, especially in light of current corporate and government bond spreads.Assuming the Fed shrinks its asset purchases without disrupting credit markets, CLO and traditional commercial mortgage-backed securities * (CMBS) offerings should remain high in 2022.

Alternative lending institution: Alternative lenders, a lending institution other than the bank, provides mortgage loans and benefits that the bank does not have, including unique loan terms, online application, accelerated application processing, etc.There are two main types of alternative mortgage institutions, the first is direct lenders, providing mortgage loans, banks, credit unions and some online lenders; the second type is middlemen, who help buyers connect with lending institutions, brokers and lending markets in this category.

Mortgage Obligations: Collateralized Loan Obligation, CLO, is a financial process that integrates loans to many different businesses into one package and resold to multiple lenders.The aim is to improve the efficiency of the financial system by overcoming the mismatch between the different needs of individual lenders and lenders.

Risk preference: Risk Appetite is the attitude of actively pursuing risk and likes the volatility of income better than the stability of income.The principle of risk preference investors to choose assets is: when the expected return is the same, choose the risky, because it will bring them greater benefits.

Traditional commercial mortgage-backed securities: Commercial Mortgage Backed Securities, CMBS, is a fixed-income investment product, backed by commercial property rather than residential property mortgage.CMBS can provide liquidity to property investors and commercial lenders.

Photo & Source: CBRE

Life insurance companies are also very active, finding good economic value in commercial real estate loans, particularly inclined to focus on quality properties in long rental apartments and industrial properties, seeking properties with lasting cash flow and value.Meanwhile, interest from private-equity firms in acquiring loan portfolios from life-insurance companies is also rising.Life insurers are expected to remain active lenders by 2022, but some of them may continue to move to the private equity sector.

Also worth noting is the growth in the single-asset, trading activity of a single borrower. Many investors remain cautious about the office and retail property segments, preferring to assess the safety of individual properties and guarantors rather than to tease through the financial situation of large property transactions. CBRE expects investors and lenders to be more comfortable underwriting office and retail property transactions in 2022, as fundamentals improve, and the effects of remote work and e-commerce become more visible.

04 Good years in the capital markets

To conclude, record investment activity in 2022 is expected, driven by ample capital liquidity and a steady return on capital. Improving economic conditions will support rising property asset values and NOI growth, thus increasing returns.The biggest risk to this prospect comes from the impact of the novel coronavirus, with an unforeseen spike in interest rates or inflation problems lasting longer than currently expected.

05 Trends worth watching

Choice of an investment strategy

Core and opportunistic investment strategies are expected to accelerate further in 2022 as investors balance risks and returns in the post-COVID-19 property market environment.Given the potential fundamental advantages, long-rent apartments could take a large share of opportunistic acquisitions.For office buildings, the transfer trend to investment in quality properties will be the most obvious, including the needs of institutional investors.Institutional investors who suspended acquisitions during COVID-19 and are now under pressure to effectively deploy large amounts of capital.

A strong recovery in the CLO drove an increase in debt-fund activity

Demand for short-term floating interest financing is growing with increased interest in buying various types of commercial real estate that require renovations or other upgrades.Investors seeking higher yields also have significant interest in such commercial properties, and large private equity firms are becoming active CLO issuers to meet that demand.

Long-term investor interest in ESG grows

The COVID-19 pandemic strengthens the need for investors to proactively consider protecting their portfolios from unforeseen external factors (such as climate change and social norms change).

Photo & Source: First Western Properties

Demand for office space will improve as more employees return to office work and tenants take advantage of favorable market conditions.The shift to hybrid work will prompt more tenants to redesign their workspaces to enhance collaboration and employee benefits.

