Economic Development Incentives Bring New Firms to West Palm Beach, Spurring Rapid Net In-Migration

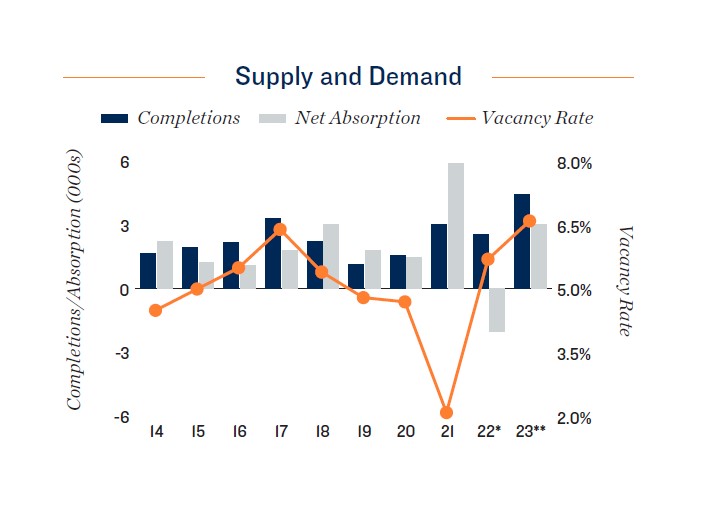

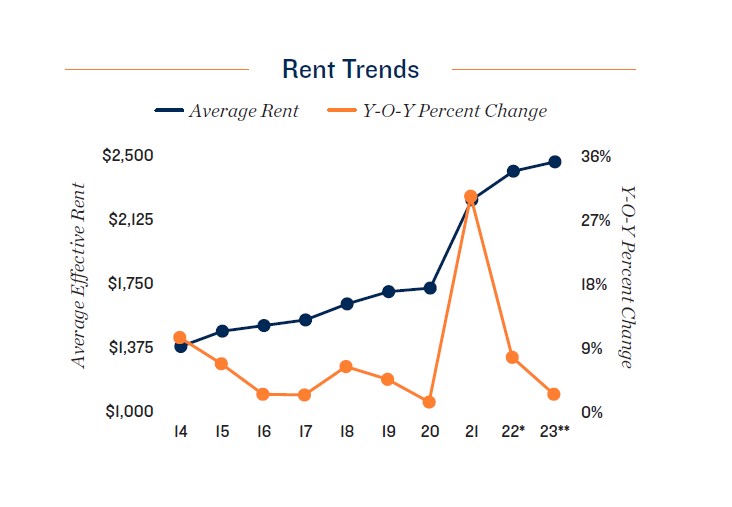

Influx of new residents drive unprecedented rent gains. Since 2019, West Palm Beach

has led all major South Florida markets in population growth, gaining more than 55,000

new residents. Initiatives from the Business Development Board of Palm Beach County

spurred many corporate relocations and expansions from firms like Citadel and KruseCom,

which, in turn, strengthened in-migration to the region. The recent surge in

apartment demand sparked an unprecedented stretch of rent growth, with the average

effective rate increasing by more than 40 percent since the onset of the pandemic. Leasing

activity slowed in response, as this rapid appreciation occurred during a time when

consumers were tightening their budgets due to widespread inflation. Moving forward,

market conditions will likely soften more in the near term, as a slowing economy is set to

further temper the rate of household formation. However, the metro’s large renter-bychoice

baby boomer population should provide a bit of stability during times of economic

uncertainty. Additionally, the region’s warm climate and favorable tax rates are expected

to draw more young adults to the area. This will create more diversity in the local renter

pool, helping bolster long-term apartment demand in the metro.

Local assets provide upside potential. Robust rent gains over the past two years have

elevated investor interest for apartment assets in West Palm Beach, with transaction

velocity rising above historical levels in 2022. Climbing interest rates also put a spotlight

on the market, as the average first-year return is at least 30 basis points higher than any

other major Florida metro. Class C apartments in West Palm Beach proper and Boynton

Beach are common targets, with average yields that are 60 basis points above the market

mean. Higher-tier assets also change hands in these locales, and may garner heightened

interest moving forward if the metro continues to attract corporate relocations. Entry

costs for apartments in this segment generally exceed $350,000 per unit.