01 The office market is near the “next normal”

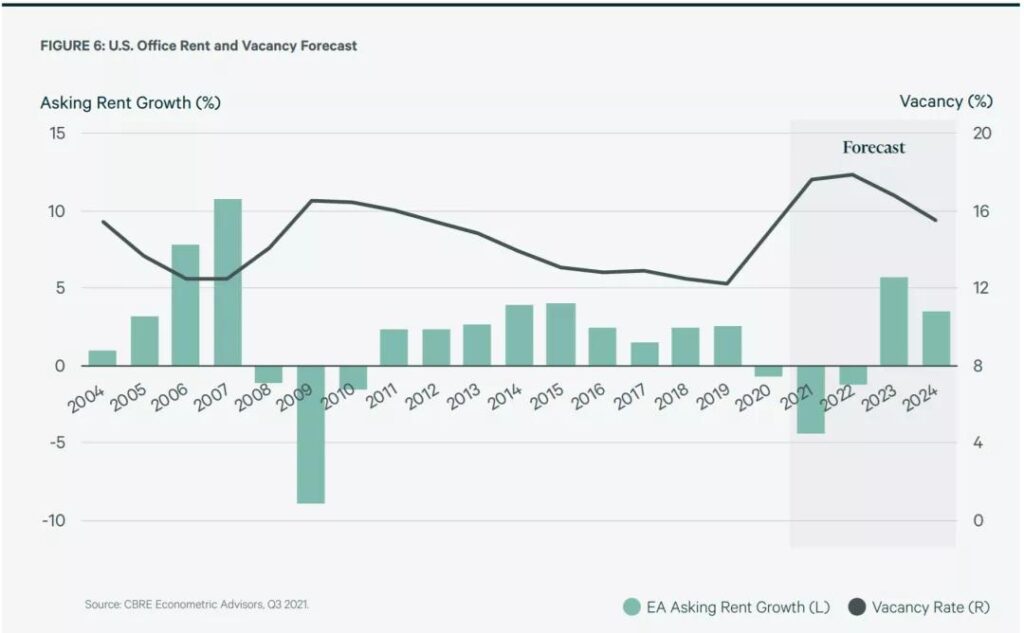

The U. S. office market trading activity has strengthened in the second half of 2021, and that momentum will continue in 2022.While its outlook depends on the social impact of the COVID-19 variant, effective medical means will make tenants more willing to make long-term lease decisions. Currently, investors and tenants are still considering how to better support hybrid work and how it will affect their portfolio strategy.While demand for office leasing will increase in 2022, the U. S. office market will face the highest vacancy rates and lower rents until the second half of the year in nearly 30 years.

02 favorable market conditions for tenants will continue

In 2021, new lease transaction activity rose from the low of COVID-19, and negative net absorption (Negative Net Absorption) and sublease space began to decline.These trends will accelerate in 2022 and are expected to create a million new jobs, marking the first net absorption (Net Absorption) positive in the US since the first quarter of 2020.

The most significant improvement in office demand will be in the most affected markets during the economic downturn, including Manhattan (Manhattan), Chicago (Chicago), Seattle (Seattle), and Dallas (Dallas).In 2022, urban markets in the Solar Belt, including Austin (Austin), Miami (Miami), San Jose (San Jose) and Charlotte (Charlotte) will benefit from the company’s migration and strong growth in the technology industry.

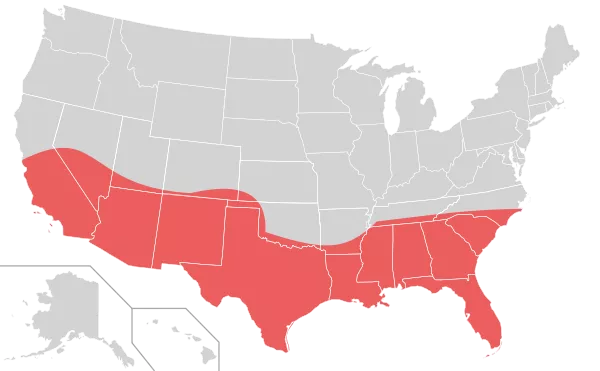

A approximate range of the Sunbelt

Photo & Source: Wikipedia

* Sunbelt: The Sunbelt is a geographic region of the United States generally believed to run through the south and southwest United States.Another more sketchy definition is the area south of the north latitude 36-degree line.The solar belt includes the following states: Alabama, Arizona, Arkansas, California, Colorado, Florida, Georgia, Kansas, Louisiana, Mississippi, Nevada, New Mexico, North Carolina, Oklahoma, South Carolina, Texas, Tennessee, Utah.

Despite the good market momentum, office vacancy rates across the nation will reach their highest level since 1993 in 2022 due to the delivery of more than 53 million square feet of new office buildings.

Average office rents will remain largely low for most of 2022, with the downtown primary market under-performing the suburbs in the short term but rebounding in the long term. Downtown office markets such as Austin and Miami are already recovering strongly compared to suburban office markets. Next year, tenants will have access to lower rents in major markets such as Chicago, Manhattan, Los Angeles, San Francisco and Washington, D.C.

Photo & Source:CBRE Econometric Advisors, Q3 2021.

03 The rise of hybrid working patterns

In 2022, workplace flexibility will go deeper into the company’s business model. The CBRE study shows that U. S. office employees will spend on average 24 percent less office, and 87 percent of large companies plan to do mixed work, according to its 2021 Tenant Emotions Survey (2021 Occupier Sentiment Survey).

As a result, employers increasingly see offices as a place for collaboration and meaningful employee contact.The event-based workplace will become a new planning standard for the company to improve employee productivity and health.Amenities that meet their daily needs, help them build and maintain relationships, and provide experiences that represent the company’s brand and values will become more important.

The shift in the office role will accelerate its progress towards high-quality office space, and office buildings with the best technology, amenities and flexible space will take up a growing share of the market demand.

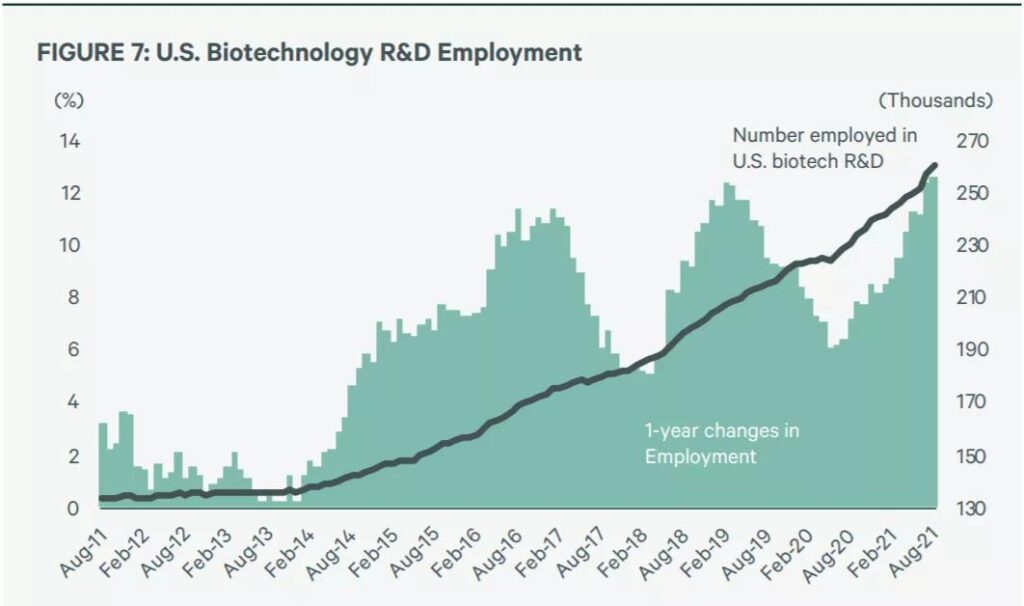

04 Life sciences affect more markets

The life sciences industry will continue to grow in major U. S. office markets in 2022, driven by biotechnology advances and record-level venture capital and other sources of funding.This facilitated the construction of the largest life science laboratory ever in the country, with 23.6 million square feet of the top 12 laboratories under construction.

As of the third quarter of 2021, Boston-Cambridge (Boston-Cambridge), the San Francisco Bay Area (the San Francisco Bay Area), and San Diego (San Diego) had record average laboratory rents. The growing workforce and new development activities in the life sciences continue to spread to emerging central cities like Pittsburgh (Pittsburgh), Houston (Houston), and Salt Lake City (Salt Lake City).

Photo & Source: U. S. Bureau of Labour Statistics, October 2021.

05 Trends worth watching

The Growing role of ESG

Environmental and sustainability issues such as carbon emissions, use of sustainable materials, energy efficiency and health improvements are becoming increasingly important to office tenants and owners. These properties will require ongoing measurement data in the future, rather than one-time certifications. In the short term, ESG programs will focus on improving the health of employees and tenants, but some office owners will make significant investments in improving energy efficiency and reducing the carbon emissions of their properties to increase the long-term value of their properties.

Mixed work will spur demand for flex space

The shift to mixed work will prompt tenants to consider office space with flexibility and nimbleness. The supply of offices with flexibility will grow in 2022 as investors continue to acquire new locations, landlords add amenities to their buildings, and leasing demand from businesses large and small grows.

Photo source: Google

Retail

Retailers are using space more efficiently, especially in grocery-dominated shopping centers, and this, combined with limited development, higher consumer spending and economic growth, will revitalize the retail sector in 2022.

01 The recovery in retail has inspired optimism and investment.

The retail sector is recovering from the impact of the new crown epidemic. Because of the low number of new retail stores under construction and rising retail sales, existing retail space is more efficient and sales per square foot have increased. Shopping centers that were previously at risk from the effects of the New Canopy epidemic are seeing new highs in traffic and double-digit sales growth. At the same time, investors are revisiting the attractive yields of retail compared to other commercial real estate categories.

02 Retail space productivity and consumer spending are up.

Sales per square foot of U.S. retail space have been on the rise since 2010. From 2010 to 2020, retail sales grew 42% while retail supply grew by only 4%. While the new crown epidemic has forced a temporary pause in this trend, year-to-date activity in 2021 suggests that retailers are using space more efficiently than ever before.

Consumer spending is expected to continue to increase in 2022 as personal savings increase during the epidemic. According to a 2019 U.S. travel Association (U.S.travel) report, a resurgence in international travel will generate $150 billion annually for tourism across the U.S., which will further boost retail markets in East and West Coast cities and other cities dominated by tourism.

Photo & Source: CoStar, U.S. Census Bureau, CBRE Research, Q3 2021.

03 Moderate volume under construction helps market recovery

The number of retail real estate buildings under construction will remain moderate through 2022 as developers focus on industrial real estate and long term apartment projects. Retail real estate development will continue to be constrained by supply chain issues affecting the delivery of construction materials, including delayed deliveries and higher costs, resulting in greater productivity gains in retail space.

04 Capital Markets Show Signs of Recovery

Retail real estate investment activity picked up in 2021 as real estate investment trusts (REITs) continued to increase their acquisition deal activity, reaching their second largest annual total in the past 10 years as of the third quarter of 2021. Grocery centers attracted approximately $5 billion in investment activity, the second most active quarter for the sector in the past decade.

Grocery-based retail properties have been operationally resilient during the new crown epidemic. The sector has adapted well to online consumption and e-commerce, such as online shopping/curbside pickup and third-party delivery services. Grocery-based retail whose e-commerce sales are expected to grow by more than 20% in 2022 and double by 2025, grocery stores will remain a preferred target for retail real estate investment given favorable supply and demand dynamics and attractive risk-adjusted pricing. As retail debt liquidity improves, the buyer base will increase.

Photo & Source: U.S. Bureau of Labor Statistics, October 2021.

Other attractive assets for retail investors include primarily those retail properties that are based on providing quick service. Examples include fast food restaurants, banks, pharmacies and small retail stores that offer drop-off-free service. Such assets have recently traded above their long-term quarterly averages. Tenants that offer quick service are designing new drop-off-free models, such as multiple pick-up/order-only lanes and dedicated mobile pick-up lanes. These new designs will maximize the efficiency of the site footprint while shrinking the indoor dining area.

The shopping center industry continues to amaze. REITs with a large number of shopping centers have been reporting positive in the third quarter of 2021. Despite increasing vacancy rates in lower-tier properties, traffic data from data analytics firm Placer.ai suggests that the operational resilience of regional and super-regional shopping centers* has been underestimated. data for July 2021 shows that monthly traffic in indoor malls was down only 0.1% from two years ago, and total traffic in outdoor malls increased by 2.1%, suggesting that traffic has fully recovered to new crown levels prior to the outbreak.

Regional Mall: A Regional Mall, as defined by the International Council of Shopping Centers (ICSC), is a shopping center with 400,000 square feet (37,000 square meters) to 800,000 square feet (74,000 square meters) of gross leasable area (GLA) that contains at least two department stores.

Super-regional Mall: A Super-regional Mall, as defined by the International Council of Shopping Centers (ICSC), is a shopping center with more than 800,000 square feet (74,000 square meters) of GLA, with three or more department stores, and a variety of smaller retail tenants, that is the primary shopping destination in its area (25 miles or 40 kilometers) within its area.

Photo & Source: Google

Retail markets such as Chicago, Atlanta, Boston, Houston, Phoenix and South Florida are expected to perform better than other urban retail markets in 2022. Markets such as Jacksonville (Jacksonville), Milwaukee (Milwaukee), Orlando (Orlando), and Raleigh-Durham (Raleigh-Durham) saw an uptick in transaction activity in 2021 and will drive this momentum into 2022.

Photo & Source: CBRE Research

05 Venture capital enters the retail sector

2021 is a record year for venture capital investment, with retail-focused companies being their preferred investment target. Technologies for e-commerce, logistics and supply chain management are particularly attractive, and there is active investment activity in mobile payment applications. According to eMarketer, a leading global market research firm, the retail trade channel, which is part of the retail industry, has been growing, with its annual sales expected to reach $295 billion by the end of this year and $660 billion by 2025, accounting for more than 10 percent of total retail sales across the United States. Venture capital is also seeking investments in location analytics, enterprise software, artificial intelligence and more to fund this evolving technology to ease the pressure on supply chains across the U.S.

These investments will also help brick-and-mortar retailers, where mobile apps that support online consumption and in-store pickup will drive steady traffic to brick-and-mortar retail stores. In addition, fintech companies such as Affirm and Klarna are working with retailers to offer “buy now, pay later” services that will appeal to a wide range of millennial* and Gen Z* shoppers.

Millennials: refers to people born between the early 1980s and late 1990s.

Generation Z: refers to those born between 1995-2009.

06 The coming period of retail activism in 2022

Retail center traffic will increase further in 2022 as cities reopen and vaccination rates rise. Tenants are signing longer leases and investors are investing heavily in retail assets, setting the stage for a busy retail real estate market in 2022, and a resurgence in international tourism will boost sales in gateway city retail markets.

Transaction activity in open-air retail centers is increasing in most urban retail markets, which will be the most popular asset class for retail real estate in 2022. Single-tenant, drop-off-free properties will also perform well and will command record sales prices in 2022.

Urban markets in the Midwest and Sun Belt regions, as well as Seattle on the West Coast, will receive attention from a variety of retailers and investors due to the low rental prices of their retail properties. Regional and super-regional shopping centres, on the other hand, will need to be redeveloped or repositioned, and their overall rents will be stagnant, but Class A shopping centres will perform better.

07 Trends to watch

Collaboration between digital and traditional retail brands

Retailers are expanding their offerings, for example by partnering with direct-to-consumer companies through branded discount campaigns, placing advertising boards in department stores, and running branded flash stores outside. This not only increases traffic to traditional shopping centers, but also provides physical stores for emerging retail brands.

Using stores as a solution to supply chain problems

The most expensive segment of the logistics and transportation process is the last mile part, which is the transportation from the last distribution center to the final customer. Physical stores will play a bigger role in 2022 and will make it easier for consumers to return, refund, and expand return locations.

Making ESG the real goal for retailers

Increasingly, consumers now prefer ethically sound brands, especially those focused on reducing carbon emissions and conserving resources. At the same time, consumer interest in the secondary market is on the rise, as consumers feel that products are unique and offer good value for money. Retailers can take advantage of this by selling their own pre-owned products. According to Forrester, one of the world’s most influential research and consulting firms, about 41 percent of consumers across the United States are more likely to buy environmentally friendly goods.

Industrial & Logistics

Industrial real estate is poised for strong growth in 2022 amidst record market demand, rental growth and investment activity. Growing e-commerce sales, economic growth, population migration and consumer demand for onshore “safety stock” to avoid supply chain disruptions over the past 18 months will drive demand for warehouse space and industrial real estate markets in the consumer market.

01 2022 will be another important year for industrial real estate.

E-commerce sales surged during the new epidemic, accounting for 21.6% of total U.S. retail sales in the second quarter of 2020, up from 16.2% in the first quarter. By the third quarter of 2021, e-commerce sales accounted for about 20% of total U.S. retail sales, up from pre-New Crown epidemic levels.

E-commerce will continue to expand in 2022 as the online consumer market grows rapidly and more consumers become more eager to shop online. The demand for space in e-commerce will continue to grow, with retailers to wholesalers needing to hold more inventory. And due to rising transportation costs, lack of available warehouse space in densely populated areas, and labor shortages to find enough workers to operate facilities, these companies will continue to outsource shipping products to third-party logistics companies (Third-Party logistics, 3PL) at an even greater rate

02 Supply chain volatility will drive demand.

In 2022, tenants’ biggest concerns will be rising transportation costs and supply chain delays. According to shipping consulting firm Drewry Supply Chain Advisors and the Cass Freight Index* (Cass Freight Index), the cost of shipping goods by ocean increased by more than 200 percent in 2021, and domestic U.S. freight rates increased by more than 40 percent. While the increase in transportation costs may ease as 2022 approaches, transportation costs are likely to remain high for the foreseeable future. During the shutdown with the new crown epidemic, a large number of manufacturing companies stopped working and shutting down production and are still unable to produce at full capacity and are not expected to fully recover until 2023.

Cass Freight Index: The Cass Freight Index, is a measure of total monthly deliveries of U.S. freight. Started in 1955, the index is a meaningful indicator of U.S. shipping activity, covering more than 400 companies and carriers in more than 1,200 sectors.

Meanwhile, demand for goods in the consumer market will continue to rise, which will lead to increased competition. This demand will drive up supply chain costs, including transportation. According to CBRE Supply Chain Advisory, transportation costs account for 40-70 percent of a company’s total logistics spend, while fixed facility costs, including rent, account for only 3-6 percent. While rents will continue to rise significantly, they are dwarfed by rising transportation costs. As a result, companies of all types will continue to lease more warehouse space to reduce their transportation costs.

Photo & Source: CBRE Research

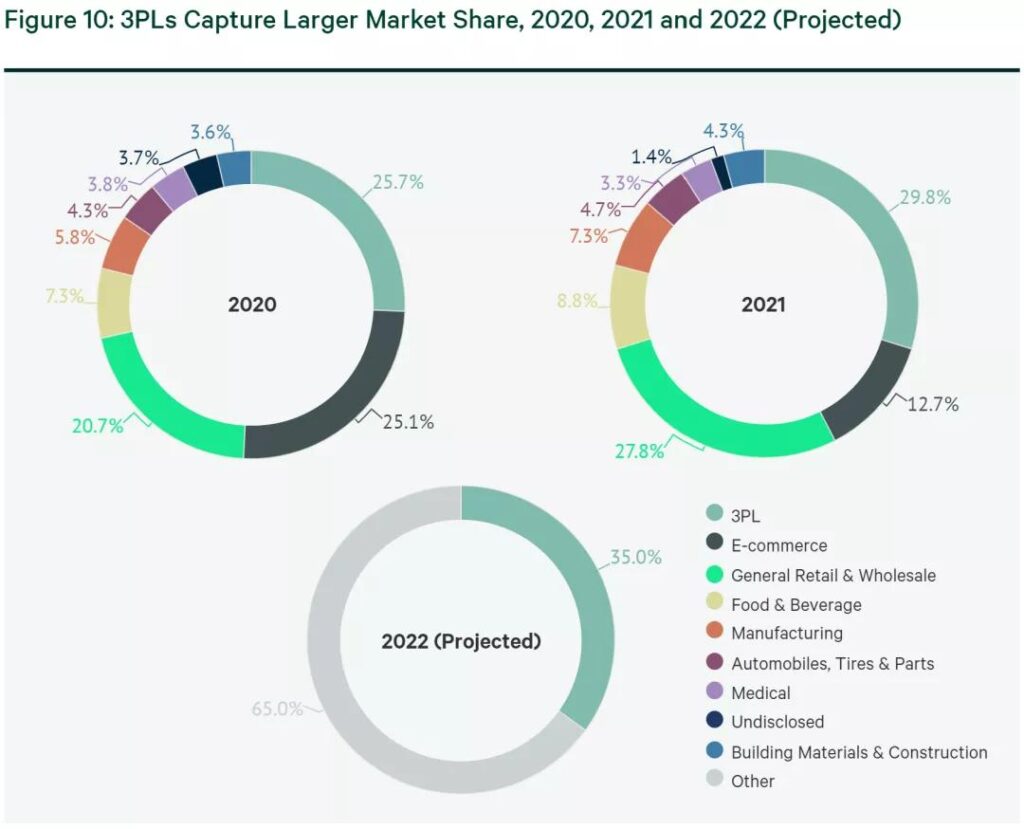

03 Logistics Outsourcing to Accelerate in 2022

Inflation will be well above the Fed’s 2% target through the first half of 2022, but will increase by only 2.5% for the year as supply chain and other economic headwinds recede. While pandemic-related disruptions will continue, the economic outlook remains bright, with GDP growth expected to reach 4.6% in 2022.

Third-party logistics to lead leasing activity in the industrial real estate market with a 30% market share in 2021, compared to 13% for e-commerce Third-party logistics will expand further in 2022 as companies look to reduce direct logistics costs and avoid the current labor shortage and oversupply of warehouse space in the U.S. industrial real estate market. With declining vacancy rates, rising rents and a further tightening labor market, 3PL will increase its market share of industrial real estate leasing in most cities across the U.S., and is expected to reach 35 percent of the leasing market by the end of the year. That said, 3PLs will also still need to overcome labor shortages, resulting in greater use of automation and other technologies to reduce reliance on human labor.

04 Manufacturing is on the rise

Strong U.S. manufacturing output in 2021, which increased to its highest level in nearly three years in November, supports the real estate base for manufacturing space, including positive net absorption, lower vacancy rates and record rents. Technology, defense, automotive and medical companies will continue to lead the way in the year ahead, with increased demand for manufacturing facilities in urban markets in the Midwest and Southeast, with Illinois, Arizona, Texas and Florida expected to be the The fastest growing markets will be in Illinois, Arizona, Texas, and Florida, primarily due to steady population growth, large land availability, and various government business incentives in these states.

Photo & Source: CBRE Research, August 2021.

05 Emerging logistics markets.

The key emerging markets for distribution facilities will again be those urban markets with growing populations and superior logistics hub connectivity. Population growth in the Midwest, Southwest and Southeast will remain strong, fueling demand for logistics real estate in these regions. In 2022, Chicago, Nashville, Las Vegas, Reno, Central Valley California, Salt Lake City, Central Florida, and San Antonio are expected to be the most important cities in the region. Central Florida, San Antonio and Austin will see a significant increase in activity in these markets.

Tenants will also flock to inland port, air and rail-connected markets such as Chicago, Louisville, Memphis, El Paso, Columbus, Indianapolis Kansas City, St. Louis, and Greenville.

06 Under construction to keep up with demand

As of the third quarter of 2021, a record 448.9 million square feet of industrial real estate space was under construction. The record number of square feet under construction reflects the fact that projects starting in 2021 and 2020 could not be completed during the New Crown outbreak shutdown. Despite this, tenant demand continues to outpace supply. If this trend continues in 2022, available space in industrial properties will remain tight, especially for Class A premium properties, resulting in more tenants choosing to renew their leases, supporting high rents for industrial properties, but potentially slowing the pace of new leasing activity in 2022.

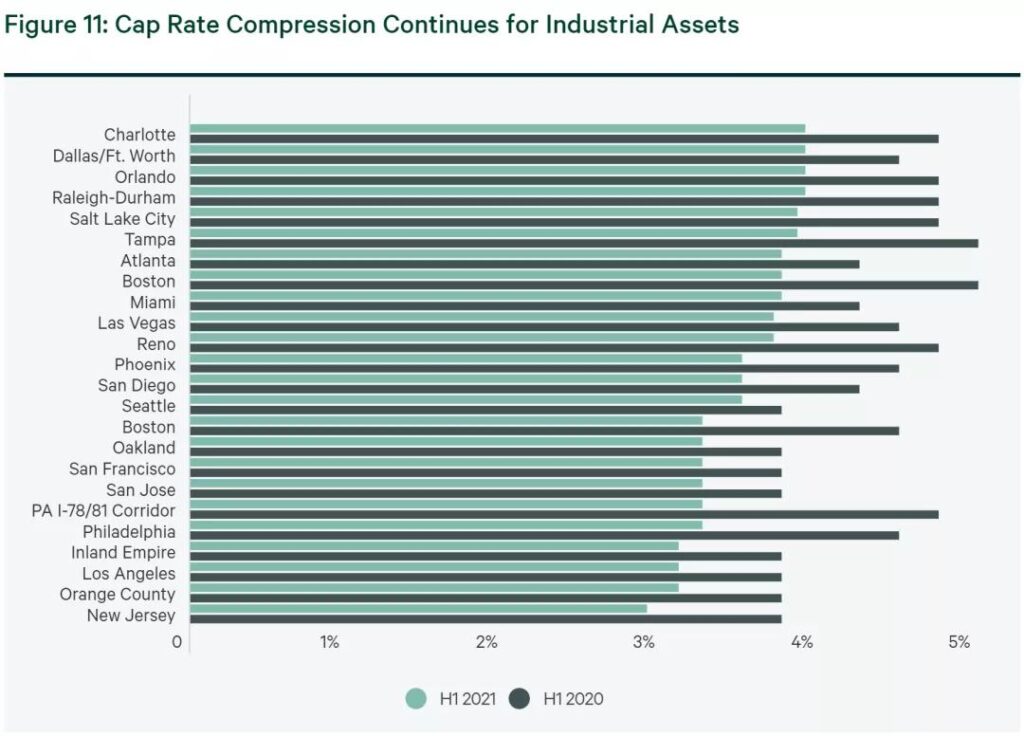

07 Investors bid for property in emerging markets

In 2022, strong investor demand for industrial assets will push prices higher and further compress returns on capital across markets and product types. The spread between primary and secondary market returns on capital will continue to narrow in 2022.

CBRE expects:

- Phoenix and Las Vegas will have a return on capital in line with the Inland Empire.

- Indianapolis (Indianapolis) and Columbus (Columbus) would have returns on capital in line with Chicago (Chicago).

- The Pennsylvania I-78/81 Corridor (PA I-78/81 Corridor) will be priced close to the New Jersey (NJ) market.

- Northern and Central Florida will have a return on capital close to that of South Florida.

With institutional capital flowing into the market, new investors are still having difficulty finding quality Class A industrial real estate properties to invest in. As a result, more capital is expected to be invested in Class B industrial real estate properties, thereby reducing the return on capital for this property class

Photo & Source: CBRE Research, Q3 2021.

08 Trends to watch

The rise of automation

Increased demand from industrial tenants, coupled with an extremely tight job market, will drive the growth of automation and robotics. As automated building facilities are mostly located in new construction facilities, this will have an impact on increasing market demand for first-generation automated building facilities in 2022 and beyond.

Impact of ESG on industrial properties

Given the need to reduce carbon emissions, the industrial sector will face increased regulatory pressure, particularly with respect to energy efficiency. While much of the work in this area is likely to focus on improving passenger and freight transport efficiency and reducing carbon emissions from manufacturing, warehousing is also likely to be affected. As a result, developers are likely to use more sustainable building materials, such as wood, rather than concrete and steel.

Photo & Source: CBRE Research

Multifamily

With solid fundamentals and high investor interest, the long term apartment market is poised to hit record highs in 2022. With tremendous liquidity and an increasing number of debt options, long term apartment pricing will remain as strong as ever.

01 Record high demand and number of units under construction

Overall occupancy and rents for long term rentals across the U.S. in 2021 are higher than they were before the new crown epidemic. While certain cities are facing challenges in the LTRO market, positive conditions for the sector as a whole will drive continued record levels in 2022.

The growing economy is boosting household formation, which had been artificially suppressed by the new crown epidemic. New household formation is driving rising rents, which are expected to match the pace of new deliveries of long term rentals under construction in 2022. Long-term apartment occupancy will remain above 95% for the foreseeable future, and rents will increase by nearly 7% next year.

In the near term, the number of long term apartment buildings under construction will remain high across the U.S. Record completions are expected in 2021, with more than 300,000 additional units to be delivered in 2022. (206,000 units delivered annually on average since 2010, 171,000 units delivered annually from 1994-2010)

Despite strong demand, the number of new Class A properties coming online will limit the performance of high-quality properties, while Class A rents, which suffered the most during the New Crown epidemic, have more room to recover. Overall, rents in the urban LTV market are expected to grow by 8% in 2022, slowing to 3% in 2023 and falling slightly below that level in subsequent years.

02 From the city to the suburbs and back again

Driven by a combination of factors, the downtown LTV market is gradually recovering, with occupancy rates approaching pre-Coronavirus levels, due to fewer restrictions on urban facilities, higher vaccination rates, a growing willingness to use public transportation, the reopening of university campuses, and more workers returning to their offices. Although the New Coronavirus variant strain Omicron introduces new variables to the human resistance process, cities and institutions of all types will remain open as medical treatments continue to improve.

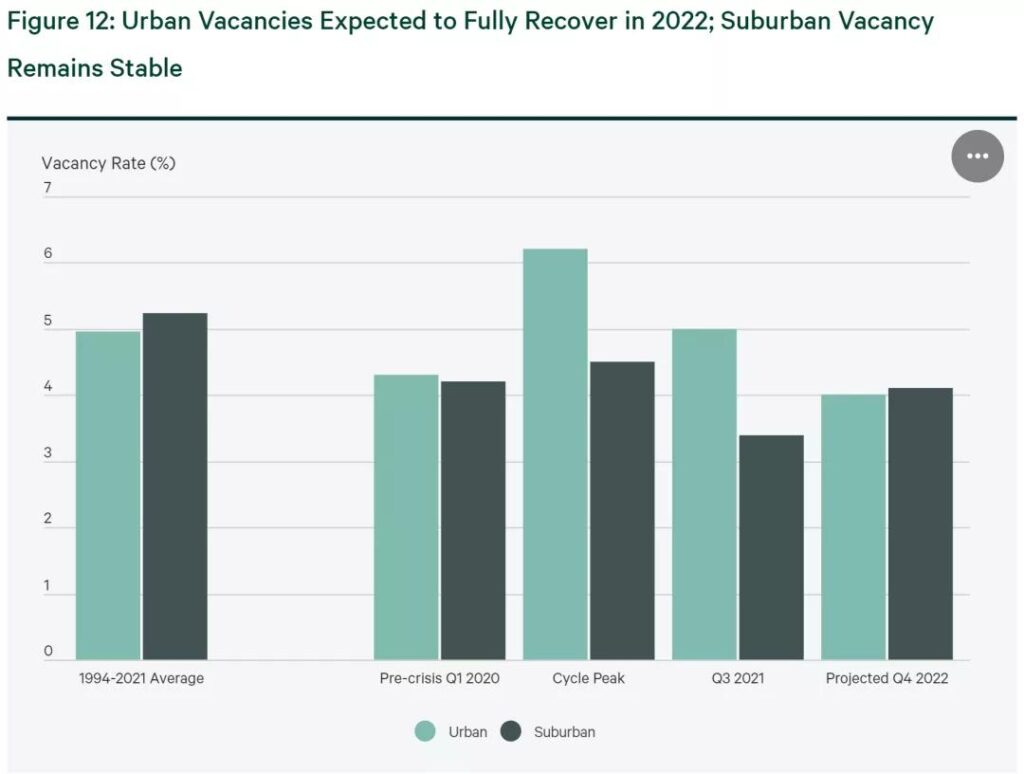

During the peak of the epidemic, the average vacancy rate of long term rentals in urban areas increased by nearly 2%. As of the third quarter of 2021, the average vacancy rate for urban long term apartments was 5%, 0.7% higher than before the new crown epidemic, and is expected to decrease to 4% by the end of 2022. In contrast, suburban long term rentals are performing better as long-term and cyclical factors such as income uncertainty, preference for outdoor options, people’s need for more space, and the growing number of millennial families needing schools are driving demand for the low density and low cost submarket long term rental apartment market.

Photo & Source: CBRE Econometric Advisors, RealPage Inc., Q3 2021.

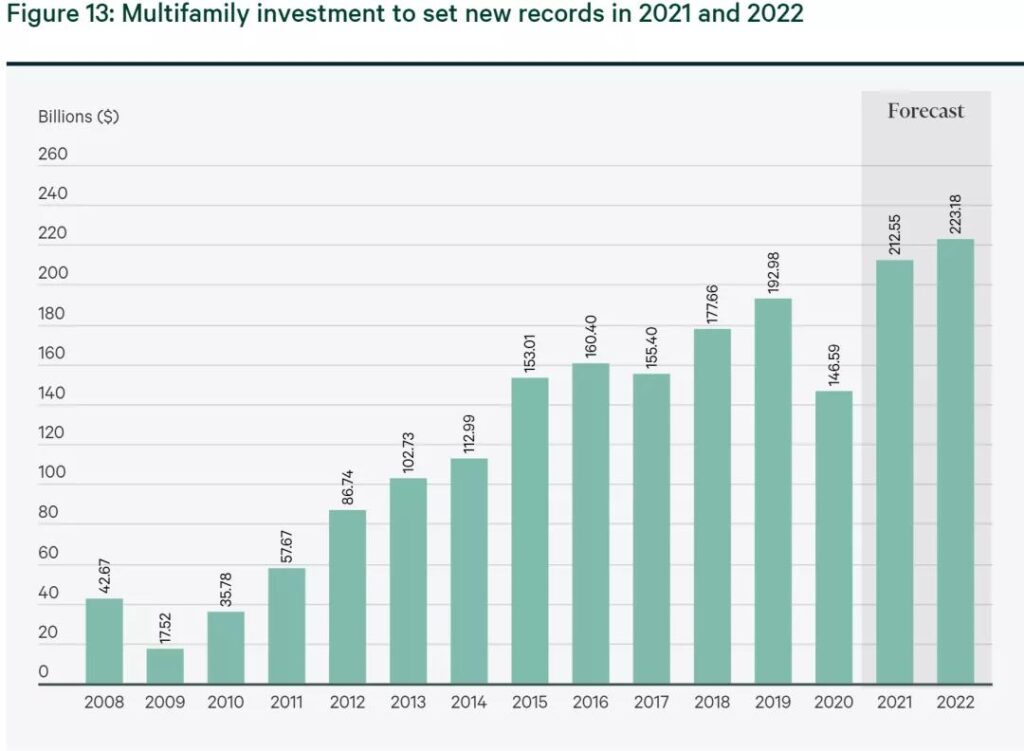

03 Investors Still Favor Long-Term Rentals

As of the third quarter of 2021, total investment in the U.S. long term apartment market was approximately $179 billion and is expected to reach approximately $213 billion by the end of the year, well above the $193 billion in 2019. Total investment in the U.S. long term apartment market is expected to reach $234 billion by 2022, a 10% increase from 2021.

While domestic and international money continues to pour into the U.S. long term apartment market, investment targets appear to be changing. Investors are finding strong growth in the LTV market outside of East and West Coast cities, and there is an increasing tendency for investors to back ESG-compliant properties, particularly from European investors.

The Federal Housing Finance Agency (FHFA) has set a cap of $78 billion for long term apartment purchases by Fannie Mae* and Freddie Mac* in 2022, up 11.4% from 2021. This level of liquidity should contribute to strong value growth. In addition, a renewed influx of capital from other countries targeting the LTRO market is expected. The liquid LRT debt capital market, including traditional lending sources and alternative lenders such as debt funds and mortgage REITS, will stabilize further and may even compress returns on capital when interest rates rise.

Fannie Mae: Federal National Mortgage Association, Fannie Mae, or the Federal National Mortgage Association, founded in 1938, is the largest U.S. government-sponsored enterprise engaged in the financial business of specializing in expanding the funds that move through the secondary housing consumer market.

Freddie Mac: Freddie Mac, the Federal Home Loan Mortgage Corporation, is the second largest U.S. government-sponsored corporation, second only to Fannie Mae in terms of business size, established in 1970 by Congress to develop the U.S. secondary mortgage market and to increase home loan ownership and home loan rental income.

04 2022 Investment Strategy

U.S. long term apartment investment strategies typically rely on a balance between risk and reward. Class A long term apartment properties in urban areas, particularly in gateway cities, offer tremendous opportunities. These markets were significantly impacted during the new crown epidemic, but have a more positive outlook in the near and medium term.

Lower risk, lower return markets include submarkets that were less affected by the epidemic. Urban markets such as Atlanta (Atlanta), Dallas (Dallas), Denver (Denver) and Philadelphia (Philadelphia) are expected to provide more modest income and appreciation returns with relatively stable investment return prospects.

Photo & Source: CBRE Research, Real Capital Analytics, Q3 2021.

05 Trends to Watch

The Rise of Single-Family Leasing

As more millennials enter the parenting phase, the single-family rental market will become more popular with tenants and investors alike. Urban long term apartment owners will rely more heavily on Gen Z to fill the resulting void.

Returning to the office will spur urban demand

Rising office occupancy will boost demand in the urban long term apartment market. The average U.S. office worker is expected to work 3.4 days per week in the office in the future, a full day less than the average 4.4 days per week in 2018. While living near an office may not be as important in the future due to the rise of hybrid work patterns, it will remain a key consideration for many tenants.

Photo & Source: CBRE Research